There is a notion taking hold in banking — especially as mobile banking usage has ramped up — that email should get pushed to the back burner in terms of customer communication, replaced instead by push notifications, SMS texts and other types of digital marketing.

Experts at three financial marketing agencies say otherwise, however.

They point out that financial services emails get above-average open- and click-through rates in the U.S., especially compared to other sectors.

Email marketing performance in banking compared to other industries

| Rates | ||||

|---|---|---|---|---|

| Industry | Open | Click-through | Click-to-open | Unsubscribe |

| Financial services | 27.1% | 2.4% | 10.1% | 0.2% |

| Media/Entertainment | 23.9% | 2.9% | 12.4% | 0.1% |

| Real estate | 21.7% | 3.6% | 17.2% | 0.2% |

| Retail | 17.1% | 0.7% | 5.8% | 0.1% |

| IT/Tech | 22.7% | 2.0% | 9.8% | 0.2% |

| Restaurant/Food | 18.5% | 2.0% | 10.5% | 0.1% |

| Travel/Hospitality | 20.2% | 1.4% | 8.7% | 0.2% |

| Average totals* | 21.5% | 2.3% | 10.5% | 0.1% |

* Averages represent 18 industries, not all shown above

Source: Campaign Group

Over time both the role and public perception of email has changed drastically. At one time consumers were very critical of marketing emails, says Quinn Jalli, Senior Vice President of Email Products from Claritas. Now, people are much more receptive.

“It’s a really interesting shift from even 15 years ago,” Jalli explains. “You wouldn’t think it because let’s be honest, email is the dinosaur of the internet, but it is still very much alive and well.”

Given the changed views about this marketing tool in comparison to the many other options available, bank and credit union marketers aren’t sure if they are approaching email the right way.

The Financial Brand asked the experts at the marketing agencies some of the questions our readers have been asking us. Among them: How much email marketing is “too much”? Is there a golden or magic number for emails per month? What is the best way to distribute emails to customers and what is the right approach?

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Q. When Has a Bank Marketer Sent ‘Too Many’ Emails?

When John Hendricks, Founder and CEO of ERGO, receives emails from different banking providers, 99 times out of 100 he rolls his eyes and asks, “Did you really need to send that?” ERGO is an email marketing software company for financial institutions.

It’s fair to wonder if customers feel the same way. Much has changed since banks and credit unions first began using email for marketing.

For one, there is more tolerance for how many emails — and what kind — are in people’s inboxes today, which is what Hendricks says has changed the most in his 30+ years of experience in financial email marketing. The industry has responded by sending out more emails to customers en masse. This isn’t necessarily the best approach.

“Every time there’s a change in economic conditions, bank marketers react by sending more emails,” which doesn’t always work, Hendricks says.

Key Takeaway:

Email frequency recommendations vary, but one hard and fast rule: Bring relevant content to your banking audience.

At the end of the day, all three marketers — Jalli, Hendricks and FI GROW Chief Strategy Officer Penne Vanderbush — agree there is no magic number, no specific formula, for emails that a bank or credit union can send to customers. Vanderbush says instead that financial marketers should determine the volume of emails distributed by evaluating an individual customer’s needs.

“For us, it is based off of behavior — what customers are doing with those emails when they receive them,” Vanderbush says. If they are clicking through the emails and visiting product pages, she explains, that’s a good opportunity to figure out from that behavior what other emails to send and when, rather than guessing what kinds of emails you should send to a segment of a certain age or community.

Read More: 10 Questions To Ask Before Launching Your Next Email Campaign

There are some people who will be more receptive to continual communication from their banking provider.

“How strong is the relationship with a particular customer?” Hendricks asks. If the relationship is stronger, a bank or credit union could think about using data it already has to generate relevant content to populate an email. However, if the relationship is weaker, he advises keeping emails to a monthly communication and slowly increase frequency based on customer activity, if they seem to have the appetite.

Sometimes it also comes down to the ‘unsubscribe rate’ of financial marketing emails, says Jalli. At a previous job, he conducted research on unsubscribe rates and found that “if your customers don’t unsubscribe on the first email, the likelihood of them ever unsubscribing or complaining about your emails drops quickly to 4%.” By the time you’ve emailed the customer three times, he adds, the unsubscribe rate is almost 0%.

Yet Jalli says customers can easily become numb to emails from their bank or credit union — even if they aren’t unsubscribing. His ‘hard and fast’ rule, he explains, is to bring relevant content to your audience.

Q. What Is In a Relevant Marketing Email?

Hendricks says relevance is a fine balance between servicing and marketing.

“There’s a blurriness — a good blurriness — between customer service and marketing,” Hendricks says. “Great marketing always feels like the company is trying to help you, but it has to be authentic.”

As Hendricks says, an email should be “dripping with tangible value.” And Jalli says the best starting point is the initial engagement. “If a customer engages with a bankng product, there is nothing more obvious and more relevant,” he says.

In today’s world no financial institution should be doing email marketing campaigns without using personalized data to customize emails, the three experts say. Otherwise, customers can (and will) quickly tune out. A monthly newsletter can be an exception, Vanderbush states, but any other email should cater to the individual and their respective segment.

Learn More: Increased Digital Banking Interactions Require Greater Personalization

“Where we have the most success is with behavior-based email marketing that is triggered by the visitor’s behavior on the site,” she maintains. “We’re sending emails within 20 minutes of somebody visiting a product page” using cookie-based behavior tracking.

Vanderbush says financial marketers should be focusing on the content — and the density of the content — in every email.

“People put way too much in an email. We have the most success with emails that cover one topic,” she says. But even emails that cover just one product often have too many additional resources that litter the message, she adds.

Food for Thought:

Keep it simple — don’t push all your bank’s marketing content into a single email.

That said, consumers have a need for guidance. Email messaging can’t just be about products or even account notices. Vanderbush advises her clients write blog posts covering topics customers are already talking about. She uses the national concern about the housing market as an example, saying many Americans are uncertain whether they should be selling their home in the current environment. If their primary banking provider can provide them with a clear strategy or even insights via a blog post, this is valuable content to include in an email.

Q. What Else Makes a Great Bank Marketing Email?

Obsess over the subject line

The subject line is arguably the most important part of a financial email campaign, Hendricks argues, especially if a marketer wants to keep customers engaged.

It’s crucial to get people in the habit of opening an email and thinking, “Every time I open an email, there’s some little thing that made it worth the click of a button,” says Hendricks. All that can be achieved with the right subject line.

Banks and credit unions should be wary of overselling or being manipulative in their subject lines. Both can quickly annoy customers. The emails that elicit an eye roll from Hendricks are those that make it seem as if they’re “trying to trick you or manipulate you into opening the email, but opening it is a waste.”

HTML-friendly email design

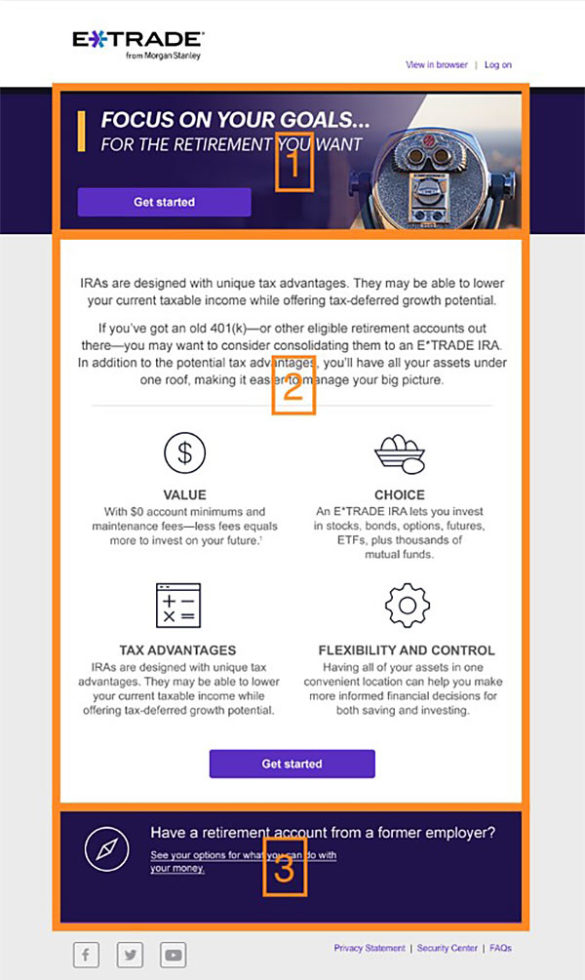

When asked what is a major design mistake financial marketers make with email, Hendricks uses an example of an email he received from eTrade, which fails to use html-friendly text.

Each of the numbered segments in the image above represents an individual photo of text instead of HTML text. (Basically, if an email recipient can copy and paste the text, it’s HTML — otherwise it’s just a picture of the words.)

“There are a myriad of problems with that approach,” Hendricks explains. One is that it’s an accessibility issue for visually impaired individuals who rely on tools to read text off the page. Using the “alt text” option in the email platform can address this, but still Hendricks recommends that “the only time to use an image… is when it’s actually an image.”

Email or SMS/push notifications?

SMS marketing and push notifications have been making inroads in the banking industry. One of the reasons is that people are more likely to open a text message than an email. This is in part because of research that has shown it takes 90 seconds for someone to respond to a text message compared to the 90 minutes or more that it takes for someone to respond to an email.

“Banks are always having to juggle a bit with the concept of ‘When do we turn to email?’ because of the constant fear about phishing,” Jalli states.

For the most part, outside of security alerts or immediate account notifications, the marketing experts advise sending an email (especially for marketing a product) rather than using a text.