It’s like laser-guided marketing. Instead of just throwing ads out on the internet blindly, Ohio-based Segmint is helping banks and credit unions target specific financial products and services directly at those consumers most likely to need them.

How does it work? A financial institution feeds its transaction data into the Segmint system — credit and debit card activity, deposits, withdrawals and online bill payments. Every transaction a customer makes is anonymously analyzed to determine his or her hobbies, activities and life events (more on that in a moment). Then all these lifestyle triggers are assigned tags that Segmint calls Key Lifestyle Indicators, or KLIs.

KLIs can fall into one of two distinct categories: “activity-based” and “event-based”:

- Activity-based – when the customer has demonstrated a history of transactions in a specific product category

- Event-based – when the customer has demonstrated a history of transactions across related product categories that point to a specific life event.

It’s Segmint’s KLIs that set the company apart. Based on the unique blend of KLIs assigned, each customer can be presented with a customized mix of offers, specific to his or her needs and interests, and in any of these three locations:

- Within the online banking platform

- On a financial institution’s public website

- On the open internet

The Segmint system has a web interface that allows bank employees tailor specific acquisition, cross-sell, retention and collection campaigns by tying banner ads to specific KLIs. For instance, you can target a home equity promotion at someone who is planning a wedding and another person who is remodeling their house. The banner ads for each KLI — the fiancé and the remodeler — can be contextualized, with one showing wedding rings, the other showing home improvement tools.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Segmint says its system offers dramatic reductions in money wasted on presenting irrelevant offers (e.g., via direct mail) because customers are more likely to take advantage of such highly targeted offers. And, as an added bonus, financial institutions can generate income from third-party advertisers two ways: through incentives offered within the online banking system, and with ads displayed when customers browse the open internet.

John Relyea, VP Marketing & Implementation/Segmint, says the company has entirely reinventied the online experience for bank and credit union customers. “We help banks build personalized online relationships with their customers by delivering the right message to the right customer at the right time — a segment of one,” he explains.

Segmint was founded in 2008, with its first product launching in 2010. Segmint, which has seven different patents pending, is a perennial favorite at Finovate, the premier conference on innovation in banking. Segmint first demonstrated its services at FinovateSpring 2010, and the video can be seen online here.

SEGMINT DEMO VIDEO

If you really want to get a good idea for how Segmint’s system works, you should take a look at this 7-minute elevator pitch the company put together for its inaugural appearance at Finovate.

Segmint currently has 14 employees, but has plans to grow. In May 2011, The company received a $1.5 million, seven-year loan from the Ohio Department of Development to spur job creation, which will help double the company’s staff. The company has committed to adding 20 new positions in the next 12 months.

Segmint Goes Social With Facebook KLIs

In the fall of 2011, Segmint rolled out SegmintSocial, an analytics platform for banks and credit unions that combines KLI analytics with Facebook.

Prior to SegmintSocial, most financial institutions responded to customers on Facebook without any knowledge about the full relationship each customer may (or may not have) had with them. With SegmintSocial, a financial institution’s Facebook administrator can list each customer’s Key Life Indicators along with a complete breakdown of their product mix, demographic data and lifestyle spending patterns. SegmintSocial can also present customers with targeted Facebook pages containing customized offers and rewards.

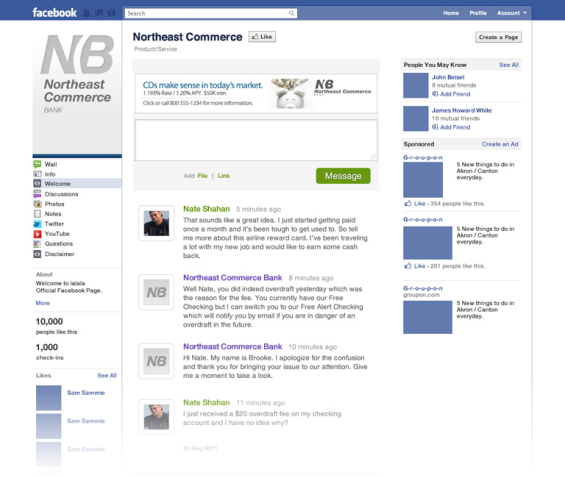

SEGMINT SOCIAL – FACEBOOK CUSTOMER PERSPECTIVE

A customer experiences a highly customized Facebook interaction with a bank representative. The Facebook experience is personalized based on the customer’s mix of KLIs and products/accounts held.

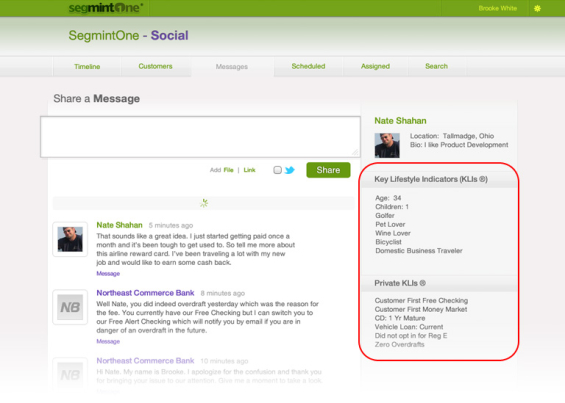

SEGMINT SOCIAL – BANK ADMIN PERSPECTIVE

When a customer comments on a financial institution’s Facebook page, the Facebook admin can quickly respond with a full understanding of the customer’s unique mix of KLIs and the extent of the customer’s relationship.

Proprietary Data & Privacy Concerns

Segmint requires that its bank and credit union clients assign unique, anonymous identification numbers to every customer/member before they will run any of the data through the their system. Segmint’s system is designed so that it never receives or contains a customer’s name, street address, social security number, account number(s) or any other identifier that could be used to identify them.

For example, the customer “Smith and Sons LLC” becomes “Business 123456” before the data is fed into Segmint. The Segmint engine performs its analysis using only the customer’s ID number, returning results like “The following business customers should be shown a banner ad for payroll services: 123456, 234567, etc.” A customer’s actual identity never resides in Segmint’s system.