To show their appreciation for their customers, TD Canada temporarily transformed ATMs inside four separate branch locations across Canada into “Automated Thanking Machines.” The bank used hidden cameras to capture the reactions of customers delighted by an ATM that dispenses gifts.

The resulting YouTube video amassed over 6 million views in under a week, making it the fastest viral mega-hit in any social channel in the financial industry.

TD relied used frontline staffers to recruit around 20 customers as unwitting participants in the ATM ploy. They were told they’d be participating in a focus group to test a new kind of ATM.

When the customers arrived for to give the new ATM a whirl, they had no idea what was in store for them.

The “talking” ATM gave some of its customers flowers.

One got tickets to Trinidad so she could visit her daughter who has cancer and was recently operated on.

Mike Jobin, a huge Blue Jays fan, got his own personalized T-shirt and cap, along with a surprise visit from Blue Jays player José Bautista, and a chance to throw out the first pitch at a Blue Jays game.

Christine Todd, who had never been able to take her two young boys on a trip before, scored an all-expenses trip to Disneyland.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Another 40 customers who just happened to be lucky enough to stumble in got to use the machines too — good for a free cash bonus.

“I look at marketing stuff all day, and I choked up at it,” marketing expert Ann Handley, co-author of the book Content Rules, told TODAY.com. “There’s nothing about it that feels canned. The best marketing doesn’t feel like marketing.”

Several customers cried in gratitude. One said he got goosebumps. Another did a backflip.

The ATM stunt is part of the bank’s broader #TDThanksYou campaign which included giving a green envelope filled with $20 to its customers at 1,100 bank locations as well as $20 deposits to all online customers — 30,000 gifts in all.

Over the years, TD has consistently embraced guerilla tactics in its marketing arsenal. Back in 2008, they undertook a massive customer appreciation campaign involving over 200,000 gifts — part of a major rebranding effort.

This isn’t the first time ATMs have been used for guerilla marketing stunt. In early 2013, an ATM in Spain dispensed free cash to folks under the condition that they do something generous with it. But TD’s “Automatic Thanking Machine” is perhaps the most original and best-executed execution concept involving an ATM thus far.

Read More: TD Bank Uses Guerilla Tactics to Launch New Brand

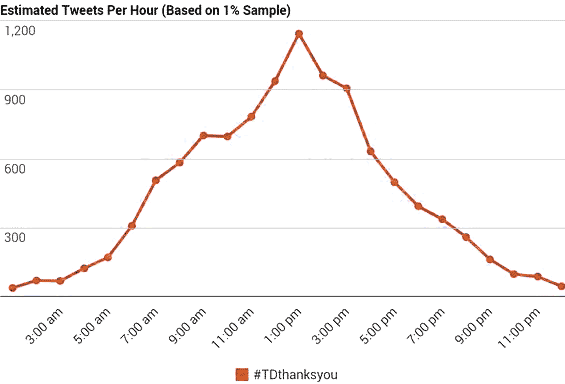

#TDThanksYou 24-Hour Trend Graph

This graph shows what happened in the 24 hours following the release of TD’s video. Twitter erupted, with over 1,200 tweets per hour at the peak. 97% of all financial institutions on Twitter won’t see 1,200 tweets about them in an entire year.

Read More: What Financial Marketers Can Learn From WestJet’s Christmas Miracle

Serious Fun?

As tempting as it may be for party poopers to dismiss TD’s thanking machine as little more than a glossy PR stunt, there are a couple very poignant lessons in there for financial marketers.

1. PR doesn’t mean “press release.” The overarching goal of PR isn’t to simply to get press coverage. “PR” stands for “public relations,” not “press release.” If you want to build a positive relationship with the public, you have to do more than issue a bunch of releases and give money to charities. You could pump out a thousand press releases and never yield anywhere near the level of exposure and goodwill as TD did with its thanking machine.

2. Interactive ATMs have real potential. TD’s Automatic Thanking Machine may have been staffed by a real, live human being sitting inside the ATM’s cabinetry. The TD rep didn’t read from a script, obviously possessing an uncanny level of empathy, an ability to improvise, and a subtle sense of humor… admittedly a rare combination of traits. But you can clearly see the potential of ATM-based interactions in TD’s video. Consumers don’t mind talking to a real person on the other end of an ATM; quite the contrary, they seem to enjoy it, particularly when the experience is tailored to them. Retail financial institutions have been wrestling with the brick-and-mortar channel for years now — what is the future of branches and ATMs? Watching this video should convince you that ATMs can play a pivotal role as banks and credit unions retool their brick-and-mortar strategies. TD has shown that you don’t have to sacrifice that personal connection with customers when eliminating tellers/branches and shifting to tech-centric solutions in retail channels.

Read More: ATM Hands Out Wads Of Cash To Nice People

3. Financial relationships are intimate and personal. Financial institutions need to find ways to scale the emotive juice loaded in TD’s ATM into something that can be implemented practically, institutionally on a broader level. For nearly two decades now, there has been big talk about CRM systems that can log every frontline interaction with consumers… if only frontline staff would make the effort to manually (and accurately) record those interactions. In under four minutes, TD shows financial institutions how collecting such data could be leveraged for maximum impact.