How are banks rebuilding trust as the financial industry regains its footing? To what degree are they reassuring their customers and managing messages?

Those were the critical questions driving a study published by the CMO Council entitled “Delivering Positive Impressions During Market Depressions.” The study was based on research fielded in August and September 2011, encompassing some 120 financial marketers — primarily CMOs and Marketing VPs with spanning all asset classes — local to global. Credit unions were not included in the survey.

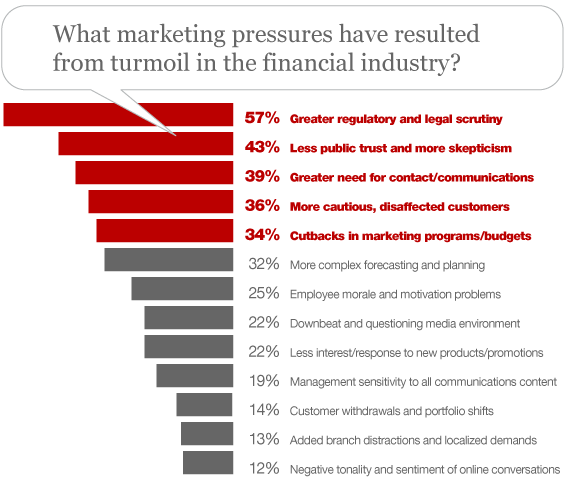

Whether consumers really are panicked or not, bankers certainly believe their customers are worried, with 89% rating customers’ level of anxiety as moderate to very high. This belief has impacted bank marcom strategies significantly. 34% have seen cutbacks in marketing programs and budgets as a result.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

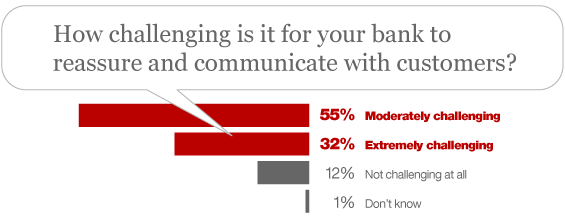

Bank marketers said the current state of the financial industry has made it increasingly difficult to communicate with consumers and restore confidence. 43% of respondents said people trust banks less and are now more skeptical. 87% blamed this negative consumer sentiment for producing a moderately- to extremely challenging environment for bank marketing communications. And yet only 39% of bank marketers feel their customers’ elevated concerns warrants increased levels of contact and communications.

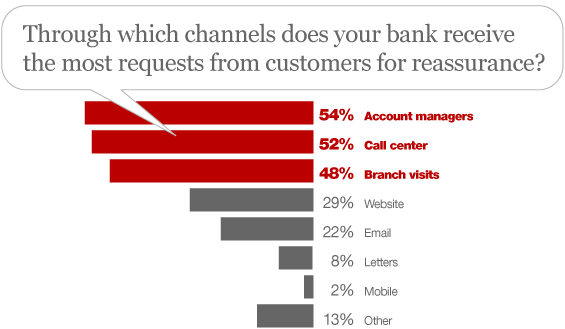

When asked which channels the bank receives the most requests from customers for reassurance, the top three most frequent responses were all in-person channels: 54% said account managers, 52% said call centers and 48% said branch visits. Only 29% cited their website and 22% said email. Social media was nowhere on the radar.