Banks are comfortable selling in branches, the traditional channel for account acquisition. But online, banks struggle selling themselves. Sure, they provide information, links and instructions, but the presentation is seldom persuasive. Banks have been stymied by a riddle: How can prospective customers experience the online equivalent of an offline sales pitch?

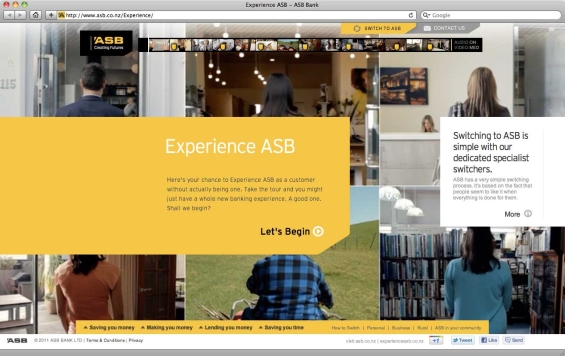

ASB Bank in New Zealand thinks it has the answer. They have created an online show-and-tell website that takes people on an interactive video tour of the bank’s brand. The entire production is filmed from a first-person perspective that is both unique and visually pleasing. It’s like the best video demo you’ve ever seen for online banking, but better. Way better. And there’s massive more information. It’s as exhaustive as it is engaging.

The Experience website, with 14 video segments in the main narrative, is as much a thorough tour of the bank’s services as it is a documentary of the bank’s progressive approach to innovation. Watch the whole thing and you’ll have to conclude that ASB is pretty dang cool for a financial institution.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

When the tour kicks off, you’re shopping in a store. When you reach the cashier, the video pauses and you are presented an interactive node. Click the hotlink and you can learn more about the bank’s “Save the Change” automatic round-up savings program.

Next stop, ASB’s mobile experience. You’re at lunch and your friend wants to pick up the tab. You offer to reimburse your share by using ASB’s mobile application to send a person-to-person payment.

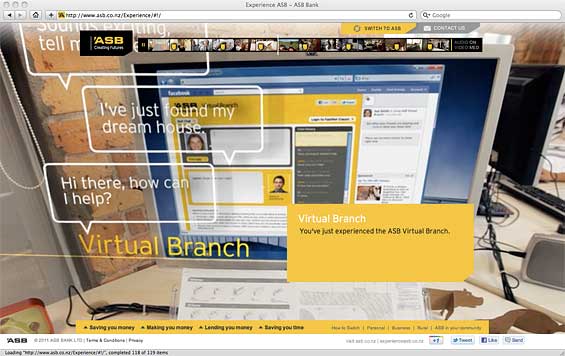

If you have a question for ASB, you can always hop on Facebook and interact with them through their virtual branch.

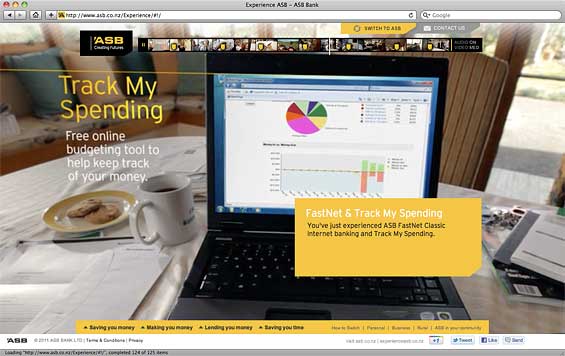

You get home from a long day and you need to pay bills. No worry. Just hop on to ASB’s “FastNet” online banking system, which includes an integrated PFM platform called “Track My Spending.”

ASB put applied a tremendous level of energy into its Experience website. The depth of information is simply staggering, and the production quality is phenomenal. Then there are the peripheral details. Videos have pause, play and volume controls. There are omnipresent tabs “Switch” and “Contact” tabs. Social media sharing tools in the site’s footer. A branch locator.

The Experience section of ASB’s website replaces the “Creating Futures” tab that the bank introduced less than a year ago as part of a broader rebranding. The “Creating Futures” section was itself a major undertaking, presenting a series of oblique narratives about the ASB brand and its connection to customers.

Dedicated Switching Specialists

ASB’s Experience website does more than just give people a taste of the brand. The bank smartly embeds “switching” messages throughout the site. Indeed visitors to the site can’t miss one of the many hotlinked calls-to-action ASB has spread around so liberally — “Switch to ASB,” “How to Switch,” “Switch Now Online,” “Switch at Your Local Branch,” “Switch on Facebook.”

Yep, that’s right. People can even switch to ASB on the bank’s virtual Facebook branch.

ASB does an excellent job presenting the options and outlining the steps. It looks simple, straightforward and convenient.

The real magic though is ASB’s promise to “handle all the nitty-gritty details of switching for you.” Regardless of whether someone initiates the switch online on in-person, ASB will assign them a “dedicated switching specialist” to manage the entire process. All it takes is one form giving ASB permission to act on their behalf.

There is a downside to the site’s execution, and it’s a big one: it takes quite a while to fully load — a few minutes, even with a DSL connection. Looking at the size and complexity of the Experience project, it’s easy to understand the slow load time. But asking potential customers to wait (“Don’t banks always make you wait?”) isn’t the best way to kick things off. Considering that the objective is draw attention to the ASB experience, this is a particularly thorny issue. If ASB could make any improvement to its Experience website, it would be to figure out an active streaming solution for its videos — let the first one play while the others load.