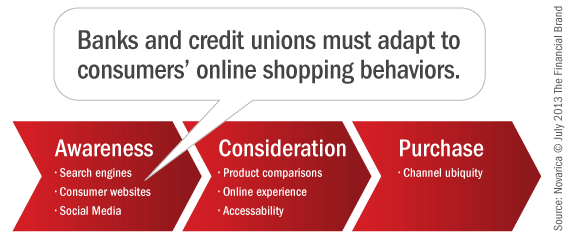

Most consumers now look online first when looking for new banking products, yet most banks and credit unions focus their marketing strategies at the branch level. Are you missing the mark?

By Jeff Bartlett from www.GoBankingRates.com

Even though more banks and credit unions have come to understand that online marketing should be a crucial part of their overall marketing strategy, still shoot themselves in the foot by not crafting a comprehensive marketing plan that fully exploits digital opportunities and efficiencies.

Up to 70% of consumers will shop online before choosing a new bank or credit union. They may eventually walk into a branch to open an account, but more than likely, they made their decision based on what they saw online. Unfortunately, most local banks and credit unions are over-shadowed by national and online banks’ websites and digital initiatives by not giving consumers a satisfying user experience.

Retail branches cost millions to build, support and upgrade. Comparatively, creating an online marketing budget and retooling your website can be done for a fraction of the cost, and potentially yield much more in the short term and long term.

There are thousands of companies that have launched over the past several years with new technologies and solutions to help local banks and credit unions compete online. However, before diving into all of the latest and greatest ideas, apps and digital technology, banks and credit unions should first take a look at what they are doing online today.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Building the Foundation for Online Marketing at Your Bank or Credit Union

To execute a successful online marketing strategy, financial institutions need to spend more time looking at their own website from a consumer’s point of view. A great banking website does not necessarily need to have video, music or amazing images, but what it does need is very clear and simple navigation for consumers to find what they are looking for when they visit.

While this homepage from America First Credit Union may not look all that sexy, it checks all the boxes: easy for a consumer to navigate the site, find rates, see specials and latest products and contact the credit union.

Consumers are primarily seeking the details of your products, including interest rates and fees, as well as an overall ease of use through all channels — online, mobile and in-branch. Make sure they can easily find your rates and easy-to-read — yet detailed — product information.

How to Develop a Stronger Online Presence

Creating a better web presence is not particularly difficult nor expensive, but it does take some time. You’ve got to do your research, evaluate other websites, talk to consumers and put a little time into creative thinking.

Most importantly, your website must make it easy for people to pull the trigger. This point seems to escape the majority of financial institutions, with thousands of bank and credit union websites scoring low in this category, This sounds obvious, but is often executed poorly among banks both large and small.

Consumers have different behavior based on who they are, their generation and how they feel about online engagement. Financial institution websites must make it intuitive and simple for a consumer to sign-up for an account or apply for a loan. Whether a consumer wants to call the financial institution, call an actual local branch, have the bank contact them directly, sign-up online, or via mail or fax, each method must be clear and simple to move forward on within a website.

An informal survey of 100 bank and credit union websites showed less than 10% accomplished this successfully. Imagine a bank buying traditional media through television, radio or a print campaign, and giving consumers a phone number that didn’t work, or an address to a closed location. Yet having a poor website and making it difficult for a consumer to become a customer or member online is exactly the same.

Track Everything

Equally as important as the having an intuitive, well-designed user experience on your website is the ability for your financial institution to track web visitors — where they come from, what they do and the outcomes of their experiences.

It is monumentally important for a successful online marketing strategy to track your advertising and marketing costs. You must determine the results and calculate impact in terms of generating new customers and revenue directly from each investment. Fortunately, one of the most beautiful things about online marketing is the ability to track who your users are, what they are looking for, and whether they find what they’re looking for… or not. Simply put, you can know precisely who and how people choose your financial institution.

There are countless companies that offer tracking services, in addition to free platforms like Google Analytics, but you must also track outcomes when consumers engage with your financial institution in other channels, including the phone and in-branch visits.

The first step is to include these three key concepts in your marketing plans today. Do not wait until 2014 because the consumers looking for you are already on your website (if they can find it) before coming to your front door.