Consumers are changing the way in which they interact with their financial institutions. The evolution of digital technology and the increasing sophistication of mobile devices has enabled consumers to conduct basic banking in milliseconds.

At the same time, hyper-connectivity with brands has heralded an ‘age of impatience’ in which consumers expect immediate access to the content they desire on the device of their choice. To harness the potential of these aligned trends, financial marketers must be equipped to offer a seamless, consistent experience across all communication channels.

But, just because multichannel marketing is a priority doesn’t mean financial marketers are actually doing it. Few financial marketers understand their consumers’ journeys and change their marketing mix as a result, while even fewer can measure the financial impact of multichannel marketing efforts.

Financial marketers have found the most success when integrating digital channels with the more traditional marketing channels such as direct mail and mass media. While email is still the most effective and efficient outbound channel, different forms of retargeting, mobile marketing and social media marketing are growing in appeal to marketers. Moreover, the desire to leverage real-time communications to reach consumers at the exact moment they will likely need a financial solution is becoming increasingly important.

The 74-page Digital Banking Report demonstrates that the best way to get value from a mix of online and offline channels is to use them in combination with each other, as part of an integrated strategy to deliver personalized content in context. The report includes 38 charts and tables and combines industry statistics with tactical advice for financial marketers hoping to hone their multichannel marketing skills.

The topics covered in the Guide to Multichannel Marketing report include:

- Digital Marketing Spending Forecast

- Email Marketing

- Digital Retargeting

- Mobile Marketing

- Video Marketing

- Search Engine Optimization (SEO)

- Marketing Attribution

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Great Digital Marketing Migration

Because of the ongoing reduction in branch visits, branch sales are expected to continue to decline by 7% annually at the same time that banks and credit unions are facing pressure to increase total sales growth by as much as 25% annually according to CEB TowerGroup’s report. In response, financial organizations need to place greater emphasis on growing acquisition and cross-sales through digital channels and integrated, multichannel marketing.

Today’s financial consumer desires marketing and an experience that is consistent and unique to his/her context. In order to provide this type of experience, financial marketers must move away from campaign-based thinking and activities, and replace this with integrated marketing activities which are consumer-centric.

Integrated, multichannel marketing is best defined as “an approach that focuses not on standalone product campaigns, but on optimizing multichannel communications that create a personalized and individual consumer experience over time and across product lines.” As marketers do a better job communicating the right messages at the right time on the right channel, consumers will become more likely to increase spend and purchase again in the future, while marketers will also benefit from greater internal efficiency.

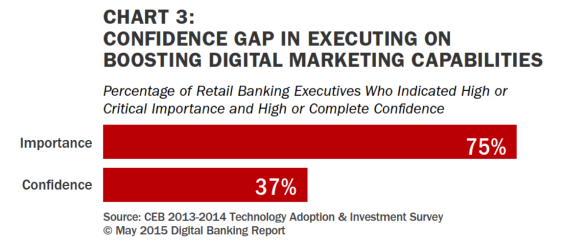

Unfortunately, in retail banking, there is timidity when it comes to confidence in selecting the right digital capabilities. While digital channels are not new, and many of the capabilities such as near-field communication and SMS mobile messaging have been adopted by technology giants for years, retail banking executives still lack confidence in boosting digital marketing capabilities.

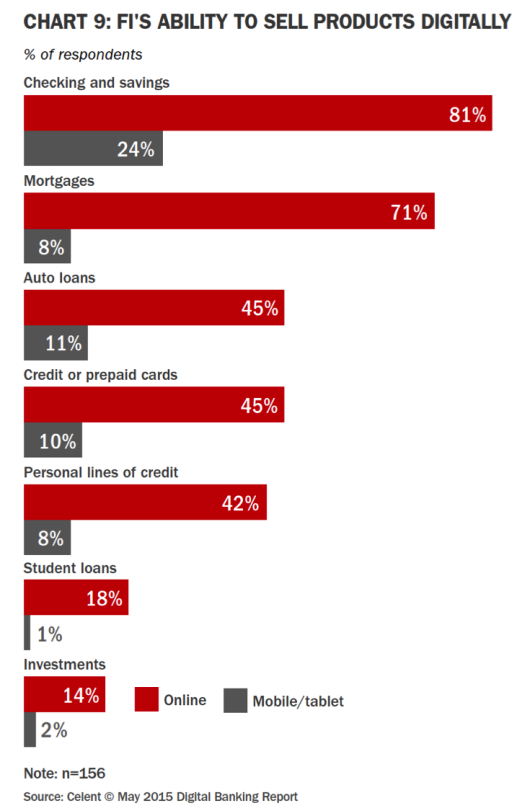

The new digital consumer gathers information prior to purchase, discovering product needs independently, and reducing branch traffic for routine requests. Ultimately, the digital native or technology-leaning banking consumer usually makes their initial buying decision before walking into the branch and has a lower cross-sale rate than consumers preferring personal channels. The question is … how well can organizations leverage digital channels to sell financial services?

Given this new environment, financial organizations need to implement several strategies that are different from the past. To be successful, CEB TowerGroup recommends that banks and credit unions use the following multichannel marketing strategies:

Given this new environment, financial organizations need to implement several strategies that are different from the past. To be successful, CEB TowerGroup recommends that banks and credit unions use the following multichannel marketing strategies:

- Increase the use of consumer data. Digitally-oriented customers are half as likely as branch-oriented customers to learn about their needs from their financial providers. Rather than assuming customer needs and creating individual offers, leverage the massive reservoir of consumer data already available to build more targeted offers.

- Ask more questions. There is a shift away from event-driven purchases towards learning-driven purchases by banking consumers. To extract consumer needs and boost cross-sales, FIs need to learn to ask consumers the right questions and leverage contextual insight, embedding the selling process into the customer lifecycle, not rely on major events to arise and prompt a need.

- Provide better guidance. Digitally-oriented customers who are offered better guidance in understanding or selecting a product or service by their primary FI have a greater propensity to purchase products from their institution. Failure to offer satisfactory guidance results in lower customer experience ratings, and therefore, lower purchase propensity.

- Build contextual offers. Banks and credit unions should not only match customers to products based on current stated needs and behaviors, but actively work to become part of the consumer’s purchase journey, selling through contextual engagement.

- Build From The Foundation Up. As has been the case since the introduction of CRM systems forty years ago, without foundational information management capabilities, financial institutions cannot make the shift to serve the banking consumer effectively.

Email Provides Foundation For Multichannel Marketing

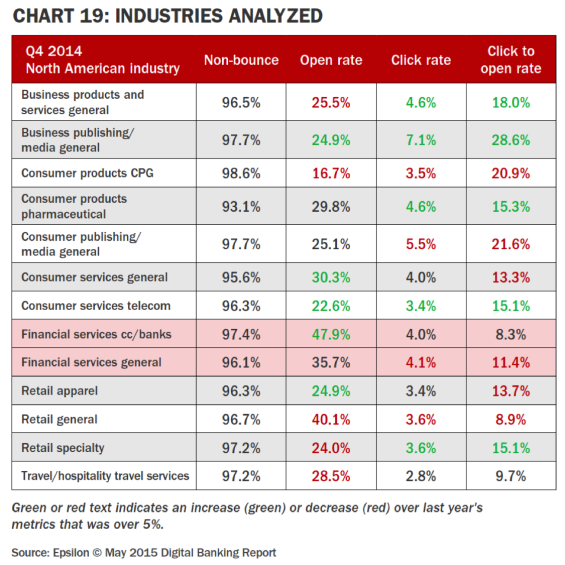

As a channel, email continues to be one of the most effective ways to engage with consumers and influence their path to purchase. More specifically, triggered emails outperform traditional email click rates by 135.8%, according to the Q4 2014 Email Trends and Benchmarks Report published by Epsilon.

Compared to other industries, the highest open rates in Q4 2014 were in Financial Services/CC Banks (47.9%), Retail General (40.1%) and Financial Services General (35.7%). The highest open rates for triggered messages across all industries evaluated by Epsilon were also in the Financial Services General (66.1%) and Financial Services Credit Cards and Banks (55.8%) industry categories.

As more consumers are tending to read their emails on mobile devices, it becomes imperative that you simplify your email design and content. It is also important that you move to responsive email design that can adjust to the device the consumer is using to view your message.

Even if you’re sending great responsive emails, it won’t matter if the email sends customers to a website that isn’t optimized for mobile purchases. Digital shoppers frequently abandon the account opening process simply because it’s too hard to complete an application. To fix that, financial institutions must focus on creating as frictionless an experience as possible. Digital design without digital capabilities will yield dissatisfied consumers.

Finally, if you don’t have at least 50% of your customer email addresses, you need to focus on collecting and maintaining a more robust email database. With more financial customers using online banking products, email is a mission-critical data point for nearly every customer communication.

It’s worth the effort to make sure you have reliable email addresses on hand. Ongoing list hygiene and validation of email addresses is now a ‘must-have’ process.

Moving to Mobile

The growing use of mobile banking services provides an exceptional opportunity for banks and credit unions to connect with their most valuable customers. Unfortunately, this also represents one of the most underutilized tools in the digital marketer’s arsenal, since few organizations effectively communicate on this ‘free’ platform.

One of the most powerful marketing tools is contextual mobile marketing, or marketing within the context of an activity being performed by a customer. In contrast to traditional ‘push’ marketing that simply blasts messages either in a targeted or non-targeted manner, contextual mobile marketing disseminates integrated messages based on the time, place and type of activity

taking place. This can be done through SMS messaging or within a mobile banking application.

Some of the benefits of SMS-based mobile marketing for financial institutions include:

- Engaging Communication. For banks or credit unions, in-app mobile marketing or alert-based SMS marketing allows for immediate, targeted and engaging communication for upsell or cross-sale opportunities. Text messages work on all types of phones unlike mobile apps that require smartphones. The major benefit of using SMS messaging is that most people open and read every text they receive – 95% of all incoming SMS messages are read, compared to around 10% of emails. Text messages also work for the hard to crack youth market. With 95% of 18-29 year olds using text messaging, there is no better way to reach younger consumers.

- Immediate Communication. With SMS messaging, the immediacy of texting beats email hands-down. On average, the send-to-open time of a text is around 14 minutes, compared with 6.4 hours for an email. That’s staggering enough – but what if a message requires a response? By email, a dialogue between customer and company might take nearly 13 hours to even get started. That’s one and a half business days! With texting, the average conversation will be up and running inside 30 minutes.

- ROI. In-App mobile marketing and SMS text marketing is not only cheap, it is also comparably easy to implement. The cost of sending out a promotion or special offer by text is also significantly lower than other marketing channels. With near-immediate contact virtually guaranteed, mobile banking and mobile marketing are a match made in heaven.

For banking, mobile marketing is cost effective and forward-looking. The only question is whether an institution is willing to implement this important component of digital marketing.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Improving Multichannel Effectiveness

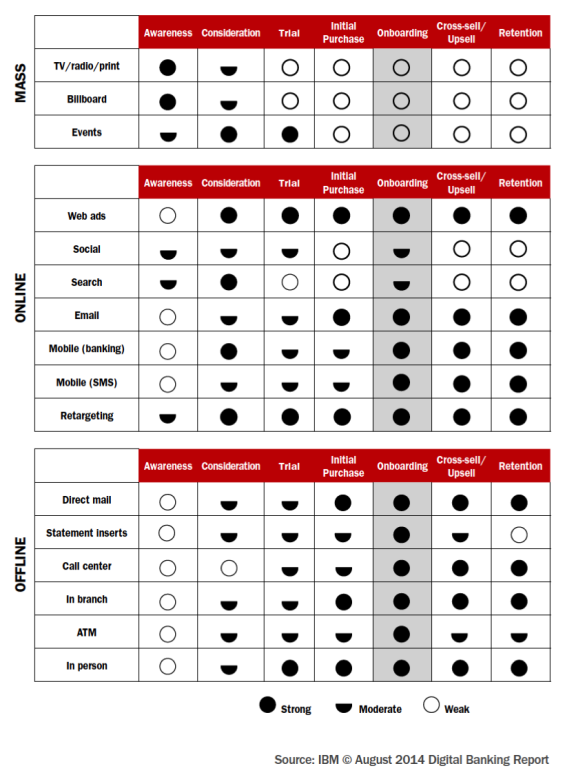

The multichannel effectiveness chart below is a great way to visualize how most successful financial marketers combine online and offline channels for continuous consumer engagement. As your communication builds and refines over time, it should integrate and complement your overall marketing mission.

Your dialogue with the consumer does not need to be extensive, with well-executed, single contact programs many times moving the needle in terms of both retention and engagement. Effective communication also doesn’t need to be overly expensive. This is because many of the ‘touches’ can be done with channels that are not costly and may even be ‘free.’

Leveraging multiple channels (1:1, direct mail, email, phone, SMS text, online, mobile banking, digital, video, ATM, social, etc.) allows you to appeal to a customer’s channel preferences while delivering a highly personalized message that will positively impact results. Many organizations have achieved a lift in results of 1.5-2X when combining multiple channels.

Optimizing each individual channel and/or device is great. Optimizing how they work together is the financial marketing manager’s ultimate objective. With consumer communication, the highest effectiveness is usually achieved using a combination of online and offline channels.

The ability to use multiple channels is contingent upon an effective data collection process at new account opening. If mobile phone numbers and email addresses are not collected, these channels can’t be used. If mobile and online banking are not ‘sold’ during the new account process, these communication channels also can’t be used.

In other words, the foundation of an effective (and lower cost) communications program is established on day one when customer insight is collected and the initiation of a typical new customer onboarding process begins.

As the tenure of the customer’s relationship expands, response and relationship growth data can be leveraged to determine the optimal communication channel mix and channel attribution. This is by no means an easy process due to a number of variables, but can decrease marketing costs while improving effectiveness.

Adding outside data sources, including social media insights helps facilitate the transition from one-size-fits-all marketing to behavior-based, personalized marketing programs. As insight is added, interactions can become more relevant, helpful, and real-time.

Bringing It All Together

As more consumers move away from the branch delivery network, the importance of delivering sales through both offline and online channels has increased exponentially. The use of digital marketing channels has become an indispensable tool for marketers, but there are still challenges in knowing the right mix of channels to use and measuring the impact these new channels have on the consumer decision process.

The number of digital touchpoints is increasing by 20% annually as more offline consumers shift to digital tools, and younger digitally-oriented consumers enter the ranks of buyers. In fact, many are comfortable with using digital tools almost exclusively.

But while some industries, such as retail, can engage the consumer digitally from the evaluation stage through the purchase, the banking industry has experienced significantly more modest numbers due to lower digital sales conversions (caused by poor digital integration of account opening processes).

Financial marketers will find their jobs to be more difficult as customers have a wider range of options and become more difficult to convert. However, those institutions that move quickly to understand and leverage digital marketing channels – better understanding customer preferences, creating unique digital experiences, and improving their digital communications process – will establish a competitive advantage that may be difficult to beat.

The ‘Guide to Multichannel Marketing’ Digital Banking Report is not meant to be a comprehensive guide to all digital marketing tools, but is intended to provide exposure to the digital marketing landscape and discuss tools we have seen to be most effective. We have also intentionally not covered social marketing, leaving that topic for a future DBR. We do believe that this 74-page guide, with 38 charts and graphs, is a great starting point and refresher for all financial marketers.