Even if your bank or credit union has been investing significantly in content marketing, if you haven’t been doing it the way Google wants to see it, chances are your material isn’t showing up on the first page of user searches — which is almost like not being there at all. And if you haven’t done much with content marketing, period, or haven’t taken a fresh look at what you are doing, you are also very likely close to invisible on Google.

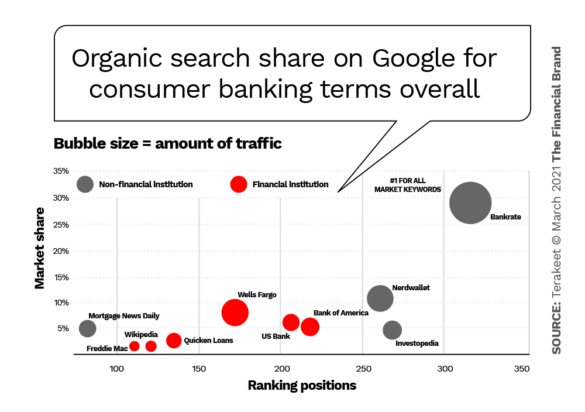

In fact, except for a handful of financial institutions, the winners in organic search for banking services aren’t banks or credit unions, but nonbank third party sites like Bankrate, Nerdwallet, Investopedia, WalletHub and even Wikipedia.

Who’s on Top

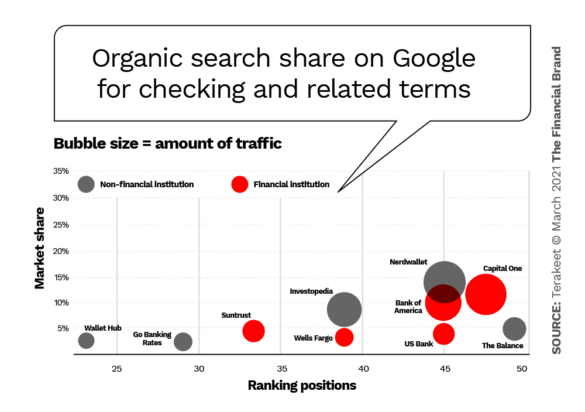

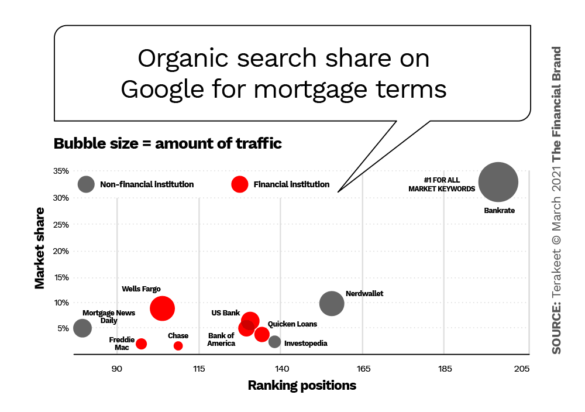

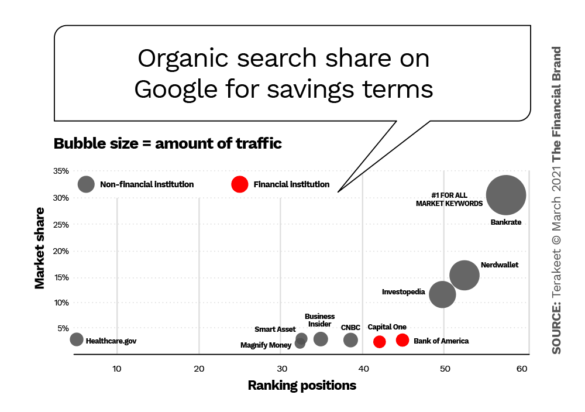

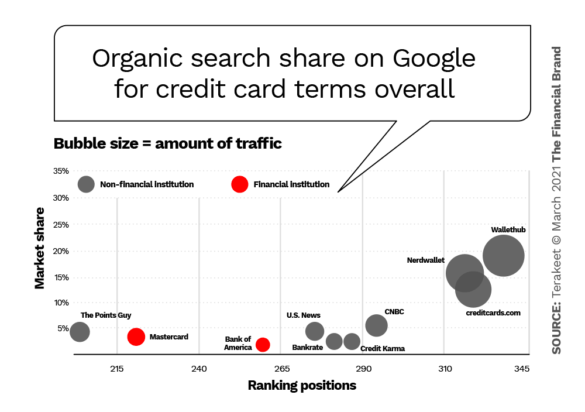

The Google search winners for banking differ by product area, but the common theme is that nonbanks generally come in ahead of nearly every financial institution.

A study of search term performance by Terakeet, using its proprietary software to analyze search results for hundreds of nonbranded personal finance terms, found that most banks and credit unions are way off the mark.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Content Means Diddly If No One Finds It

Content marketing sets out material in specific financial areas to educate and inform consumers, ideally at a point where they are exploring a particular financial service or are seriously shopping for help.

“Capitalizing on the opportunity, however, is not straightforward, nor easy,” states Terakeet’s report. “The personal finance market is hyper-competitive in Google’s organic search landscape. And what Google is looking for today is not the same as ten years ago.”

The report accuses many institutions of putting out inferior content. Much of what’s out there is “weak,” “sub-par,” and “not worthy of being placed on Google page one from a customer experience perspective,” it states.

Financial institutions, as a group, appear to be assuming that content should be used to sell the bank or credit union’s own products and services from the get-go, according to the report. The result is a bad mismatch for what people want.

Typically, what banks and credit unions are publishing is “simply not what Google is looking to put in front of consumers searching for relevant, authoritative, high-quality information,” the report states.

The Skinny on Search:

Google and financial institutions are looking at content marketing from different parts of the “sales funnel.” But it’s Google that calls the shots.

“Google is rewarding content at the top and in the middle of the funnel, not just lower funnel information,” according to the report. A common segmentation of the sales funnel is Awareness, Interest, Decision and then Action — where the sale takes place.

Terakeet’s report delves into the leaders in key areas and what marks their content and other notable aspects of their sites. It makes a point worth emphasizing:

Typically, site visits that nonbank sites gain are visits that financial institutions miss. Lost opportunities number in the hundreds of thousands of visits, at least, according to the report.

Bankrate and Nerdwallet Earn Top Share for Consumer Banking

The charts accompanying this article, based on those in the report, plot market share and frequency of Google search ranking positions. The overall situation in consumer banking is staggering to anyone who works with financial services content marketing.

Bottom Line:

The top five brands in consumer banking search make up over 50% of the market share. And most of that 50% is owned by nonbanks.

The top five institutions by market share were evaluated for what makes their sites stand out. Here is what Terakeet reports:

- Bankrate (29.2% share): Lots of long-form content that is search engine optimized, many online calculators, over 84,500 websites pointing links to it.

- Nerdwallet (10.4% share): Lots of optimized content, 45 calculators, 71,500 sites pointing links to it.

- Wells Fargo (7.9% share): Much content, including hubs built for personal financial education, small business resources, economic commentary. Also publications for business. Over 40,100 websites pointing towards it.

- U.S. Bank (4.9% share): Lots of optimized long-form content, interactive quizzes, over 20,900 sites point to it.

- Mortgage News Daily (4.5% share): Lots of long-form content, plus news stream and popular Q&A section. More than 9,300 sites pointing to it.

A common element among these and other dominant sites is long-form content that has been organized into clear subject areas. Rather than presenting superficial 700-word posts, the articles go into the depth someone seeking education and advice would need. The report notes that the average of ten recent articles on saving money on Bankrate was 3,617 words.

What It Means:

Google likes longer content that demonstrates some expertise. Short and promotional content, not so much.

“Bankrate’s long-form content is pervasive throughout the site,” the report states. “It’s this commitment to content that has helped it to capture over 29% of the organic search market share of the keywords examined.”

Online tools, such as the numerous calculators, encourage backlinks, which leads to strong showings in Google results. Alternatives that also help with Google are pages devoted to the site’s community, according to the report.

Digging Into Three Subgroupings of Consumer Banking

The study goes deeper into three specific areas in consumer banking, where, again, nonbank sites have the stronger showing. Given the financial resources at the command of the top ten banks alone, the report says it is surprising that they don’t compete better for valuable search terms by improving content. This is especially so when the alternative many financial institutions tap is paid search. The implication is that more attention to and better performance with content marketing could have a better overall payoff.

Bottom Line:

A persuasive argument for good content is that the cost per lead of organic search is a fraction of that of paid search.

In the area of checking and other banking services, almost half of the top sites are nonbanks, with the strongest being Nerdwallet and Investopedia.

In the mortgage area, Bankrate is practically in a separate league, at 31.8% market share, from both financial institutions and nonbanks.

( Read More: How Bank Comparison Sites Are Radically Altering Financial Marketing )

In the savings area, Bankrate at 30.4% outdoes the closest rival, Nerdwallet, 14.2%, by just over double, and the top six are all nonbanks, at a total of almost 66%.

Beyond these there is the credit card area. There, the top five brands are nonbanks, accounting for about 58% of market share.

Two additional forms of content mentioned in this section of the report that help draw Google’s attention are video content (CNBC) and featured deals (The Points Guy). The report delves into multiple types of card site breakdowns as well as such personal investment areas as retirement savings and mutual funds.