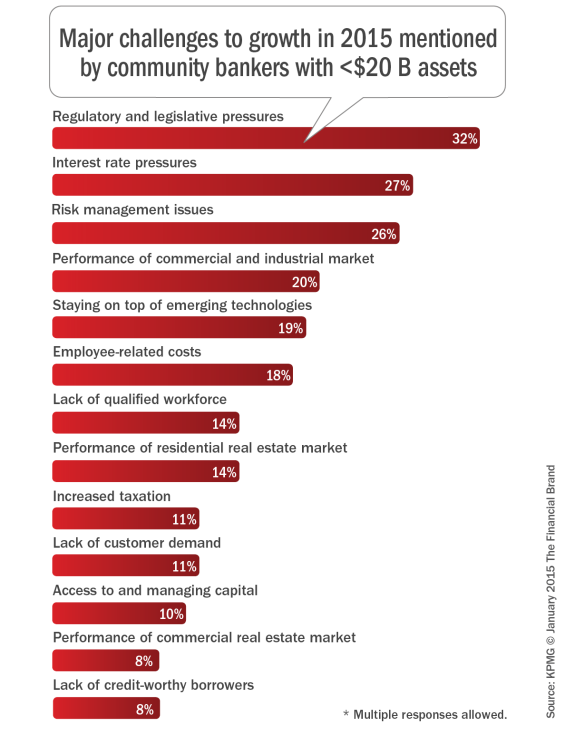

According to KPMG LLP’s annual Community Banking Outlook Survey, regulatory and legislative pressures will continue to be the most significant barrier to growth over the next 12 months. Of 100 CEO’s and senior executives in the community banking sector surveyed, 32% said regulatory and legislative pressures will impact growth, down from 42% in last year’s survey.

Nearly 80% of those polled said regulatory compliance costs now comprise anywhere from 5 to 20 percent of their total operating costs. Regulation has forced banks to hire compliance specialists and support personnel, as well as retain third party consultants to review and implement policies. In addition, banks have had to purchase new technology and/or update current systems to meet the new requirements.

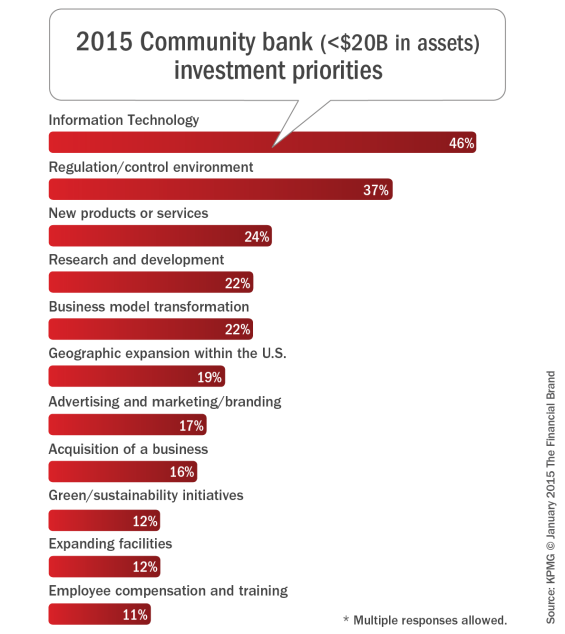

More than a third (37%) said spending on compliance issues will continue to increase over the next 12 months. That is second only to increased spending for information technology, which was chosen by 46% of the executives polled.

“There is no question that rising regulatory compliance costs will continue to be a challenge for community banks, but now is the time for these institutions to move beyond the compliance and risk management burdens that are stalling their growth plans,” said John Depman, national leader for KPMG’s regional and community banking practice.

“It is critical for community banks to change their focus and to look for new methods, products and services to reach new customer segments to drive growth,” Depman said.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Focus On Internal Growth Strategies

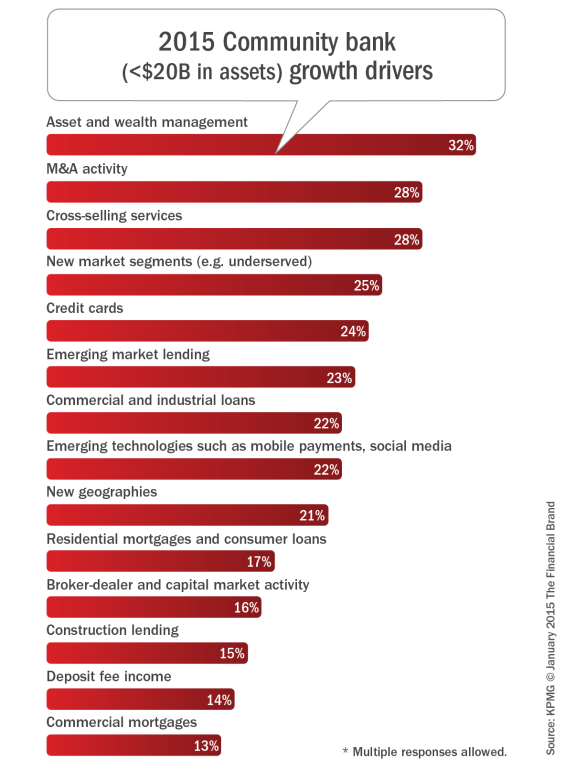

Following years of cutting costs to offset the increased burden of regulatory costs, more community banks will be relying on revenue growth strategies in 2015, mirroring their larger bank counterparts. To achieve this growth, KPMG found that organizations had a desire to focus more on asset and wealth management (32%), followed by M&A activity (28%) and the cross-selling of services (28%). While important, emerging technologies such as mobile payments and social media were seen to be a lesser priority for growth in the upcoming year (22%).

One of the obstacles facing community banks’ growth is a changing customer base. Asked which customer segments present the greatest growth opportunity, 22% said the underbanked, 19% said consumers nearing retirement, and 16% said the top 10 percent of income earners.

M&A Activity To Increase in 2015

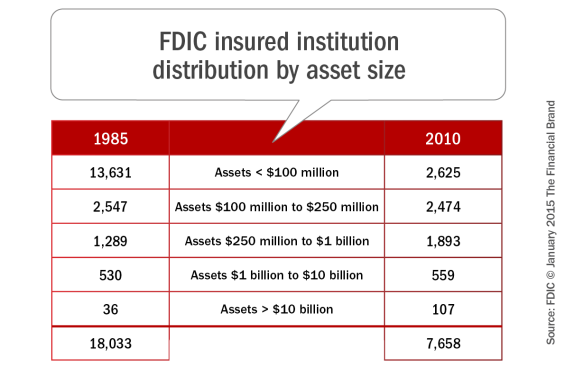

Looking beyond organic growth, KPMG’s survey found that 49% of respondents were “somewhat” or “very likely” to be involved in a merger/acquisition in 2015, a 20% increase from a year ago. According to the report, “The future of the community banking sector will be determined by consolidation among community banks and acquisition of smaller banks by larger banking organizations.” This will continue a trend that has been taking place for decades, whereby community banks purchase each other, raising them to the next asset classification.

Access to new markets, access to additional resources, and offsetting increased regulatory costs were cited as the top three reasons for considering M&A activity. While access to new markets is important, the nature of the customer base was the most likely criteria to be used in planning M&A transactions. Interestingly, while being a reason for pursuing M&A activity, the regulatory environment was also considered one of the top barriers to completing M&A successfully.

IT Investments at the Heart of Internal Growth Strategies

According to the survey, as community banks look toward growth, they are investing in upgraded core IT platforms to meet compliance requirements, achieve operational efficiencies and to target new customer segments. Nearly half of community banks surveyed said they expected to increase spending on information technology in 2015. This priority was even more pronounced in the $10B to $20B segment of banks, where 55% mentioned a plan to increase IT spending.

One of the benefits of increased IT spending is that community banks will be in a better position to leverage data and analytics for uncovering new customer insights and improve customer acquisition and retention efforts according to the research. Tying their big data strategy to their business strategy will also help banks achieve growth by providing better informed decision making to keep ahead of competitors.

“Rather than waiting too long to make IT infrastructure investments, the proper balance now will allow for more time to focus on growing their business,” Depman said.

Enhanced Digital Banking Services a Priority

Being able to serve clients effectively on a 1:1 basis has been one of the differentiators of community banks over time. As more consumers are becoming ‘digital natives’ however, the ability to provide a basic level of electronic banking services has been more difficult due to the need for adequate scale to ‘keep up’. Going beyond simple online banking services, more community banks need to upgrade their mobile banking offerings.

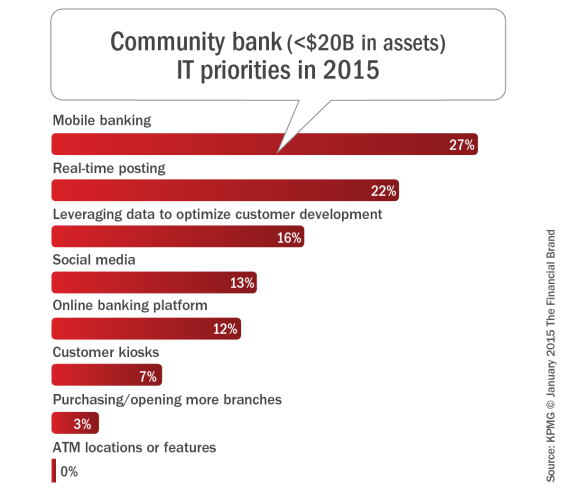

With the goal of improving their customer experience, 27% of the bank executives said they plan to make “significant” investments in IT related to mobile banking over the next one to three years. Twenty-two percent said they plan to invest in “real time posting,” while 16% said “leveraging data to optimize customer development,” and 13% said “social media.” The larger the banking organization, the greater the emphasis was on providing an improved mobile banking experience.

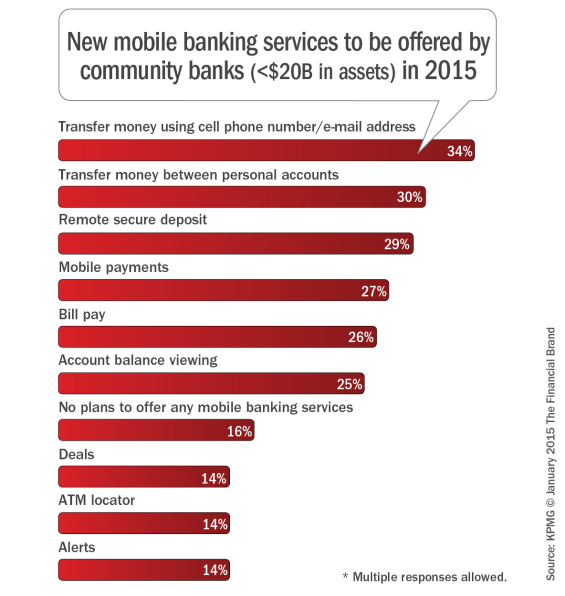

Asked what types of mobile banking services they plan to offer next year – that are not currently offered – 34% chose transferring money using cell phone number/email address; 30% said transferring money between personal accounts, and 29% said remote secure deposit. “We believe community banks need to continually embrace mobile banking innovations,” said the authors of the survey.

The chart below illustrates the mobile banking services that will be offered by community banks that are not currently being offered (digital banking gap fillers). As can be seen, the majority of these services are those already offered by larger financial institutions.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

2015 Will Be a Pivotal Year for Community Banks

2015 will be a year successful community banks will need to move beyond regulatory compliance and cost cutting strategies that are stalling growth opportunities. The KPMG survey reveals the potential for community banks to seize growth if foundational IT investments are made. This may require the combination of assets of other smaller banking organizations to achieve scale, but remaining stagnant is not a viable option going forward.

“There is clearly an untapped opportunity for this sector,” KPMG’s Depman said. “There is great potential for community banks to seize growth opportunities, but first they must take stock of areas where operations and infrastructure need to be improved and enhanced.”

With a well thought out plan for growth, which includes catching up to larger organizations that provide services of interest to targeted segments, community banks can create new and improved revenue streams that can provide a strategic advantage to this sector once again.