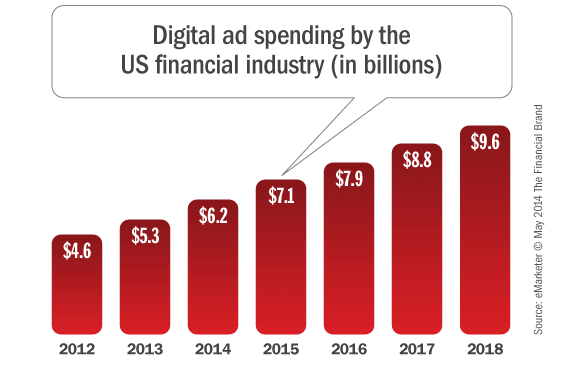

Advertising spending in paid digital media by the US financial services industry totaled $5.30 billion in 2013. According to a report from eMarketer, this number is projected to hit $6.20 billion in 2014 and rise to $9.57 billion by 2018, for a five-year compound annual growth rate of 12.5%.

Digital ad spending among financial marketers grew 15.3% in 2013 and is projected to increase another 16.9% this year, with growth rates tapering off but remaining positive through 2018. In a separate study by SMI, digital ad spending in the financial services category grew an estimated 17.0% last year— slightly more than eMarketer’s 15.3% rate of growth.

Digital ad spending among financial marketers grew 15.3% in 2013 and is projected to increase another 16.9% this year, with growth rates tapering off but remaining positive through 2018. In a separate study by SMI, digital ad spending in the financial services category grew an estimated 17.0% last year— slightly more than eMarketer’s 15.3% rate of growth.

When looking specifically at digital marketing, the majority of financial marketers say they plan to maintain their current spending levels, with 42.9% opting for growth, and no respondents planning a digital pullback.

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Financial firms that leverage paid digital advertising — banks, insurers, investment firms and others — remain primarily focused on performance, with 62% of their dollars dedicated toward direct-response objectives and the remaining 38% being used for branding.

In a March 2014 news release, Kantar Media reported that measured media spending in the financial services industry dropped 4.1% in 2013 to $7.60 billion, which the firm attributed to “weakness in ad budgets for credit cards and retail banking.”

Mobile Advertising is The Future of Financial Marketing

While spending on search and display remains steady among banks, insurers and brokerages, mobile advertising will be a key growth driver in the years to come, as financial marketers adjust their media mix to reach consumers where they spend most of their time. Mobile advertising is becoming a substantial part of the digital media mix for the financial industry, driven by broader market trends as well as a concerted push by institutions to get consumers to use mobile financial services.

eMarketer estimates that the US financial services industry will spend $2.20 billion on mobile advertising in 2014, accounting for more than one in three (35.5%) digital ad dollars. Financial marketers will be the second-biggest spenders on mobile advertising this year, behind the retail category.

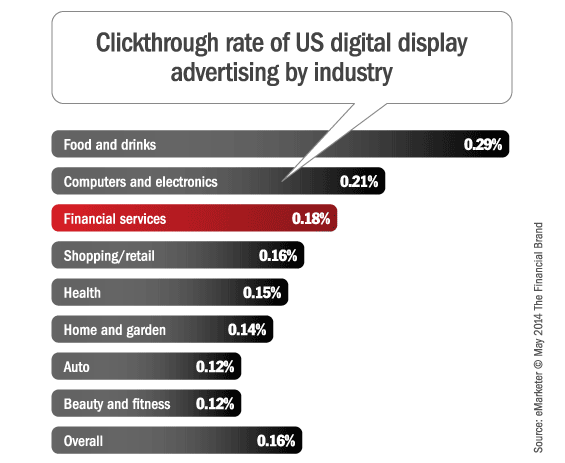

Mobile CTRs for the US financial services industry tend to be higher than those from digital display campaigns, and the addition of video is also proving to be a key factor at boosting performance. The clicktrough rate on ads in the banking industry averages around 0.34%.

Optimistic Outlook for Ad Spending in the Financial Industry

Areas like video, social media and sponsored content continue to get a lot of attention from financial marketers. Financial institutions are experimenting with these formats and tactics in new ways to try and reach their target audience and meet an array of objectives, with the ultimate aim to drive business growth.

| Difference between the % of respondents increasing and those decreasing their ad spending in the next 12 months |

Fall 2012 | Spring 2013 |

|---|---|---|

| Mobile | +58 | +69 |

| Digital video | +49 | +56 |

| Digital search | +46 | +41 |

| Digital display | +39 | +41 |

| Cable TV | +7 | +19 |

| Broadcast TV | +6 | +12 |

| Newspapers | -19 | -21 |

| Magazines | -9 | -22 |

“Whether it’s mobile, social, video or search, we are investing more in all of them than we have been historically,” Jamie Moldafsky, CMO of Wells Fargo, told eMarketer. “Some of that is a shift, some of it is incremental.”

The financial services industry will remain the second-biggest spender on digital advertising this year. eMarketer expects its share to slip a bit in the coming years, not because of declining spending, but due to sharper increases in spending by the automotive industry.

eMarketer’s digital ad spending figures include advertising that appears on desktop computers, tablets and mobile phones, and all the ad formats on those platforms: banner ads, classified ads, email ads, mobile messaging (SMS), rich media, search ads and video.

eMarketer’s US digital ad spending estimates are based on the analysis of reported revenues from major digital ad-selling companies; estimates from other research firms; consumer internet usage trends; and eMarketer interviews with executives at ad agencies, brands, digital ad publishers and other industry leaders.

Access more information on eMarketer’s “Digital Ad Spending by Industry” report series, and download a free executive summary here.

Corporate subscribers to eMarketer can view the complete 20-page forecast report by clicking here.