Your competition is tougher than ever and your budgets are getting tighter. But expectations just keep rising.

So, how can your institution’s marketing team increase qualified conversions across your digital channels?

Personalized interactive content at scale is a good place to start. And here’s some great news: 83% of consumers say they are willing to share their information to create a more personalized experience, according to Accenture.

Now that you know that your audience is on board, your biggest challenge may actually come from within. You have to present the strategy to your boss, your coworkers, your lending team, and who knows who else.

Whether you are revamping your website or trying to build a better online experience for your customers, the information below will help you build a business case for your team.

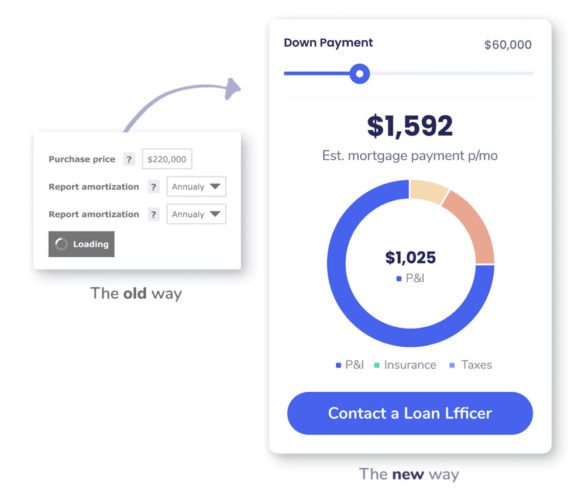

How Are Things Working Today?

As noted above, most consumers want their financial institution to use their data. But get this: 94% of financial institutions admit they can’t deliver on the “personalization promise,” according to research by The Digital Banking Report.

In fact, according to Salesforce, financial services was the second lowest ranked industry when it comes to how well they’re able to engage consumers (only government was ranked worse – yikes!).

Your prospective customers are telling you what they want, and yet so many financial institutions aren’t able to fulfill those needs. Sounds like a pretty huge business challenge to us!

Contributing to that already high hurdle are these other common digital challenges:

- Competition stealing market share: Traditional competition and digital-first newcomers like Bankrate, Nerdwallet, and fintechs are attracting customer eyeballs before you do. Since they are dominating SEO rankings with their vast libraries of content and rate comparisons, you have a lot of catching up to do.

- Slow digital adoption: Your existing customers are slow to adopt new technology and you need better engagement across your digital channels.

- Not enough qualified leads: You are not getting enough qualified visitors to your website and into your sales funnels. It’s not an unfixable problem, however. It just means that right now, you aren’t providing targeted answers to the questions that your customers are asking online. Questions like: How much mortgage can I afford? Should I refinance my home? How much will I make if I open a CD?

- Low conversion rates: Even if you’re getting people to your site, if you’re not engaging them across SEO/SEM, via your email marketing, on landing pages and product pages, and across your website, it will be all for nothing. As Forrester states, “trusted advisor” status is what will differentiate banks from all other touchpoints that offer embedded financial services.

- High customer acquisition costs: Industry estimates put acquisition costs for banking around $300. In other words, it’s not hard to use up your budget on expensive paid campaigns like SEO and across digital channels and have nothing to show for it.

- Disconnected systems: Especially for smaller banks and credit unions, a lot of your digital technology may be outdated and disconnected from the rest of your systems. The J.D. Power 2020 U.S. Retail Banking Satisfaction Study called out this problem, citing a real gap when it comes to banks offering a great digital experience.

- Technology and development resources are expensive: Again, it’s about using your budget wisely and seeking out “bang-for-your-buck” partners that can help you stay competitive in a budget-friendly way.

So, how can you level the playing field?

Winning Strategy:

A rising tide lifts all boats, as they say. If you are able to provide personalized, interactive answers at scale, every digital channel you have will reap the benefits.

As a marketer, personalization is something you know and understand. But we get it – you need to share metrics to support that. Below are tips on how to build an ROI analysis that will convince your team to pull the trigger on incorporating financial calculators on your website.

Why calculators? Because calculator pages will drive valuable inbound traffic to your website from search engines.

What Will the Business Impact of Calculators Be?

This is the key question you will have to answer in order to win over your team: What measurable impact will financial calculators have on your digital strategy?

Once you understand that, you need to put it into the language of the folks making the business decisions. So go ahead and tell them this: “I’ve found a solution that will help us tap into a new audience of qualified leads.”

Calculators allow people to find the answers they’re looking for online, which gives you an opportunity to tap into a whole new audience. Now translate that to business-speak:

- More qualified website traffic from your paid campaigns? Check.

- Improved SEO Rankings for priority keywords? Check.

- Lowered Customer Acquisition Costs? Check.

Here are three additional reasons supporting the use of financial calculators

1. You will improve your website health

Interactive and personalized tools are more engaging than products, rates, and traditional digital content. Here’s how you explain this in ROI terms:

- Improved website engagement: In a study by DemandGen, it was revealed that interactive content gains 2x more engagement than written articles.

- Increased time on your website: 66% of marketers say engagement levels increased after introducing interactive content to their marketing plans.

- Lower bounce rate: Marketing website Quicksprout estimates that interactive content can help you drop your bounce rate by 15% or more.

- More pages per visit: As marketing expert Neil Patel explains: “If visitors are looking at a lot of different pages, spending a lot of time reading those pages, and leaving comments or reviews, they’re still interacting at a high level. Even if they’re not converting (yet) your goal should be to increase these interactions.”

2. You will win more people online

Once people find the answers they’re looking for, you need to be able to convert them – that’s when the “R” of ROI begins to really kick in. Calculators are a direct measurable channel to convert more people into your application and online account opening workflows. Show your team exactly how it’s done:

- Higher conversion rates on landing and product pages featuring calculators: According to one study by Outgrow, conversion rates from interactive content are nearly 30% higher than your typical landing pages.

- Increased click through rates on email marketing campaigns featuring calculators: Get more people to your landing pages by offering them something they value.

- More online applications directly from calculators: Dime Savings Bank saw 200 people clicking into account applications flows within three months of adding a financial calculator.

- More online account openings directly from calculator CTAs: First Foundation Bank saw an additional 500 customers clicking to open savings accounts after launching a calculator.

- More appointments for loan officers and bankers booked directly from calculators: Direct Federal Credit Union had over 120 people click into their mortgage application funnel in just three weeks after launch. This led to a 71% increase in mortgage applications.

3. You will improve your digital benchmarks

Digital Transformation is one of the most important efforts facing financial institutions today. With 50% of people interacting with their bank via web and mobile applications at least once a week, according to Accenture, banks need to evolve with the times.

Consumers expect a digital experience that is beautifully designed, easy to use, and simple to understand. Calculators provide that experience seamlessly integrated to the rest of your website and products. This can help your site achieve recognition including:

- Improved Net Promoter Scores

- Higher JD Power website rankings

- Industry awards for a best-in-class digital experience

Avoiding High Development and Opportunity Cost

The average time to design and launch a custom calculator from scratch is 12-16 weeks (that’s not even counting the time it takes for you to build the business case and win budget). Not to mention that it ties up so many resources from across departments including UX/UI designers, developers, your website team, compliance, legal, and your boss. Here’s just a few of the headaches that you can save by outsourcing to a trusted partner instead:

- Billable hours of your agency to build, maintain and fix broken calculators

- FTE hours spent trying to fix outdated technology

- Frustration over poor integrated and unorganized data

- Missed opportunities that your team could be focused on other high impact projects

In other words, if you can save money by investing in a solution that solves all of the above problems, the bottom line improves.

Key Arguments for Adding a Financial Calculator

Armed with all of the above information, once you’re in the home stretch of making the business case for adding calculators to your site, you want to end strong. Here are a few more stats to get you across the finish line:

- Interactive content generates conversions “moderately” or “very well” 70% of the time, compared to just 36% for passive content, as per Kapost.

- When marketers were asked by the Content Marketing Institute which stage of the buyer’s journey calculators are most effective, there was almost an even split between: early stage/awareness (35%), middle stage/consideration (35%), and late stage/decision (35%).

- Marketers put the effectiveness of interactive content at 93%, according to Inc. magazine, compared to just 70% for static content.