Financial marketers who haven’t boarded the mobile marketing train yet had better hop aboard before they get left behind. That’s based on a wide scan of research concerning consumer use of smartphones and tablets through the ongoing COVID-19 period and the behavior of other marketers through the pandemic and their plans for keeping a strong emphasis on mobile channels post-pandemic.

However, as they climb aboard they have to make sure they understand what they are getting into or they’ll be wasting their increasingly tighter marketing budgets.

In a special midyear 2020 update of Deloitte’s The CMO Survey, U.S. spending on mobile marketing and social media marketing rose sharply, increasing by 70% and 74% respectively, to hit 23% of marketing budgets, on average. “Marketers anticipate that mobile spending will continue to grow over the next 12 months, while spending on social will remain close to this new high level,” the report states.

It appears that these increased efforts have been needed to continue to hold each firm’s market position, at the least, if not to strengthen it. The special survey report indicates that spending on mobile didn’t contribute to perceived growth in performance. On the other hand, investment in social media, in many ways a variant on mobile marketing, has increased its contribution to company results by an average of 24% in the Deloitte study.

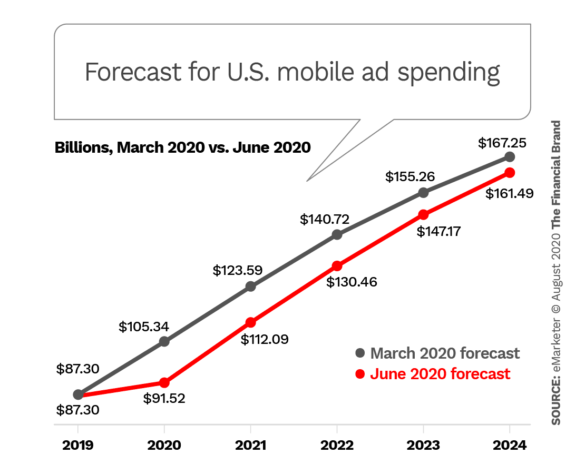

But mobile is booming. eMarketer reports that even after revising its initial annual forecast due to COVID-based economic conditions, the growth in mobile channel marketing is anticipated to rise rapidly in the next few years. If the trend outlined in the chart below holds true, the next four years will see an increase of just over 75% in U.S. mobile ad spending. For 2020, it’s anticipated that a bit over two-thirds of U.S. digital ad dollars will go to mobile avenues, according to an analysis written by Yoram Wurmser, Principal Analyst at eMarketer. He adds that mobile’s growth is keeping digital spending from falling in the COVID period, due to cutbacks in marketing spending.

Marketers also reported a growing investment in optimizing their websites for mobile usage — dwarfing spending on developing new apps. Various studies have indicated that even though many people have continued to work at home, with desktop and laptop computers readily available, many are visiting websites via mobile devices — access from the couch rather than the desk or kitchen table.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Financial Usage of Mobile Marketing Gets COVID Kick

During the pandemic period companies in the study’s banking, insurance and real estate group have been spending about 22% of their marketing budgets on mobile channels and they plan to hike that to 26% over the next 12 months.

To get a sense of comparison, consider that in the pre-COVID version of the Deloitte study, the group’s spending on mobile was running at an average of about 17% and that the group predicted hiking mobile’s share of the marketing budget to about 29% — in five years. Clearly, COVID has accelerated interest in mobile marketing at the same time that financial institutions have found that consumers have, from necessity, adopted mobile and online banking channels in greater numbers than pre-COVID trends would have indicated.

Speaking broadly, Collin Colburn, Senior Analyst at Forrester, indicates in a report that the firm believes that mobile ad spending will account for 64% of total digital ad spending in the areas of search social, display and video advertising in 2020.

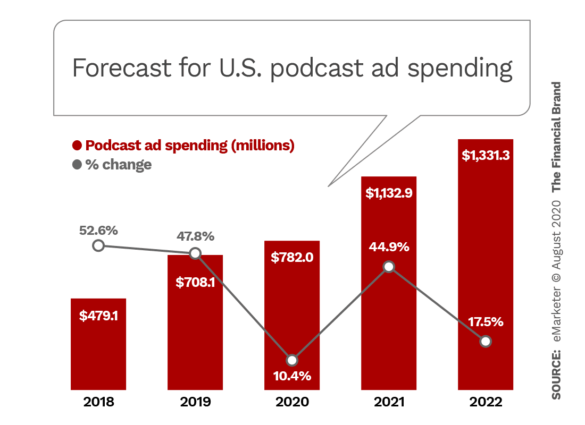

Increasingly, that spending will also take in podcasts, the report predicts, which people are consuming at an increasing rate, and on their mobile devices, even as they spend more time at home. This will include sponsoring podcasts produced by mainstream publishers and others who are ramping this up to increase COVID-crushed revenues. Forrester adds that customized, branded podcasts presented by advertisers themselves will also be growing over the course of the year.

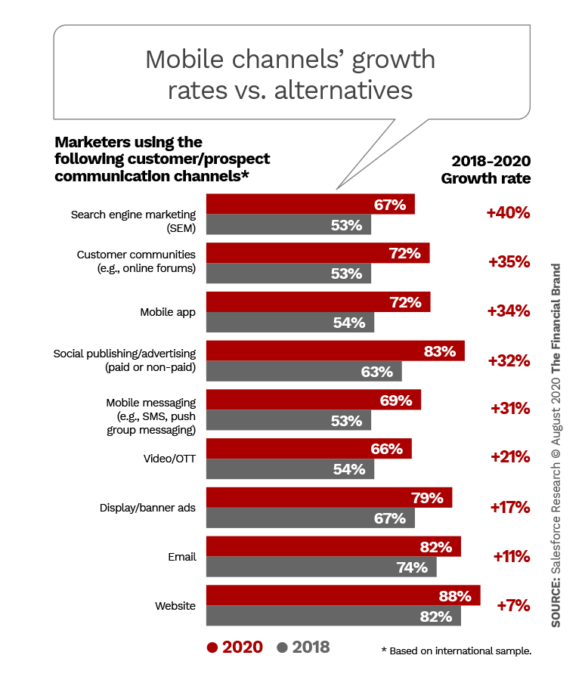

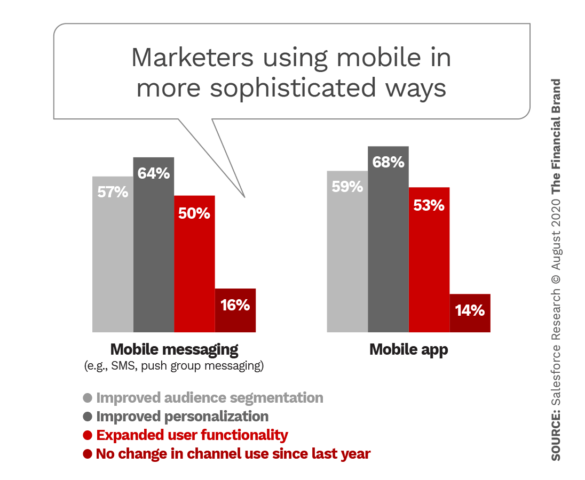

An international study by Salesforce found that mobile app marketing is one of fastest growing forms of digital marketing now.

While that is a good guide to the trends, mobile marketing actually covers much more than apps. An article on Adobe’s Marketo Engage defines it as follows: “a multi-channel digital marketing strategy aimed at reaching a target audience on their smartphones, tablets, and/other mobile devices, via websites, email, SMS and MMS, social media and apps.”

Read More: How Financial Marketers Can Tap The Surging Mobile Ad Market

Consumers’ Love Affair with Smartphone Gets Deeper and More Serious

Research in 2013 by Adweek estimated that 79% of smartphone users had their devices on them or near them all but two hours daily. By now, many could probably have the devices surgically implanted and not notice a difference.

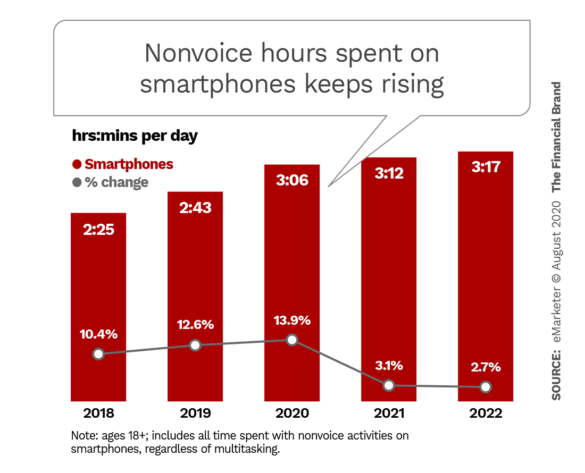

Beyond just having the device with them constantly — imagine carrying a mailbox, radio and television around on one’s back all the time — people keep increasing their time on the gadgets, such that by 2022 eMarketer estimates we will be spending about an eighth of every day and about a fifth of our waking hours on our smartphones.

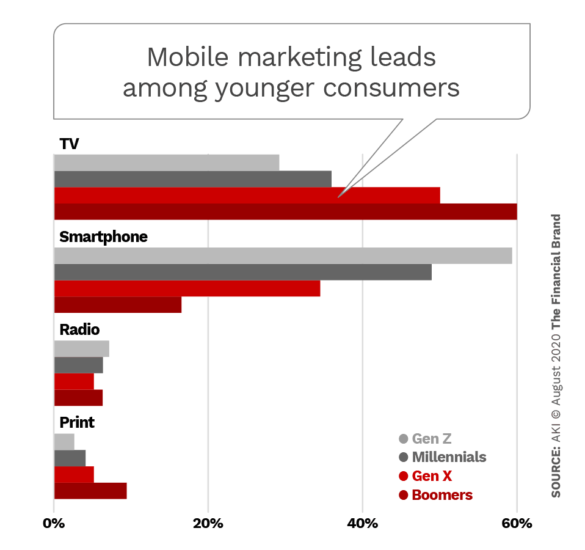

Research by Aki Technologies indicates that while television has a slight lead on mobile devices as the ad environment having the greatest impact on consumers, that gap is rapidly closing and the smaller screens may overtake the larger screens within a year. Already, younger consumers favor mobile ads over classic “tv commercials.”

When asked what effect a mobile ad would have on them, the following portions of each generation said they sometimes wanted to buy the product:

- Gen Z: 70%

- Millennials: 69%

- Gen X: 59%

- Boomers: 50%

What makes that especially interesting is that Aki’s research indicates that the time consumers say they are most receptive to mobile advertising is while they are watching tv — anything from networks to streaming — or just about to go to sleep.

Indeed, 63% of those reached while watching tv visited a brand’s website as a result of seeing an ad that night, and 65% of those watching ads before sleep did so.

Consider these points from the Aki report as well:

- 40% of consumers are on their smartphones for some reason about one out of three hours.

- 57% use their phones at least four hours daily.

- 36% say mobile video captures their attention over other ad formats.

- 50% of respondents say there are tracking screen-time, which may mean that there will be an upper limit (someday).

Podcasts continue to grow in popularity, and are especially popular for when people are doing other things, such as walking, exercising and driving. They can incorporate marketing in multiple ways.

eMarketer reports that podcast listeners account for about half of digital audio listeners and that this will rise to about 60% by 2023. In addition, the U.S. podcast audience will rise from 105.6 million in 2020 to 131.4 million in 2023. That an increase of

Understanding How Different Facets of Mobile Marketing Work

Before a financial institution moves too far in adopting mobile marketing, it’s critical that its marketing team understands all the elements that need to go into decisions on what elements of mobile marketing to use and how much to allocate for the effort. Mobile marketing is so broad and deep today that this merits several separate articles, but we can give a taste of what should be considered.

A key issue, as in all good marketing, is deciding what the goal of a campaign is. Brand awareness advertising has a whole different set of considerations than a campaign that ends in an opportunity for the consumer to interact with the brand.

Consider the ads you see on the apps you see on your own smartphone, for example. One ad may just be an awareness campaign for a household cleaner that’s thrown at you every ten minutes with an engaging jingle. You listen and get back to your music. On the other hand, another ad that is being used to drive sales may end with the invitation to “tap the button” or “tap the ad” on the screen.

Another consideration is the way the ad will be presented. Is it a glorified static banner? Is it an animation? Does it rely on audio? Is it a video? Different pricing is involved.

Budget becomes especially important as a marketer gets closer to committing to a campaign. This is lightyears away from placing an ad in the local paper. It’s not unusual, for example, for campaigns to be priced based on success — did the target consumer click on a link taking to the advertiser’s website? That may be where the provider makes or doesn’t make money.

The complexity of even the how, the when and the who of your mobile ads exposure is mind-boggling to the neophyte. In an article on Inmobi’s site, content strategist Matt Kaplan describes how ads get connected to consumers on mobile apps. Typically, once an ad exists, he explains, a “demand side platform” collects ads for potential placement. An “ad network” — a go-between — matches the desired audience attributes on the demand side platform to those generally available on their publisher partners’ apps, directly, or via yet another party, a “supply side platform.”

Note that this initial matchmaking is the barest of beginnings. A complex but high speed — it happens in milliseconds — process begins when someone opens their app. It’s showtime! What the platforms know about that consumer is exposed. Who wants to reach this person? What do they bid?

However, the process grows more complex when payment will hinge on performance, according to Kaplan. He explains that the ad network will assess the would-be candidates and determine which has the greatest likelihood of being clicked — which means the network and the publisher and supply-side platform make money.

This is just one element of mobile marketing. While Inmobi states in a report that 90% of all time spent on smartphones is spent on apps, the other 10%, frequently devoted to mobile websites, is not trash. App ownership skews towards males, for example, sometimes based on the subject matter, sometimes for other reasons. Certain types of mobile websites skew towards women — Inmobi notes that the CarMax research and buying site is visited by more women than men.

And gender is just one element. Age is another, and less precise, though Inmobi research has found that mobile website users tend to be younger, and that mobile app users tend to be older.

Consider two facts drawn from a paper by Liftoff. First, according to Forrester data the firm cites, 75% of marketers buy programmatic in-app ads, as described above, because they provide better targeting of consumers and the possibility of better customer engagement. Second, the population of apps allowing in-app advertising grew by 60% in 2019, according to App Annie, which tracks app store details. That will open up more inventory over a greater spread of interests.

Note that the data-heavy nature of the unseen back end of the ad placement and purchase process has attracted Washington’s attention, and how this is treated may depend on the upcoming elections. Privacy issues are unusual in that they have appeal on both sides of the aisle, historically, though for different reasons. The Wall Street Journal reported that a group of Democratic senator and representatives have asked the Federal Trade Commission to investigate the use of bidding data and to look specifically at how it can be used to track where consumers have been. Case in question was presence at Black Lives Matter protests and at churches.

Read More: What Big Techs Like Apple Can Teach Banks About Brand Loyalty

You’ve Got Less Than Half a Second to Grab Eyeballs

If the time period for platforms to decide who gets ad exposure flummoxed you, consider how mobile reacts with the human brain. Research conducted for the Mobile Marketing Association found that people form their impression of mobile ads in 400 milliseconds — less than half a second.

“Essentially, by the time a consumer blinks, their brain has already seen and processed a mobile ad,” the association stated in unveiling its study, conducted by Neurons, Inc. “And more so, by the time it takes for their heart to beat once, they have very likely formed an emotional response.”

Interestingly, because the mobile screen is taken over by each ad, the process is faster on a smartphone than for a desktop website ad. (The latter takes two to three seconds to register, if it does. There’s much more going on when a website is served up.)

Two more findings of interest: Video ads register an emotional response even faster than static ads. And weak ads excel in one way: They fail even faster.

The bottom line of this, according to MMA: “Although brands have been trained to develop 15/30 second creative and media strategies, or even 06/07 second strategies, marketers should now develop plans and strategies that address the first one second.”

Bank Marketers Must Think Like Mobile Users

In a report, Forrester’s Collin Colburn notes that would-be mobile marketers must think in terms of what will appeal to targeted consumers. Mobile users are not a captive audience — after all, a music app with an annoying repeat advertiser can be turned off, or can be upgraded to commercial-free status. As the number of users putting mobile ad blockers on their phones rises, marketers must keep this in mind.

Colburn also notes that marketers must understand that publishers have moved away from complete dependence on advertising income. Many have introduced premium content and paid levels, which means they are focused on customer experience as much as on ad revenue.

“Mobile ads don’t help accomplish that best experience as they are often interruptive and even slow down the site or app load times,” says Colburn. In fact he points out that the New York Times has removed programmatic apps from its mobile app to improve the paid-user experience, even though it means giving up millions in ad revenue.

“The entire digital ad industry is at fault for bugging consumers relentlessly with ads that aren’t relevant,” writes Colburn, “just because we can with programmatic technology. This challenge has spread from desktop to mobile and is more glaringly obvious to the consumer using a smaller screen. As a result half of all consumers innately ignore ads on their mobile device.”