According to the IAB, the financial sector spent over $7.19 billion on display advertising in 2015. This figure reflects a massive shift in the industry — two out of every five financial institutions in the U.S. say they will move 20-40% of their offline budgets to digital in the next two years. The advent of programmatic advertising (the automated buying of digital media) has created massive opportunities for increased efficiency and relevancy at every stage of the consumer’s journey.

Financial advertising trends

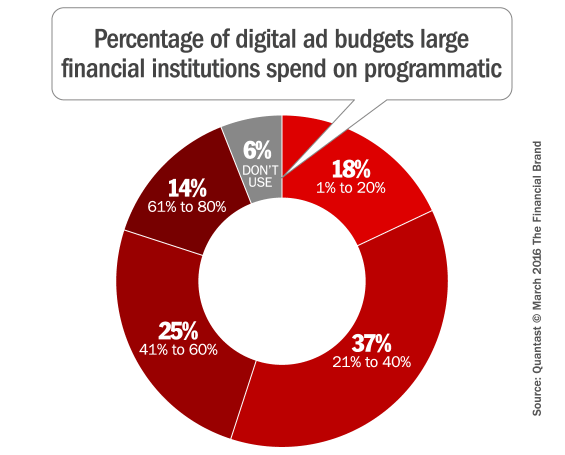

Increasingly, digital display ads are being purchased programmatically. Today, 45% of U.S. digital display advertising is spent on programmatic.

As advertising moves towards digital, financial institutions, too, have reworked the ways they advertise online. According to an independent study commissioned by Quantcast, the majority of larger financial organizations (over 500 employees) are already spending 20 to 40% of their digital display budgets programmatically.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Understanding your audience

Programmatic advertising, like all forms of advertising, should always start with target audience — i.e., the customer. Looking at audience insights from global Quantcast campaigns in the financial services sector yields a deeper understanding of who a typical online borrower/credit applicant is. Credit card and loan applicants are:

- Likely to be young, professional males who live in big cities

- 2x more likely to have a graduate degree

- 2x more likely to be in the top income bracket

- Often researching international travel destinations and fine dining

- Making purchases on retail sites, booking travel and searching for homes

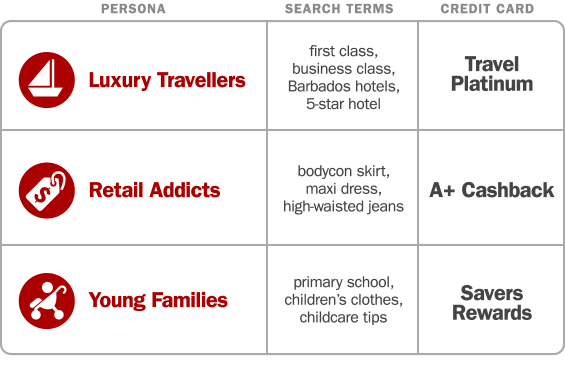

Take a financial services brand that has three different credit cards. On the surface, all three credit cards are similar products with similar audiences. However, in reality these products — and their audiences — are very different. By understanding the nuances that make each of these audiences special, marketers can create much more relevant and targeted advertisements.

While understanding your target audience is important, you have to reach them on the devices that they are using. The Quantcast study revealed that 51% of large financial brands derived over 41% of their overall web traffic from users on mobile devices. This means that there is a massive opportunity to reach consumers where they are spending the majority of their browsing and searching time: mobile.

From the day the first credit card ad is seen, it takes someone an average of 23 days to submit an application. And credit card applications on tablets are more likely to be submitted on weekend afternoons, whereas the desktop channel is favored during the week.

But how can you manage all these variables in your digital media plan? What is the appropriate product to offer someone based on their past online behaviors? Should you deliver the ad on desktop vs. mobile vs. tablet? How can you retarget interested credit card shoppers during their 23-day consideration phase? It can quickly become bewildering.

This is where a programmatic ad strategy can really help.

Leveraging Programmatic Technology

Programmatic advertising allows for enhanced efficiency and effectiveness in media buying via ad exchanges that instantly serve hyper-targeted advertisements. In short, you can automate the purchase and delivery of ads to consumers at the right time, on the right device, and for the right product.

Unlike traditional forms of advertising, programmatic advertising enables marketers to target users based on characteristics such as browsing behavior or interests. These programmatic ad systems crunch massive streams of user data — effectively doing your Big Data dirty work for you — so you can target customers throughout their journey with precision messages.

By incorporating and taking action on the intent signals your audience is giving off, such as keyword and browsing behaviors, marketers can take advantage of potential consumers as they continue their journey toward conversion.

And in an industry where accountholders stay with their institution for years, it’s critical to connect with audiences early, then continue the engagement throughout the process — from initial awareness, preference and building to the final action. Programmatic advertising is one of the few options that provides the scale needed to maximize your reach across the entire sales funnel.

Prioritizing Your Advertising Budget

When allocating advertising budgets, financial marketers prioritize growing their customer base, retaining customers, driving conversions, upselling, increasing site visits and branding. The majority of financial services marketers allocate more of their digital budgets to prospecting (bringing new customers to their site) than retargeting (driving conversions from site visitors).

But driving leads and sales isn’t the only objective. 90% of financial marketers say that branding is an important priority in their advertising budgets. Generating brand awareness with key target audiences before they are even in-market for a credit card or bank account can help to build brand affinity. With the right messaging, you can guide consumers from the very initial “awareness” stage to “consideration” and ultimately “preference.

Niche Targeting With Programmatic

One global financial services provider wanted to find and reach frequent fliers quickly with a promotion for its high-end airline credit card. The company worked with Quantcast to identify and target a niche audience of frequent fliers after analyzing large data sets of real-time web activity. Quantcast’s technology enabled a comparison of the browsing patterns of frequent fliers with millions of other web users to find similar behaviors. Quantcast was then able to serve ads for the promotion to this new, previously hidden set of prospects before they even started researching any credit card options.

Fast analysis of the data also uncovered a new customer segment. An unusually large number of applicants were also researching animation and comics. Further investigation revealed two major comics conventions along the promoted route shortly after the credit card promotion dates. Quantcast was able to tap into this new segment of comics fans and serve relevant messages in real time to boost conversions.

Ultimately, comics fans made up 35% of the total conversions that signed up to the credit card. Crazy, right? That’s not something you’d probably ever be able to figure out on your own.

Putting It Into Practice: Implementing Tags

Of course, to make all this happen, you have to implement “tags” — tracking codes you need to place in your website that will become the building blocks for your campaigns. Valuable data from tags provides the insights necessary to improve modeling of new audiences. The attributes of visitors who complete acceptance pages could, for example, feed into the creation of an advertising model, which can be used to score other Internet users and serve them ads accordingly.

However, the Quantcast study found that 61% of all respondents at large financial organizations have concerns regarding data privacy when it comes to tagging website pages.

Financial marketers should be careful to ask these questions before working with any potential programmatic ad solutions provider to ensure their data is being handled correctly:

How does the company ensure its products do not collect or use any personally identifiable information (PII) of individuals based on their website actions?

- Does the company sell its clients’ audiences to third parties?

- Will the company use client data for other advertisers’ campaigns?

- Has a third-party regulating body carried out a security assessment of the supplier’s systems?

- Where is the audience data stored?

These are all issues you’ll want to sort out with your compliance team if your financial institution is going to get seriously involved in any programmatic ad buying.

Closing Thoughts

Forward-thinking financial marketers need to start researching the opportunities to leverage the real-time changes in consumer behavior offered by programmatic ad buying. Consumer engagement with mobile devices will only increase, but most financial marketers struggle devising an effective mobile advertising/marketing strategy. Financial institutions have the ability to amass consumer data in vast quantities from these devices, but success will be determined by how data is used to identify prospects, create models of new audiences and deliver personalized messages at scale.

Done correctly, programmatic can help you uncover untapped audiences. You can reach your prospects when they are most receptive to your message. You can get in your audience’s consideration set, and put your brand top-of-mind before prospects start shopping, then usher them through the funnel to purchase. The ultimate objective is to identify potential customers and deliver them the right message — on every device — faster than your competitors. If you get started with programmatic advertising today, you’ll have a big jump on them.