Over the past several years, the dynamics of financial marketing have changed dramatically. While the past was a combination of mass media and some direct channels, the addition of new channels and technologies has impacted not only the tools available, but also the skills required to be successful.

These changes create both challenges and opportunities for financial marketers as they need to see each new innovation application as a starting point for further developments and changes in consumer attitudes and behavior. Unfortunately, most marketing departments in financial services are staffed with marketers who are having difficulty keeping up with the transformation of marketing. This is a recipe for failure.

Today’s financial marketer needs to embrace the dynamics of modern marketing. According to eConsultancy, this includes competencies and capabilities around domains of expertise like data and analytics, customer experience, content, multichannel delivery and personalization.

Despite this obvious requirement, most marketing departments in banks and credit unions don’t know how to acquire the skills it needs or how to blend traditional and digital marketing capabilities. Now more than ever, it is imperative to maintain a learning mindset for financial marketing teams that want to remain agile and adaptable in an era of exponential change.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Modern Marketing Model

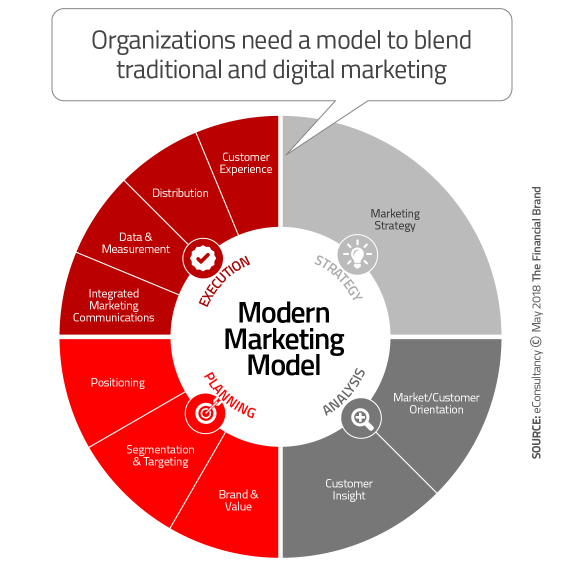

When we consider the new complexities of modern financial services marketing, it is best to integrate both traditional and digital marketing in a manner that achieves synergistic benefits. By fusing together both classical and digital marketing, organizations are in a better position to identify capability gaps placing a focus on where and how to move forward. The chart below from eConsultancy helps to visualize the required components.

This model is a natural progression from previous models used by marketers. For instance, in the 1960s, the prevalent marketing model was the ‘4Ps’ (Product, Price, Place and Promotion). In the 1980s, there were three additional Ps added (People, Process and Physical) reflecting increased customer interaction and the beginning of targeting. In the 1990s, ROI entered the equation, as did the ongoing increase in importance of targeting (the ‘4Cs’ included Consumer, Cost, Communication and Convenience). The new marketing model highlights the importance of customer insight, analytics, brand and customer experience.

An explanation of the components of the Modern Marketing Model illustrates how all of these competencies interrelate with each other.

- Marketing Strategy: This is the foundation of the entire marketing process, outlining how marketing will deliver against business objectives, the techniques to be used and the resources needed to execute against the plan.

- Market/Customer Orientation: Going beyond product and sales, this element builds positioning research around the consumer, the market and the competition to determine ability to succeed in the marketplace.

- Customer Insight: This component is to develop insights into who the consumers are, how they prefer to interact, their needs and expectations.

- Brand & Value: What is the differentiation that we can bring to the marketplace. In addition, what is the brand value, purpose and other overarching components beyond price.

- Segmentation and Targeting: Not to be confused with personalization, here is where we break down the marketplace to determine demographic, psychographic, contextual and geographic targeting components.

- Positioning: Drilling down to the individual level, this is where you determine the message that each person will receive based on the combination of branding, targeting insight and customer/member insight. With digital marketing, there is the potential for dynamic personalization leveraging data and AI logic to deliver messaging in real time.

- Customer Experience: More than ever, there is a need to understand the customer journey across multiple channels going beyond last touch attribution to improve engagement and sales.

- Distribution: This is where we determine how we will be found by the consumer and when. This includes online content distribution, marketing automation, etc. reflecting the ‘pull’ of marketing.

- Integrated Marketing Communications: Reflecting the ‘push’ of marketing, this is where we describe how we will use both traditional and digital marketing to reach the consumer with the right message, at the right time, across the right channels.

- Data and Measurement: How do we measure and optimize performance? Metrics must be defined, data sources determined, privacy policies agreed to and distribution of insights formalized to improve performance and validate the impact of marketing.

Probably the biggest model adjustment is related to the ownership, management and application of data. Data is now a marketing asset that must be leveraged and protected in ways never before imagined. Sources of data have expanded as have the tools to make data more valuable. In most organizations, data management and performance measurement are the competencies in shortest supply.

Marketing Departments Under Attack

The importance of having a structure for deploying modern marketing and delivering results has never been greater. A marketing survey revealed that 80% of CEOs don’t trust or are unimpressed with their CMOs. In comparison, just 10% of the same CEOs felt that way about their CFOs or CIOs. Without a clear definition of what the marketing function does, or the value it delivers, the marketing role in financial institutions will continue to be undervalued.

This lack of trust and belief in CMOs is also reflected in tenure. Another research report found that CMOs have the highest turnover in the C-suite. In this research, CMOs only stay in office 4.1 years on average, while CEOs average 8 years, CFOs for 5.1 years, CHROs for 5 years, and CIOs for 4.3 years. Similar Harvard Business Review research indicates that churn rates may be even worse: They found that 57% of CMOs have been in their position three years or less.

To address these dynamics, bank and credit union marketing departments need to find new talent trained in digital marketing disciplines, train current teams to become fluent in new technologies and channels, and collaborate with organizations with the needed capabilities to succeed. This is made difficult by the reality that most academic organizations are not teaching modern marketing techniques.

Building a Marketing Organization for the Future

Understanding the model is possibly the easiest part of the equation. Ensuring that the necessary competencies and capabilities are addressed in creating a ‘future fit’ organizational design for the marketing function is far more difficult. What is interesting about the model presented by eConsultancy is that it is completely scalable. Most models in the past were geared just to the largest organizations with massive media budgets.

Financial marketing organizations need to determine how they will embrace the changes in the marketing discipline. They should determine the expectations of what the marketing department should be responsible for, how it is structured, and how it will integrate with other departments and outside providers of technology and tools.

Each marketing department needs to look at the internal and external capabilities and find a way to disrupt old school thinking and credentials, doing the training and recruitment needed to build a modern marketing organization. There needs to be a realization that the current talent pool probably isn’t enough.

The power of data and digital transformation has probably impacted marketing more than any other area of banking organizations. This provides both risks and opportunities both internally and externally. Management teams will expect marketing to embrace the potential of becoming ‘like Amazon’, while consumers will expect nothing less. The question is whether organizations will disrupt themselves fast enough to embrace the power of modern marketing.