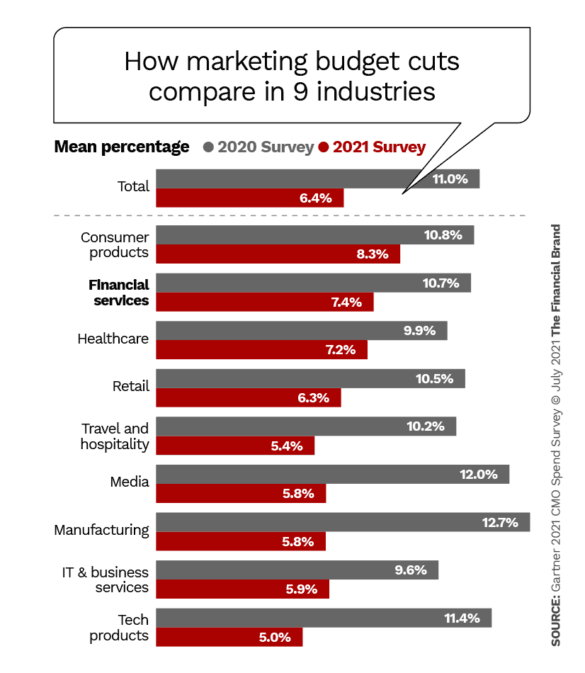

During 2020 chief marketing officers across nine major industries, including financial services, took major cuts to their budgets but told Gartner that they expected to regain the lost ground in 2021. Not only did that not happen, despite the economic resurgence, but CMOs saw budgets cut even further — setting a record.

Marketing budgets, expressed as a percentage of total company revenue, fell from 11% in 2020 to 6.4% for 2021, according to the Gartner Annual CMO Spend Survey. Financial services companies’ CMOs had an easier time than many others. Their industry saw marketing budgets fall from 10.7% of revenue to 7.4%, better than retail, travel and hospitality, media, manufacturing, IT and business services, and tech products. Only consumer product and healthcare marketers held their budgetary ground better than financial marketers.

That’s somewhat good news, but losing less than others is hardly any reason for celebration or planning major new initiatives. In fact, as we’ll explore, some of the loss to marketing budgets results from reallocation of funds to chief digital officers’ budgets.

A Record Drop for Marketing:

Gartner’s CMO Spend Survey saw marketing budgets fall to the lowest level since the annual study began in 2012.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Marketing Always Gets It in the Neck First

On one level, the massive drops should be no surprise. Marketing budgets have always been the first company budget to be cut and always the last to be restored, when there is company or economic trouble, according to Ewan McIntyre, VP/Analyst and Director of Research at Gartner for Marketers. During a webinar based on the research, he noted that marketers tend to be optimists, but that “the swift bounceback hasn’t happened yet.”

The research found that marketers are already predicting that budgets will come back in 2022.

Gartner includes the following in marketing spending: agencies/services used by marketers; paid media, including both digital and traditional advertising; labor, including salaries, fringe benefits and training for both full-time and part-time employees; and marketing technology.

The Gartner report gives two potential reasons for the continued budget squeeze in Marketing. One is that chief financial officers like the savings and won’t increase funding easily. Further, “CMOs proved that they could do more with less,” according to the study, “curbing spending on events, agencies and ad budgets in the face of a crisis.”

Not all U.S. financial services companies cut back marketing spending in 2020, of course. An analysis of 2020 federal call reports, which include a line item for marketing spending, was conducted in early 2021 by EMI Strategic Marketing. The firm found increased spending by multiple players, including Ally Bank, American Express and Bank of the West.

The Gartner study drew on research conducted online from March-May 2021, with about half of the 400 respondents based in the U.S., 27% from the U.K., and the remainder from Canada, France and Germany. About 12.5% of the sample consisted of financial services companies.

Read More:

- 5 Essentials for Bank & Credit Union Marketing Budgets

- What to Cut, What to Keep as Bank Marketing Budgets Get Squeezed

- How Big Should Bank Marketing Budgets Be for Profitability & Growth?

- How Big Should Credit Union Marketing Budgets Be for Profitability & Growth?

Will CMOs Lose More Budget to Chief Digital Officers?

McIntyre said a key reason for Marketing losing budget is digitization.

All industries had to ramp up spending on digital delivery, not just financial companies, in 2020 and that investment has continued in 2021 as well. Adding to digital infrastructure is an enterprise budget matter, McIntyre explained, and takes priority over marketing spending. The report points out that spending on digital development is broadly considered a path to growth. Marketing appears to be seen as expendable. This finding was bolstered by a separate Gartner research project probing the attitudes of CEOs.

“The impact of near-term marketing budget cuts on brand awareness and consideration is often not immediately appreciated by Marketing’s stakeholders in the enterprise. CMOs need to demonstrate in their next budgeting cycle that the illusion of savings today presents a significant risk for tomorrow.”

— Gartner, “The State of Marketing Budgets in 2021”

If CMOs don’t regain funding, over time brands will “lose customer relevance, share of voice and the ability to reach customers with targeted and timely messages,” the CEO study concludes.

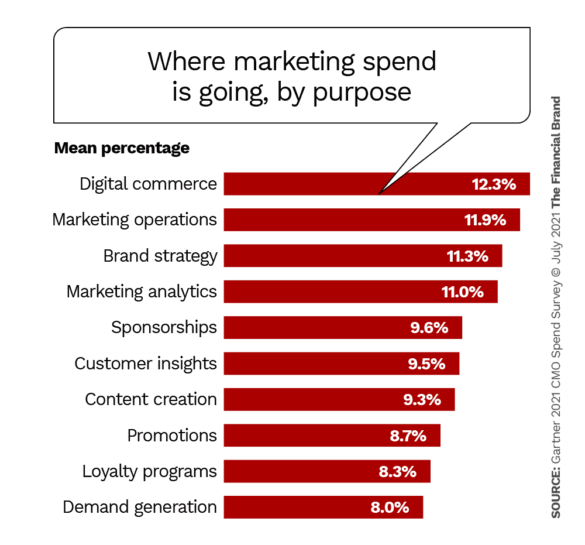

The study further indicates that chief digital officers are getting some of the funding that might have been Marketing’s. Customer experience and e-commerce were top priorities for the leaders.

“As these capabilities move to be enterprise digital business initiatives, a CMO’s accountability and budget authority may give way to mere supporting roles,” Gartner states. “Therefore, CMOs must not only focus on how to reclaim the wholly cut resources needed to achieve their objectives but also continuously justify their ownership in both budget and delivery of critical business priorities.”

CMOs Revise Their Spending Decisions

The marketing study indicates that CMOs have been reprioritizing how they spend the budgets they have, but that cost is only a small part of their reasoning.

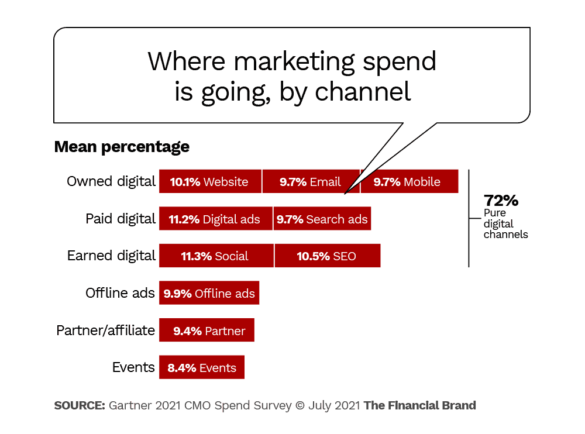

“Changing the marketing channel mix is not a pure cost play,” McIntyre said during the webinar. 47% of the sample said they were shifting spending to meet the pace of change brought on by digital technology. 39% hope to gain more insight through analysis of data obtained from digital channels. Only 24% of the survey sample cited cost cutting as a key reason for shifting.

In the study digital channels accounted for a growing portion of the marketing dollar.

While nearly three quarters of spending is going to purely digital channels, Gartner says the lines between digital and traditional channels are blurring so much that differentiating by “digital” and “traditional” is nearly moot. McIntyre noted that much of the spending on TV, for example, is moving from broadcast and cable television to streaming.

The pandemic has altered some thinking about channels. “Channels that have traditionally been seen as drivers of awareness, such as TV or out of home, are now vying for budget alongside those that have been considered as performance marketing channels, such as search and social advertising,” according to Gartner’s ebook.

Spending on media is only about a quarter of the cost of marketing, however. Over the entire sample the leading spending category for 2021 is marketing technology. This category actually saw a small rise over 2020. About half of the sample expects to see this increase slightly in 2022. One out of five expect martech spending to rise significantly.