2020 was a great year for many online businesses but obviously it was a bad one for many others as well. Even prior to the pandemic, we were seeing a shift to a need for a different content strategy than what most financial institutions are used to producing.

During the pandemic, many agile institutions were able to adapt and create the content needed that consumers have been looking for, while the banks, credit unions and card issuers who weren’t able to adapt have seen a dip in their search engine results page rankings.

I’ll be covering five steps you must take to make sure that you’re positioned for success moving forward — and I’ll be leaving out anything that I don’t feel is possible to secure in a short timeline, but giving you a checklist to take your efforts further.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

1. Upgrade Your Keyword Strategy As Soon As Possible

To some who work in search engine optimization, this might seem like a silly point to put on my list. However, the truth is, I speak to many large financial institutions that have done very poorly at SEO. And it’s merely because they keep choosing the wrong keyword themes to target.

“Many large financial institutions have done very poorly at SEO. And it’s because they keep choosing the wrong keyword themes to target.”

Whenever I’m presented with a set of keyword themes, the first thing I want to know is how the institution determined which themes to focus on. 95% of the time the reason is monthly search volume. Unfortunately, that can put you into a situation where you’re building lots of content, and optimizing existing pages for themes that might take years to gain traction on Google and any other search engine.

There are tools out there that will help your institution leverage the scores to help your team select which themes will most likely to see traction when optimizing. (iQuanti has one called ALPS.) Such tools help build short term/quick wins and long-term pathways to acquiring keywords that might be extremely competitive.

In the absence of such a tool, there’s also a “good old-fashioned way.”

My starting point would be search volumes, most likely. If your site deals with financial services, I wouldn’t target anything less than 3,600 in search volume a month for broad terms and nothing less than 320 a month in search volume for anything in the mid-funnel and upper-funnel consumer journey stages.

After doing that I would review the site for “topical relevancy.” Compare all the on-page elements, including theme usage in the header tags, theme usage throughout the body copy, theme usage in the URL naming convention, images with supporting theme usage, and how many supporting pages I have on my site versus the competition.

Then I would compare competitors’ site speed metrics to my own, because since Google considers that as a factor.

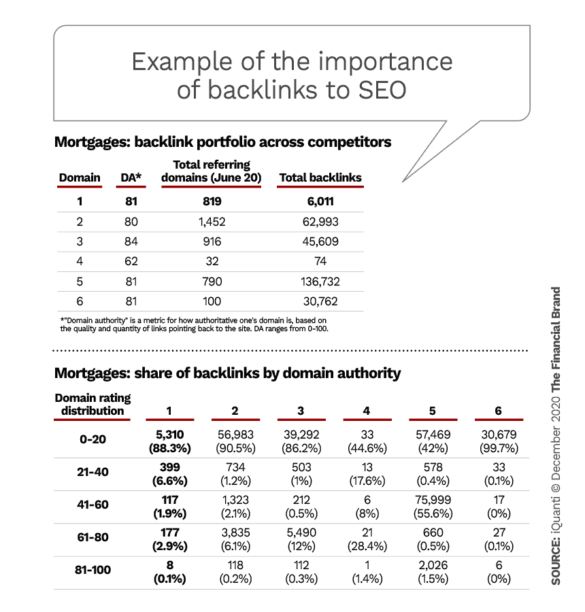

Finally, I would use a tool to pull my backlink profile as well to compare it to the competition for whatever themes I’m looking to move up on Google. (For relative newcomers to SEO, a backlink is an incoming link from another site.)

2. Building a Content Framework Is Essential For Fixing Your Site

Now that you understand which keyword themes you’re going after and what your topical relevancy gap is, you can put together this framework to help build your target goals and the right key performance indicators. For this you need a content framework. (This is not the same thing as a content calendar, which I deal with in step 5.)

“Most people in financial services tend to say that their target market is ‘everyone’ — but that’s not true. It’s even less true when it comes to ranking on Google.”

To start, a critical task is to determine what resources you have that can be deployed to creating content. Before the new year, if possible, but certainly as early as possible, schedule meetings with all marketing teams to check on content resources. Assuming you don’t have a content writer on staff, go hire one, or at the very least, find a good freelancer.

Here’s a task list that writer should be tackling asap:

- Covering keyword themes that the institutions doesn’t currently rank for on Google, but where we feel we could add value if we ranked for it.

- Building topical relevancy.

- Generating backlinks.

- Bringing in external traffic.

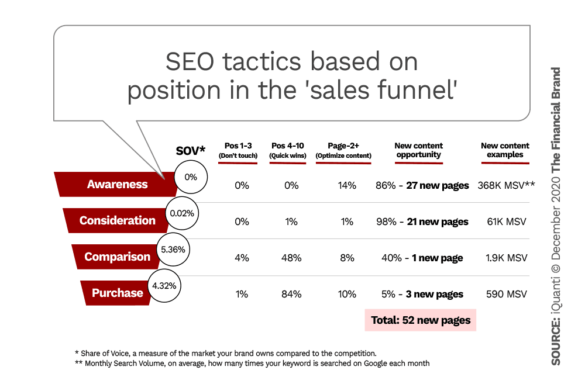

A warning: Before ramping things up, take the extra step of matching up every theme with a clear target audience. Most people in financial services tend to say that their target market is “everyone” — but that’s not true. It’s even less true when it comes to ranking for certain themes on search engines like Google. So segment out your target audience into the different funnel states like the example below:

Read More: Google Brand Exec: How to Humanize Digital Experiences in Banking

3. Make Sure Your Content Answers Upper-Funnel Queries

The biggest content gaps I usually see on financial services sites is in the upper-funnel and mid-funnel stages. The main reason for this is that financial services institutions typically concentrate their content on brand loyalty personas and personas who are in the purchase funnel stage — the very bottom. As a result of this tendency, most financial services sites need a serious injection of new content that covers the upper-funnel and mid-funnel stages.

“People do their shopping for everything on the web, and they like to compare one institution or card or loan or deposit account to another.”

Here’s a key point to understand: People do their shopping for everything on the web, and they like to compare one institution or card or loan or deposit account to another. So they are seeking information or trying to compare products side by side.

Traditionally, then, this is why aggregator sites like Bankrate.com enjoy the traffic they do. They understand the upper- and mid-funnel stages.

Remember that Google never stands still for very long. Google made some key updates in 2020. One is that it will index specific passages within your page. Right now is the prime time to roll out some new content which covers the mid to upper-funnel content personas.

Many financial institution webmasters have been confused about this update. Understand that it does not mean that Google will only index a passage on your page and not the rest of the content … that’s not what will happen.

Google will continue to index your entire page, but it will give a separate “weightage” or value to specific passages in your page that closely align with what the end-user searched for.

This is great news for sites with mid- and upper-funnel content currently in market. But it is really bad news which could cost you impressions and clicks assuming you don’t have content like that in market.

In a company blog, Google explained what it is up to with this new twist: “Very specific searches can be the hardest to get right, since sometimes the single sentence that answers your question might be buried deep in a web page. We’ve recently made a breakthrough in ranking and are now able to not just index web pages, but individual passages from the pages. By better understanding the relevancy of specific passages, not just the overall page, we can find that needle-in-a-haystack information you’re looking for.”

Try this tip: Consider bulleted-style content or a step-by-step guide, when either makes sense. In some cases those structures will have a higher chance of ranking above content which isn’t in those formats.

Put yourself in the searcher’s place: What would be the quickest way for you to consume the answer you’re looking for when you have found what you searched for?

Read More: 4 Keys to Improving Search Performance for Banking Websites

4. Set A Firm Schedule Via A Content Calendar

This is not to be confused with your public relations content calendar, which I’ll cover in a moment. The content calendar should have a specific focus on closing the content gaps on your site. There are a few steps you could take to help your content team come up with a scalable content calendar. (And notice how I am setting this next section up as a passage with steps in it?)

- Figure out the themes that you want to rank for (as stated earlier).

- Start Googling those themes, make a list of all of your search engine results page (SERP) competitors based on those themes.

- Use a keyword tool to pull all the keywords the competition ranks for on Google.

- Think about which themes make the most sense based on the KPIs you have for the next two quarters and the level of difficulty to rank for those terms.

- Build out a weekly calendar in Excel with all the themes you’ll target over the next three months. Put a timeline to the release of each new page.

Here are the column headers such a calendar might have: Category, Topic, Search Volume, Current Status, Content Brief Delivery Date, Compliance Status, Main Keyword, Article/Page Title, Published Date, Proposed URL, Quick Review on Implementation, Recommendation Made. (The latter is an SEO best practice.)

5. Build Your PR Calendar With A Strong Focus On Lifestyle Content

Most marketers reading this will think: “What do SEO and Public Relations have to do with each other?”

Funnily enough, while Google tells you “PR doesn’t work for SEO,” that’s nonsense.

Logically, PR is the way your site becomes authoritative in the first place.

Every year I spend a huge amount of time training in-house PR teams at large banks on how to double-dip from their PR efforts. The biggest “ah-ha” moment I see is when I bring up SEO … it’s like a veil has been lifted off their eyes, and it just “clicks” with a realization that it’s genius! You would be surprised by how many PR professionals have never even heard of SEO before.

“I spend a huge amount of time training in-house PR teams at large banks on how to double-dip from their efforts. The biggest ‘ah-ha’ moment is when I bring up SEO.”

Think about it. Most in-house PR teams will produce and promote at least two press releases per quarter, and one affiliate or guest posting opportunity. Typically the effort focuses on releasing earnings, publicizing their stance on a social topic, or just issuing general news like a promotion or a new product.

Reboot your PR thinking. Add “lifestyle content” to PR officers’ do-lists. Such content that catches a user when they’re just looking for information but don’t really know what product they need yet.

Here’s an example: Take a user who searches Google for something like “What are some ways to save for a home?” or “How to start investing in 2021?”

They want some education, and in both cases, that can be tied to a product. Neither searcher knows which product they’re looking for yet, but they have a need, and by devising lifestyle content that is not “super salesey” you can help them and make a case for your institution.

This is content that will sit in the mid-funnel and upper-funnel stages. Your in-house PR needs not to shift focus from what they’re doing, they just need to add additional resources to create this kind of content.

Start off with doing one more release every month, but this could defer greatly depending on the theme you’re focusing on.

My firm has financial clients who produce over a dozen such items each month. So keep that in mind if you decide to do only one.

Get Moving Now (While Others Are Taking It Easy)

The five steps I’ve outlined are basics, must-dos to implement as early as possible. Here are a few other things I would consider taking steps to correct moving into the first quarter, or as soon as your institution buckles down to serious SEO. Consider this a checklist for discussion with an expert.

- Benchmark your site speed metrics. Work with your development team to put in place a plan of attack to make the site faster.

- Breed a need for speed. If you’re using a site built on JavaScript consider using a Content Delivery Network — CDNs literally reduce physical distance between site and searcher — or moving to SSR (server-side rendering), a different way of delivering web pages to browsers that could speed up your site.

- Build a small scrum team (1 person) who could work on some of the small mundane — but necessary — SEO tasks.

- Get into Schema Markup. Ask your developer to put a plan together to add Schema Markup sitewide. This term refers to code that helps search engines return more informative results for users.

- Considering remodeling your site. If you haven’t had an SEO re-architecting of your site in the past five years, chances are your due for a new one that is search engine friendly.