Email is an essential digital marketing channel for banks and credit unions. High ROI, customer retention, cost savings on customer communications and immediacy are all benefits of this channel.

Email is an essential digital marketing channel for banks and credit unions. High ROI, customer retention, cost savings on customer communications and immediacy are all benefits of this channel.

But getting the most of this high-performance marketing medium requires the right mix of strategy and tactics to ensure success. With more people viewing email on mobile devices, the challenges to financial marketers is even greater.

Below is an excerpt from the in-depth analysis of digital marketing tools provided in the 2015 74-page Guide to Multichannel Marketing Digital Banking Report.

Top 10 Email Marketing Strategies

1. Introduce Customers to Email Early. As discussed in our ‘Guide to Multichannel Onboarding in Banking’ report, email should be part of any communication program that introduces a new customer or member to your organization. Creating a series of automated emails with content about engagement services and how your organization can assist the new household with their financial needs, builds early trust as well as provides exposure to how you will be communicating with the household using this channel.

2. Build an Email Cadence. As with any communication, consistency improves results. While all email communication needs to be targeted and pertinent, there needs to be an ongoing cadence of communication the consumer can depend on. While the frequency of communication is usually increased early in a relationship or immediately after a purchase, most successful financial marketers will connect with their customers and members an average of 12-15 times a year.

“The majority of emails being opened are occurring on iPhones, Androids, and iPads representing 51% of emails being viewed.”

— Litmus

3. Make Your Email Mobile-Ready and Responsive. As more consumers are tending to read their emails on mobile devices, it becomes imperative that you simplify your email design and content. It is also important that you move to responsive email design that can adjust to the device the consumer is using to view your message.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

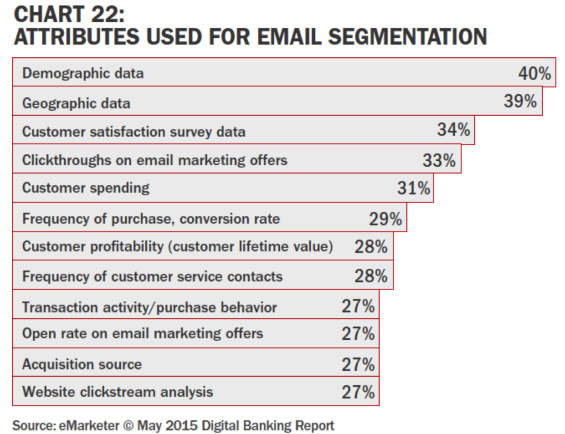

4. Personalize and Contextualize. With the availability of more and more consumer insight, email marketing has gone beyond simply using a customer’s name to leveraging tailored content, that is based on their demographics, behavior and even their purchase history. Dynamic content lets you display different content to different people based on who they are, what they like and how they currently use your organization.

Research shows that personalized email yield significantly better results, with relevant emails driving 18 times more revenue than broadcast emails (Jupiter Research). According to Aberdeen Group, personalized emails can help to improve click-through rates by 14% and conversions by 10%.

5. Remove the Friction. Even if you’re sending great responsive emails, it won’t matter if the email sends customers to a website that isn’t optimized for mobile purchases. Digital shoppers frequently abandon the account opening process because it’s simly too hard to complete an application.

Financial institutions must eliminate the number of keystrokes and clicks involved in applying for a new product as well as required usernames and passwords or even app downloads.

6. Leverage Predictive Analytics. Financial institutions need to use advanced predictive analytics to better anticipate customer’s needs – well in advance. Using both internal and external data sources, this process has become the standard for most digital organizations. Predictive intelligence applies propensity models to identify the combination of content and offers that will most likely generate a response.

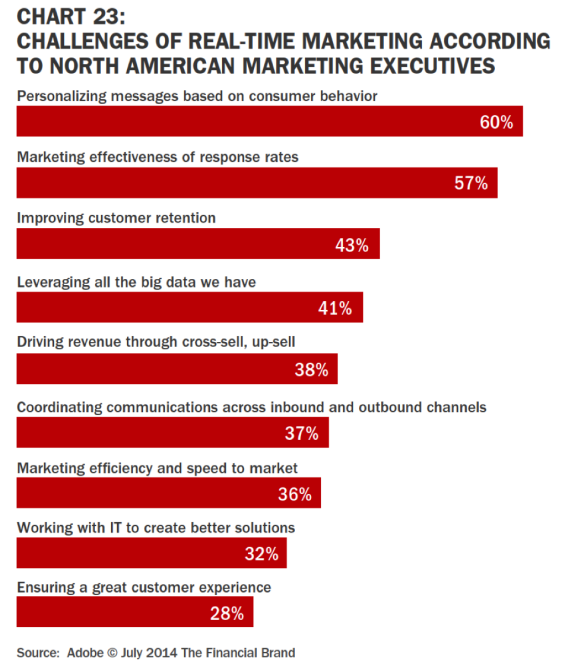

7. Move to Real-Time Marketing. The promise of real-time marketing is to meet the needs of consumers with the right message … in the right place … at the right time. There are several challenges to delivering on the promise of real-time marketing, including the personalization of messages, measuring the effectiveness of the marketing efforts, leveraging the data available and the coordination of communications. While the data gathering, analysis,and even the tools may be established at many banks and credit unions for the processing of internal insight such as demographics, product history, prior marketing reach-out and response, most organizations are less adept at leveraging external (big data) insights.

8. Use Video Content Within Email Messages. To increase engagement and to improve response rates, many banks are beginning to include videos as part of their email strategies. While it may seem complicated, there are several ways to combine the power of video with the immediacy and targeting benefits of email.

Instead of emailing the actual video, you can embed a link to the video right in your email. Most email clients handle images just fine. But, you want the image to be what is essentially a snapshot of your video. It should also include the ‘playback’ button. In other words, users should be led to believe that, if they click on the little video still, it will play.

In reality, the still picture contains an embedded link to your website where the video is located. Take users to the page where the video is hosted and enable an ‘autoplay’ feature so that users’ expectations are met.

Finally, follow the rules of any video content which includes making sure the video can be played on as many devices as possible and that the video is short and simple in design. Remember, most people will be viewing the video on their mobile device.

“With more financial customers using online banking products, email is a mission-critical data point for nearly every customer.”

9. Automate and Integrate. Deploying multiple campaigns every month can be taxing for any financial marketing team. Between list uploads, versioning, QC and analyzing results (for appropriate follow-up), email can consume a lot of time and effort. Automating certain processes (list feeds and updates, reporting, list hygiene, sales alerts, etc.) will leave you more time for developing strategy, identifying opportunities and understanding your email ROI.

Integration is the flip side of automation. By integrating processes around email, your entire marketing program becomes more agile and responsive to market opportunities.

10. Build and Cleanse Your Email Lists. If you don’t have at least 50% of your customers’ email addresses, you need to focus on collecting and maintaining email addresses. With more financial customers using online banking products, email is a mission-critical data point for nearly every customer.

Using readily available channels, such as your call center, branch personnel, community events, direct mail, etc. to capture email addresses has proven to be effective. While an investment in a direct mail campaign may seem high, the long-term value of being able to leverage the lower cost, and more effective, email channel makes the ROI quite high.

Email Marketing is Evolving

Email continues to be a highly effective digital channel to engage consumers in the financial services industry. But the consumer is changing the way they read and react to email, so financial marketers must respond to these changes accordingly.

Consumers take email with them as they move from their desktop, to their mobile and laptop or tablet devices. While consumers may be able to open and view email on all devices, they aren’t always taking action – which presents a new challenge to financial marketers.

Still, every customer interaction is a moment of opportunity for financial marketers to better understand the value created by the engagement and the experience the customer has. It is up to bank and credit union marketers to leverage the vast amount of data at our disposal to create continuous, consistent experiences – through email and across all online and offline channels – that deliver value and forge deeper relationships.