Think about it. How did feel the last time you hopped online and couldn’t find information you were looking for? Especially when you thought it was something obvious a company should have been able to anticipate — something consumers might commonly need? It’s pretty frustrating, isn’t it?

Apparently that’s the experience many consumers are having when they go looking for information on bank and credit union websites. Either they can’t find the answers they’re looking for, or the answers they find don’t jibe with answers they get in other channels.

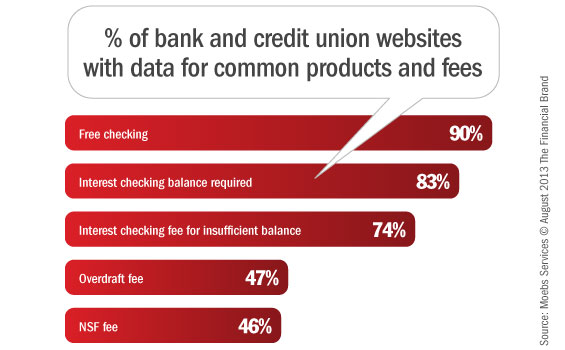

According to Moebs Services, few financial institutions are consistently maximizing the most basic, utilitarian role of websites — as an encyclopedic reference tool. Banks and credit unions still have significant room for improvement before their websites realize the full potential as a resource to develop new business.

Moebs, a research firm specializing in the financial industry, evaluated website information for every financial institution in the U.S. with assets of $500 million or more — that’s 1,676 banks and credit union total. The results of this unique, comprehensive study found that only a third of institutions offered the information being sought on their websites, and only 83.7% of the answers were consistent with answers given via their call centers.

Between mid May and early June this year, Moebs visited websites from banks, thrifts and credit unions with assets of $500 million or more, then answered 15 questions. Moebs also contacted each institution’s main call center in early June to evaluate the same 15 questions. This allowed for an interesting comparison between two channels: Were the answers consistent?

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Bigger Institutions Had More Answers and Info More Consistently

| Asset Size | # of Answers Found (Out of 15 Total Qs) |

Consistency of Answers With Call Center |

|---|---|---|

| >$50 billion | 7 | 89.7% |

| $25 to $50 billion | 6 | 89.2% |

| $5 to $25 billion | 6 | 85.6% |

| $1 to $5 billion | 5 | 82.3% |

| $500 millioin to $1 billion | 4 | 84.9% |

Credit Unions Outshine Banks in Availability and Consistency of Website Information

| % of Websites Providing Data Sought |

Consistency of Answers With Call Center |

|

|---|---|---|

| Banks | 28% | 84.3% |

| Thrifts | 33% | 83.5% |

| Credit Unions | 40% | 83.9% |

| Average | 32% | 83.7% |

Banks and Credit Unions Need to Self-Assess, and Be Honest

Moebs says there were two major findings:

1. Financial institutions don’t adequately utilize their websites as a source of information for consumers.

2. Banks and credit unions need to put in place procedures that will ensure consistent information, regardless of channel.

According to Moebs, addressing these issues can reduce pressure put on call center and branch personnel to provide information consumers’ seek — often quite common requests.

Larger institutions, Moebs notes, provide more info more consistently.

“The results of this study indicate opportunities for financial institutions,” said Michael Moebs, Founder/Chairman and CEO at Moebs Services. “Websites can be enhanced to provide more data and more consistent information for consumers, which can: reduce compliance risk, promote greater efficiency of call center and branch personnel, and foster more sales.”