Before COVID-19, most financial institutions were actively promoting digital solutions and channels, and were beginning to take advantage of the modern technologies available for improving marketing effectiveness. As with most areas of banking, marketing budgets and priorities progressed modestly based on plans created in previous years.

Then the pandemic changed virtually everything for consumers and businesses almost overnight. COVID-19 impacted the services desired, the way people and organizations conducted business, and the messages we communicated. The pre-March optimism felt among marketers plummeted to levels not seen since the depression.

With communication of digital alternatives and solutions for those experiencing financial stress being moved to the forefront of financial institution’s priorities, the role of marketing increased in importance across all industries. Brand awareness and activities to authentically connect with consumers took center stage, with sustainability and social awareness being paramount. At a majority of financial institutions, marketing budgets as a percent of organizational budgets increased to new highs despite some marketing job losses.

Those marketers who could communicate personalized, relevant and compassionate messages in real time using multiple channels were the most prepared for this unprecedented period.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

COVID-19 Shifts Marketing Priorities

The Covid-19 crisis increased the adoption of digital products and capabilities across all industries as consumers were forced to work from home. Despite a lower likelihood for consumers to buy non-essentials after COVID hit, 84% percent of marketers believe customers place more value on digital experiences than before the pandemic, according to a special Covid-19 edition of The CMO Survey sponsored by Deloitte, Duke University and the American Marketing Association. The survey conducted from May 5 -27, 2020 polled marketing leaders at for-profit U.S. companies across a range of industries.

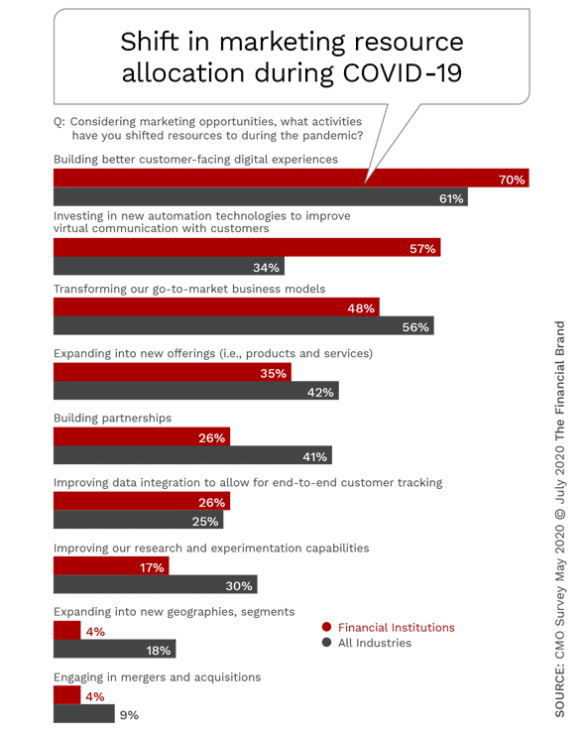

According to the CMO Survey, financial institutions are adjusting their offerings and pivoting their businesses to meet these new expectations and opportunities, with 70% indicating they have shifted resources to building customer-facing digital interfaces, 57% investing in new communication technologies, and 48% transforming their go-to-market business models.

Marketers surveyed also predicted consumers will place a higher value on trusting relationships as has happened during all previous times of economic uncertainty.

Marketing Spend Goes Digital

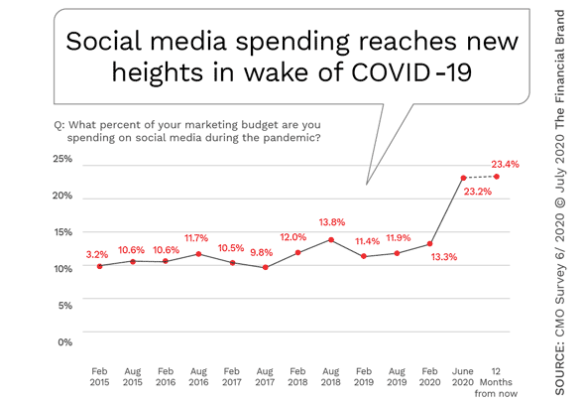

As expectations increased due to the need to communicate with current customers and communities more frequently and in real-time, marketers in all industries increased their use of social marketing exponentially. This follows an extended period of relatively flat growth.

This strategy was prompted by a tremendous increase in social media engagement by consumers who were no longer in traditional business environments and were craving interaction with others and information from the the firms they frequented regularly.

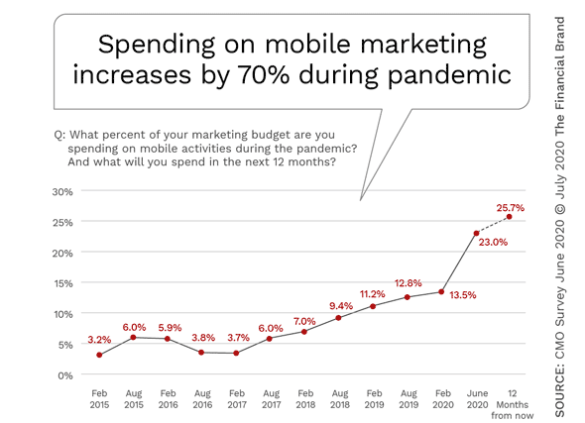

Similar to the increase in use of social media, organizations in all industries increased their use of mobile marketing to reach their current customers. Much of this marketing was focused on ever-changing updates around modified rules and regulations as well as offers for current customers. Part of this effort was also around brand building and loyalty, reassuring customers during stressful times.

Desired Skill Sets Change Amid Pandemic

In almost all industries, there was some job loss in marketing departments despite an increased importance of marketing overall. The job losses were rather minimal in financial services compared to some other industries (retail, consulting, hospitality, travel).

When asked about the skills that are now desired in marketing departments, there was a significant divergence between what skills were desired in financial services vs. other industries. For instance, while financial institutions stated that ‘leadership abilities’ would be the most important skill, the ability to pivot was noted as number one by all industries as a whole. In fact, the top four skills desired by financial institutions didn’t make the top four in other industries.

Looking Forward

Despite an increase in prominence of the marketing function within banks and credit unions, it is expected that budget pressures will mount for financial institution marketing departments. This may prompt some departments to bring some work in-house to achieve cost savings. The challenge may be whether in-house teams have the skills needed to respond to this transfer of work.

Other significant changes in the future will include investment increases in marketing technology, a continued heavy emphasis on customer retention and growth, an increased focus on strengthening a firm’s brand, and a shift in channel mix to include a greater emphasis on digital channels … including social marketing.

The impact on financial institution marketing from recent social issues regarding race and gender has yet to be seen, but it will certainly not be able to be ignored. This rings true with all sustainability issues as well.

The COVID-19 pandemic highlighted the importance of agility, as the marketplace changed quickly and often throughout the crisis. Understanding various customer journeys also can’t be underestimated, since consumers can react to ‘tone-deaf’ marketing in an instant with a push of a button.

It is anticipated that the role of marketing in financial institutions and the priorities to achieve objectives will evolve throughout the year. Similar to consumers, organizations in all industries are still grappling to understand the implications of COVID-19, and how it will impact the way people live, work and bank. As with all times of change, financial institutions will need to be able to pivot as the marketplace changes and maintain a focus on customer needs as they continue to suffer financially.