NAB, one of the biggest banks in Australia, recently shook up its marketing team. The CMO? Gone. Brand experience manager? Also gone. In their place, a new role was created: the Chief Customer Experience Officer, who oversees a new division incorporating CX, marketing, digital, products, and NAB’s innovation lab — basically everything that matters.

Is this the future for marketing and CMOs in the banking industry?

Possibly, yes. But the convergence of marketing and digital technology is more likely to spur CMOs into greater roles than push them out the door.

According to a report from IBM, CMOs today face “an expanded mandate to reimagine their role within the C-suite and across the enterprise.” That specifically includes strategically addressing how their organization can compete in a world where marketing is shifting from product-driven to experience-driven.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Leading for Growth: Champions of Change

The forces transforming both retail banking and marketing are putting anyone in a senior marketing role directly in the spotlight — whether they have a “C” in their title or not. The pressure is on marketing leaders to drive change.

“The need to create change is core to my role. That’s more important for CMOs than ever.”

— Susan Johnson, SunTrust Banks

“My main role is to spur growth for the organization,” says Susan Johnson, SunTrust Banks’ CMO in an interview with Forbes. “The need to create change is core to my role. That’s more important for CMOs than ever.”

In research fielded by IBM, seven in ten CMOs say the ability to lead organizational growth and change is now essential to their professional success. Specifically, IBM’s research identified five critical priorities:

- Increase sales/revenues

- Improve the omni-channel experience

- Reinvent CX through digital innovation

- Demonstrate marketing ROI

- Champion a customer-centric corporate culture across the enterprise

Chief Collaborators & Air Traffic Controllers

According to a report by Accenture, many organizations believe that providing great consumer experiences drives growth, but few consistently deliver that experience. Why? They don’t have someone filling the role of “chief collaborator” — someone to bridge the gaps between organizational silos who can help knit together an omni-channel strategy.

But marketing leaders, who are often more connected to consumers than other members of the C-suite, are in an ideal position from which to facilitate collaboration in their financial institution. Indeed some analysts, like those at Forrester, tend to think of effective CMOs as “Chief Collaboration Officers.”

“The chief marketing officer is positioned perfectly to adopt these responsibilities by evolving their role to drive collaboration across the entire organization,” Forrester explains. In their view, CMOs should be responsible for both “the desired perception of the organization — the brand — and the customer’s actual perception of the company — the experience.”

Along these lines, IBM says CMOs need to embrace “design thinking” and constantly seek new ways to create frictionless experiences.

Steven Page calls this expanded marketer role “air traffic control.” The long-time banking exec doesn’t have the CMO title because his California-based SafeAmerica Credit Union doesn’t use “C” titles (except the CEO). His real title is VP of IT, Marketing & Digital Banking, and he reports to the CEO, but he is CMO in practice. But his title reflects the broader trend in the industry to create cross-functional roles from combinations that have historically been kept completely segregated.

SafeAmerica has only $500 million in assets, and Page readily admits that his tri-cornered leadership hat would be a tough fit at large institutions. Nevertheless, he believes that eventually even the biggest banks will have to evolve.

More Tech and More Data Means New Skills Are Needed

Marketing has undergone numerous transformations over the years. Not that long ago, financial marketers used TV, billboards and newspapers to create reach and frequency. This is the era when CEOs joked that half their marketing budgets were wasted, but no one really knew for sure which half.

More recently, marketing has shifted from a largely creative focus to an intensely analytical role, fueled in large part by new technologies and vast new troves of data.

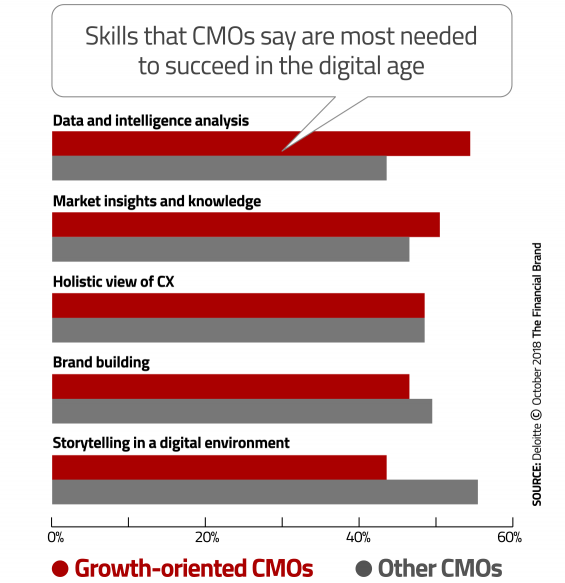

Deloitte says that research it conducted with the CMO Council identified a budding cohort of marketers with a long-term growth mindset who intend to transform marketing’s traditional role of Chief Brander & Storyteller and push farther into new territory to drive profitability.

“What’s different now is that marketers know which 50% is successful,” observes Sundeep Kapur, a marketing and digital banking authority with Digital Credence. He believes bank and credit union marketers should be able to demonstrate marketing ROI for every single consumer because they have the ability to not only track actual results, but can now estimate future patterns using artificial intelligence.

Along the way, marketers have become the ones with the most data about consumer behavior and preferences.

Veteran marketer Clay Stobaugh, CMO of John Wiley, says marketing leaders can now earn a seat in the C-suite because they the have data representing the voice of the customer. In AMA’s Marketing News, Wiley says everybody else likes to talk about customers qualitatively, but “marketing actually has all the quantitative data, so they can have a voice.”

Both SunTrust’s Susan Johnson and SafeAmerica’s Steven Page say marketing leaders need skills from both the left (analytical) and right (creative) sides of the brain. For people like Johnson, this comes naturally; she is an engineer by training who switched to marketing.

“I never thought I’d use so much technology and analytics in marketing as I do today,” she says.

Achieving balance between the left and right brain isn’t easy for all CMOs, however.

“Most marketers aren’t trained technologists, so navigating through these waters can be a real challenge,” observes JPMorgan Chase CMO Kristin Lemkau, in a profile with Boardroom Insiders. Lemkau, who came to her post from the public relations side of the bank, where storytelling is a key skill, blames a large part of the problem on legacy systems that weren’t built for big data and a martech industry that “promised to solve all our problems overnight.”

Some right-brain marketers, however, can take heart: some experts believe the marketing pendulum may have swung too far over towards data analytics.

Marketing professor Kimberly Whitler thinks all the focus on CMOs being “quantitively capable” is superfluous. Her research at the University of Virginia’s Darden School of Business, as reported in Marketing News, found that quantitative CMOs — those driven mostly by data science — are less effective than what she calls “hybrid CMOs” — those with the ability to empathize with consumers and create deep insights beyond spreadsheets.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Content Marketing: The Focus Shifts to Storytelling

The desire for empathy and customer-centricity is driving a renewed focus on storytelling and the growth of content marketing. Globally, investments in content marketing was forecast to top $16 billion in 2018, an increase of 15% over the year prior, according to PQ Media.

“Content” is a broad term, ranging from Chase’s “Kneading Dough” video series in which Lebron James and other world-class athletes discuss their financial lives to simple web-based tips on how to save.

But budgets don’t have to be on par with Chase to tap into this trend.

“I tell my team all the time, we are more and more becoming storytellers and content developers,” notes Jeff McCarthy, VP/Marketing Director for Wisconsin’s First Bank Financial Center.

Even though he’s not a fan of some of the newer “C” titles, McCarthy is intrigued by the idea of a Chief Content Officer for the $1.2 billion bank. Already one of his four-person marketing staff is devoted to social media, and he is looking at in-house video capabilities for 2019.

“Video will continue to be a very important way to tell our stories,” says McCarthy.

How One Financial Institution Balances Marketing and IT

Forrester identifies three characteristics of CMO collaboration leaders:

- Encouraging their teams to work across the company, departments and locations

- Having agile, cross-functional teams

- Instilling a new culture that fosters collaboration.

Collaboration is easier to talk about than implement, but it can be done, as the experience at SafeAmerica Credit Union illustrates. Steven Page, who oversees IT, marketing and digital banking at the credit union, says that two of his roles — IT and marketing — are no longer “siloed,” but that doesn’t mean they have been merged. How they work has changed, plus they have a singular leader who actively promotes collaboration between the two camps.

Physically the groups are situated near each other in an open configuration on the same floor. This encourages IT staffers to interact with their counterparts in marketing to explore new solutions together. Page, who spent two decades at Shell, says that many large organizations “tend to get endlessly tied up in formal meetings” — an inefficient approach that’s often counterproductive in today’s fast-paced digital world.

The cultures of the groups remains distinct — marketing is more free-flowing, IT tends to be more precise — and the managers one level down from Page are more focused on traditional marketing and IT responsibilities. But each side has more opportunity to learn “how it works” and “how it will be presented to the consumer.”

Page says some of the most productive sessions occur at the water cooler or during lunches composed of small groups from both departments.

“They’ll start talking about a project and someone from tech will say, ‘Maybe we could do this,’ then someone from marketing pops up with, ‘Hey, that could work!’ I just sit back and listen,” Page explains.

Page acknowledges that this co-managed approach may not work for every financial institution, and would have to be adjusted for size. But for SafeAmerica, the new approach enables it to get to market more quickly than before.