According to the research done by Epsilon back in 2012, brand loyalty is strained whenever consumers move. The keys to reaching this transitional segment include.

- Monitoring current customers who give signals of an impending move (retention).

- Being first to communicate with the new mover right before or after their move when there is less competing clutter (acquisition).

- Building a system for efficient and ongoing processing of the new mover target audience and delivery of offers (cross-sell).

- Measuring the impact of your new movers retention and acquisition program.

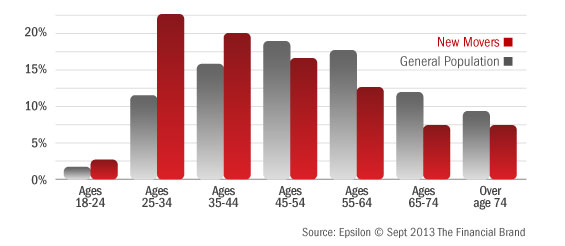

Epsilon’s 2013 New Mover Report sheds light on this segment’s spending habits and brand affinity when they move. Using only general demographic data, financial marketers can create the following standard profile of the average new mover.

Under the age of 44. Younger people tend to be more transient than older households. In addition, new movers tend to be more avid online shoppers consistent with their younger demographic.

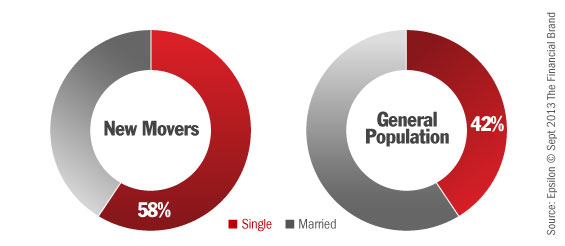

Single. New movers tend to be single (58%) compared to the population as a whole.

Household income of less than $75,000. While new movers tend to have an income distribution similar to non-movers, households with <$75,000 are more likely to move than households with higher income. The largest income stratification of new movers is between $50,000 and $74,500.

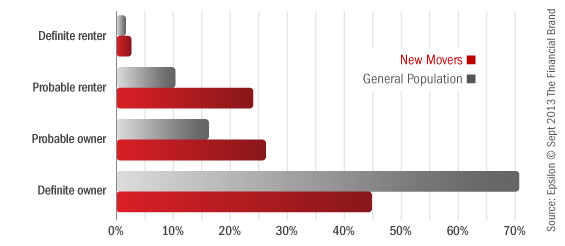

More likely to rent. Home ownership trends have been the most dynamic over the past 5 years as more households have needed to move into rental properties than in the past due to economic conditions. Marketers should not correlate renters with lower opportunities, however, since many of these households have sufficient income and financial needs to be a good prospect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

More Than Just a List and The Same Old Demographics

While a new mover list and the demographic profiles above provide a good starting point, bank and credit union marketers need more to build a successful retention and acquisition marketing program.

The Epsilon 2013 New Mover Report identified five specific groups of consumers who are most likely to move, along with five groups who are the least likely to move. These profiles include preferred purchase channels, shopping propensities, engagement with non-profit organizations, interests and more. Building profiles of movers and non-movers for your bank’s or credit union’s footprint is helpful in developing messaging as well as offers. This requires additional data overlays that are readily available.

“Based on a single source of data, marketers may find that new movers tend to be single. However, there are certainly married couples and families moving every day. This indicates a number of missed opportunities for marketers to drive brand engagement and revenue,” said Don Hinman, Epsilon’s SVP of Data Strategy. “When data attributes are correlated and put into broader context, marketers can identify specific consumer characteristics within segments and target in a more meaningful and insightful manner. To drive deeper, long- term engagement, marketers must be able to identify their audiences as well as their needs and ultimately communicate relevantly and on a personal level.”

Best Way to Reach New Movers

As consumers use more and more channels to shop and buy services, it should be no surprise that a multichannel approach is recommended to connect with new movers related to retaining or acquiring households on the move. As with the general population, new movers tend to begin their shopping experience online, shifting to more traditional channels as moving day gets closer. Therefore, working with digital sites related to moving is a great overarching online strategy.

Secondly, you need to work with a list compiler that specializes in new movers files to support direct mail programs (which new movers prefer). As many as 33% of new movers do not report their new address to the USPS, the central compiler of the National Change of Address (NCOA) file. And since phone number changes are often not done since cell phones are the primary phone service, targeting new movers (or even keeping a house file current) requires compiling multiple list sources including utility connections, phone changes, county records, etc.

The key is to deliver new mover communication to the new residence as quickly as possible (requiring both frequent list refreshes and ongoing mailings). While it is more expensive to process files more frequently and to mail smaller batches of direct communications, the ROI on “being first” pays off.

Finally, all postal mailing addresses should be processed for CRM retargeting, which will provide the opportunity to use your offline new mover database to reach individuals and households online, not just after they visit your website. By onboarding your new mover postal addresses, you can reach your new mover customer and prospect segments with highly targeted display ads appropriate to their new move. This type of retargeting is also possible through mobile channels.

The combination of direct mail, email, SEO targeting and CRM retargeting through online and mobile channels will allow financial marketers to reach an audience that has a strong propensity to buy new services.

For the majority of my clients, a new mover program is the foundation of their acquisition and retention efforts, generating one of the strongest returns on investment and a steady flow of new households at a time when market growth is at a premium. With physical convenience is becoming less important for households, more and more of my clients are also using robust modeling of households likely to move to protect this household from attrition.

Examples from Banks Targeting Consumers on The Move

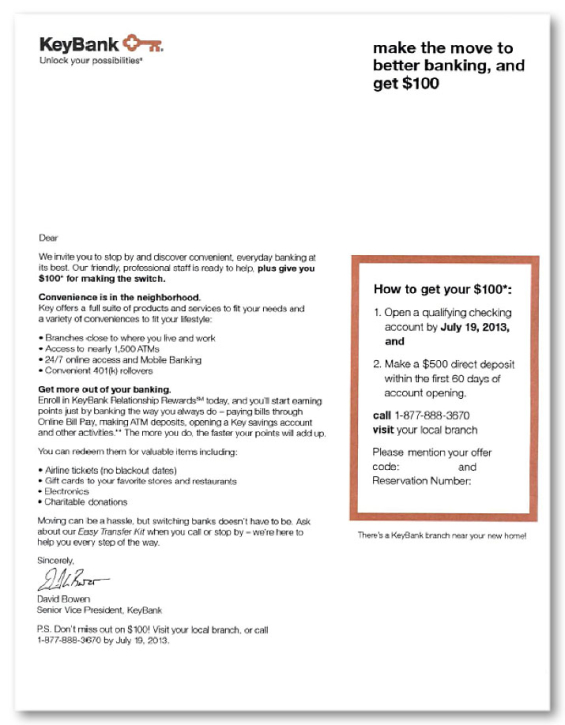

A letter from KeyBank targeting movers (click to enlarge). Source: Competiscan.

An envelope and letter from TCF Bank targeting movers (click to enlarge). Source: Competiscan.

A two-part mailer from Wells Fargo targeting movers (click to enlarge). Source: Competiscan.