Email has been around so long people almost forget that it is a digital marketing channel. Sometimes overused, sometimes abused and routinely expected to fade away, email remains, a workaday tool for financial marketers who need results, not necessarily coolness. And now this old standby has become much more than that.

Email’s importance has grown markedly during the pandemic period.

“People who frequented branch lobbies have started paying more attention to email communications to stay current on information from their financial institution,” observes Penne VanderBush, Chief Strategy Officer at FI Grow Solutions.

“Some banks, especially mid-sized and regional institutions, didn’t have a fully developed digital service infrastructure leading into the pandemic,” says Jackie Mattia, Director of Client Strategy for Movable Ink. “Email has been a great way to bridge that gap to serve and reach customers digitally.”

While digital marketing spending in other channels has decreased significantly, email volumes for financial institutions have remained consistent, according to Lierin Ehmke, Senior Digital Marketing Analyst at Comperemedia, which tracks digital ads and other types of marketing activity.

“Email is the fastest way to communicate status updates, business continuity messages, and empathetic messaging,” observes Garin Hobbs, Director of Deal Strategy at Iterable. “It’s starkly contrasted with websites and social platforms, which can be quickly updated but are passive mediums that require initiative by the customer in order to connect.”

Even so, since the start of the COVID crisis, financial marketers have had to think about using email in new ways — moving away from typical messaging and segmentation strategies. The Financial Brand reached out — by email, actually — to email marketing professionals at firms that work with financial institutions, asking them how best to use email marketing in current circumstances. Their suggestions and observations are summarized below.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How Should Financial Brands Tweak Email Marketing Strategies?

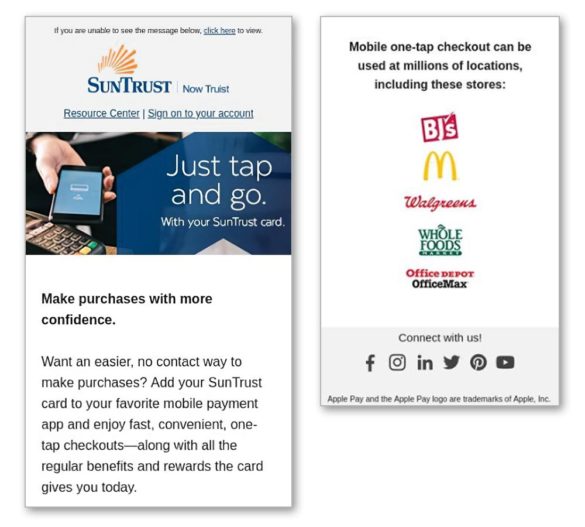

One adjustment is to recognize that despite earlier communication efforts, anxieties have heightened once more as phased reopenings have occurred in tandem with increasing COVID-19 cases. “It’s essential for financial institutions to continue to remind consumers about how they can engage with their brand and products in a safe and secure way,” Ehmke maintains. Reassurance is key, she says, and successful brands are using email to promote contactless payments and similar features that allow customers to continue living their lives as safely as possible.

The analyst points to SunTrust (Truist) as a great example. “Not only did it remind customers of its contactless payments capabilities,” Ehmke states, “but they took it a step further by listing retailers where contactless technology is offered. This helps customers plan for a safe shopping experience while working to boost the business of both the bank and the retailers.”

Iterable’s Garin Hobbs responded to the question of how email strategy should change, with several specific points:

Acquire more customer data. The more data you have about your customers, the more personalized you can make your messaging, he states. To help accomplish that, banks and credit unions should create opportunities for consumers to provide zero-party and first-party data. Showing them opt-in forms and pop-ups when they visit your institution’s website is a great way to start.

Communicate with empathy. “When dashboards and stats dominate the decision making, it’s easy to forget that behind every open there is a person,” says Hobbs. The human being behind the conversion is especially important during a pandemic, as they are in a heightened state of stress and sensitivity, he continues. “The task at hand for marketers is to message with empathy, which involves acknowledging the audience’s perspective, crafting judgment-free messages, and mirroring customer emotions.”

Reconsider customer segments. “Because COVID-19 has produced new social polarities,” Hobbs states, “customer segments must be redefined.” For example, some people have been financially impacted by COVID-19 and some have not; and there are consumers who are eager to return to normalcy and physical banking versus those who wish to continue remote banking. Hobbs urges banks and credit unions to use these segment changes to their advantage, by communicating with each one appropriately.

Even during the pandemic, retention should continue to be a core near-term focus of email marketing for traditional checking, savings and credit cards, suggests Elle Kross, Associate Director of Client Strategy for Movable Ink. However, there’s also a significant opportunity for financial service brands to expand their relationships with existing customers through cross- and up-sell marketing. “Brands that have proven to be a loyal partner to customers during these hard times have an opening to deepen that relationship,” Kross states.

Read More: New Email Habits & Trends Demand Fresh Financial Marketing Strategies

How Do Marketers Determine the Right Tone Now?

While the right tone in email messaging is always important, it’s critical right now. But that doesn’t mean grim. “While you certainly don’t want to make light of the situation, communication style and imagery that is too somber are not going to drive a lot of click-throughs,” says VanderBush. “It’s important to find the right balance that’s in alignment with your brand voice.”

Part of that balance is communicating in a clear, simple and human way. “During a period like this where so many are experiencing economic hardship, the last thing you want to do is add friction or stress by using difficult-to-understand terminology or jargon,” Mattia emphasizes.

Emails from Keypoint Credit Union and Bank of America are succinct and demonstrate that simplicity can be effective, in Hobbs’ opinion. The analyst points out that people want to know what you’re going to do for them now — in the next 30 days, not sometime in the future.

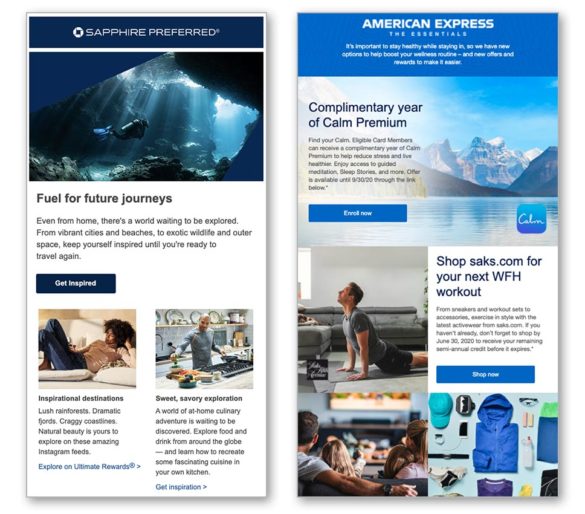

Again, keeping in mind the pandemic segmentation point made earlier, helping them now can be something pleasant. The two emails below demonstrate this, showing ways that customers can use their credit card benefits to stay healthy while spending more time at home (American Express Essentials) and satisfying wanderlust with vicarious travel to digital destinations (Chase Sapphire Preferred).

Movable Ink’s Jackie Mattia points out that data should be used to set the right tone.

“Financial institutions have a tremendous amount of information they can use to personalize their messages and tone,” she states. For example, if someone’s normal monthly spending habits suddenly decrease, marketers may want to personalize messages to be cognizant of that and not promote, say, a new car loan. But if someone is just taking out a mortgage, there’s an opportunity to share in a joyful tone, Mattia notes.

Authenticity Is Needed Now More than Ever

All the experts emphasized the importance in any marketing communication. “Authenticity means understanding and emulating the attributes that fuel trust in your brand,” says Jeannette Ornelas, Senior Digital Marketing Analyst at Comperemedia. Financial marketers, in particular, must address the growing inequities and disproportionate access to needed financial resources brought on by the pandemic, she adds. “Brands need to show how they’re uniquely positioned to help specific subsets of customers.”

“The authentic marketer is a storyteller. Connect with your customers like you actually know them.”

— Garin Hobbs, Iterable

Mattia reports that some of the most authentic financial institution emails she’s seen in recent months have used email as a content hub. “While they might have contained a product or offer that is properly targeted to the customer’s needs, they also contained useful non-sales content such as guides to how customers can maximize their account benefits or use digital tools, and helpful perspectives on financial wellness.”

States Garin Hobbs: “With financial institutions, there are emotions built on the problems you solve and the possibilities you enable. Your goal with marketing should be to demonstrate these feelings through your narrative. The authentic marketer is a storyteller,” stresses Hobbs. “Connect with your customers like you actually know them.”

Read More: How Financial Marketers Can Keep Their Emails Out of the Junk Folder

Other Email Tips & Suggestions

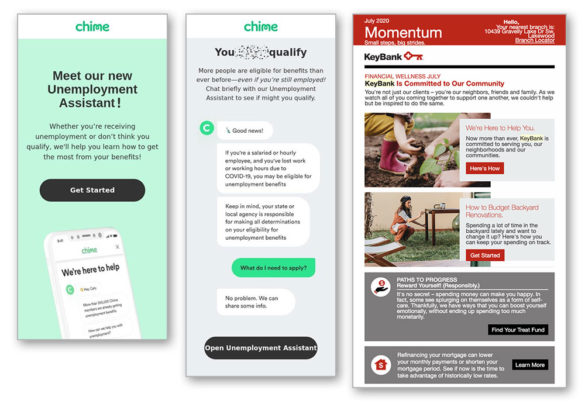

Try to anticipate the mental and emotional state your customer may be in when checking email, advises Comperemedia’s Ornelas. “Consumers are stressed and inundated with emails,” she points out, “so every email should have a clear purpose and the purpose should be clear to the customer right in the subject line.” A great example, she says, is Chime’s email (below) proactively offering a tool to help customers navigate unemployment benefits. It’s subject line is very clear: “You or a loved one could be eligible for unemployment benefits. Find out more.”

The KeyBank email focuses on the emotional needs of its customers, showcasing the bank’s community focus and how it can help with home improvement projects, which Garin Hobbs feels is quite effective.

“Remember that you have a human you are messaging to,” he states. With this in mind, he offers four suggestions to email marketers:

It’s not about you. It’s not about your product. It’s not about getting the sale. Shift to a customer-first narrative.

Avoid generality. Invest in messaging that is highly personalized and hyper-empathetic. Ask what you can do for your customer and act on it.

Avoid complexity. Keep your text simple, short and approachable. No one reads the iTunes Terms and Conditions, so they won’t read a long-winded email, either. Your messaging should be infused with clear calls-to-action, rooted in integrity and values. Visual content such as infographics and GIFs/videos are a great way to make information more easily understood.

Reach out as a human. The greatest gift you can give consumers now is advice, and conversation, and a promise that their status at your bank or credit union is the least of their worries. The important point here is that customers feel like a real human person is reaching out to them, despite a rapid influx in available digital channels.