The competitive bar has been reset in social media marketing. Some financial services providers are now calling out their competitors’ shortcomings as a way to highlight their own strengths. Challenger brands in particular are showing off how scrappy they can be by utilizing social media platforms for bold messages, some snarky and some downright combative.

How should legacy brands’ respond? Should this be part of their marketing mix?

For better or worse, social media provides financial marketers a platform for punchy, quick-hit messaging. This can be tricky territory to navigate for brands unfamiliar with it. Even those with the biggest marketing budgets have found themselves in hot water as Chase found out with a Tweet that backfired. But marketers shouldn’t let the mistakes of others scare them off — they should be taken as learning opportunities.

In the fast-moving world of digital marketing, a brand has to learn how to speak out in order to stand out. And that’s exactly what some smaller players, especially those without the big bucks to spend on mega influencers or mass mail campaigns, are banking on.

“Today, consumers want to engage with financial brands that share their same values and ethics.”

— Lily Harder, Mintel Comperemedia

A key driver behind this emerging trend is a growing consumer demand for brands that are willing to take a stand. In today’s highly polarized times, consumers want to engage with financial brands that share their values and ethics. As a result, corporate social responsibility (CSR) programs have grown far beyond charitable initiatives, and in some cases are completely reshaping how companies do business.

Not only can CSR initiatives define a brand’s mission, but they can create the perception of value. According to Mintel research, 82% of consumers surveyed believe that companies with CSR initiatives have higher quality products and 73% believe these companies are changing things for the better.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

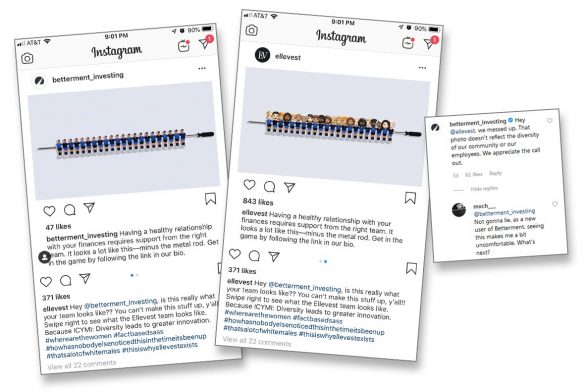

Ellevest Targets Betterment and Chase

Ellevest, the robo investment advisor focused on women investors, posted a jab on Instagram, calling out Betterment, another robo-investing platform, for its post showcasing their team as a string of identical white men. Fitting with its well-established brand identity, and the company’s mission to “close the gender money gaps and get more money in the hands of more women,” Ellevest took direct aim at this post.

Ellevest followed up the jab with an email to subscribers and prospects to draw more attention to the post, even including a snapshot of Betterment’s Investment Committee with names and photos.

Betterment responded maturely, acknowledging the mistake and thanking Ellevest for bringing it to their attention. This was a smart approach as opposed to fighting back with a snarky comment or calling Ellevest out on something negative in retaliation.

This wasn’t the first time Ellevest took on a competitor directly. Chase tried to bring some humor to its Twitter feed with advice on how to avoid a low-balance bank account, including the tip: “Make coffee at home.” The idea was to appeal to the Millennial segment, but the tweet was taken very negatively and created enormous backlash.

Brands like Ellevest were quick to jump on this opportunity as a way to insert their own opinions on the matter and offer a different perspective. This led to the launch of Ellevest’s campaign around the slogan, “Buy the f***ing latte.” Customers and fans can even buy mugs with the slogan printed on it, a true call to the cause and a way to create genuine brand ambassadors.

Read More:

- Social Media & Social Issues Create Brand Challenges For Financial Marketers

- How Banking Firms Can Build ‘Purpose-Driven’ Brands

- Ally Bank Pokes Rivals’ Negative Online Reviews in Fun Campaign

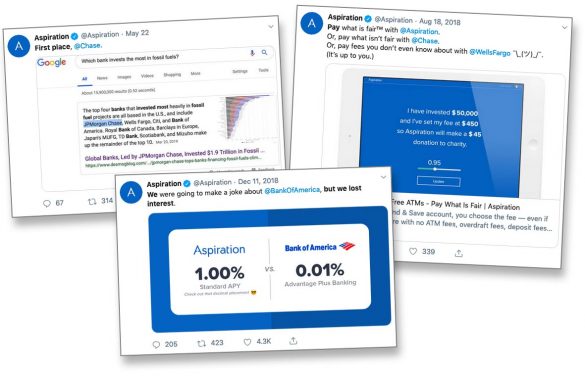

Aspiration Bank Takes Swipe at Big Banks

Aspiration Bank, another financial institution challenger, has built its brand identity on an environmentally-focused approach to banking and investing. Across all marketing channels, Aspiration drives home its message of “doing well, by doing good,” including a give-back program that donates a portion of customer fees to charity.

Doing good in investing doesn’t preclude rough marketing, however. Aspiration is especially aggressive on Twitter, where it calls out other banks by name — especially the largest national banks — in order to draw attention to the big institutions’ environmental or product shortfalls.

Tough Competition Doesn’t Have to Be Negative

When Daimler CEO Dieter Zetsche retired from the auto industry. BMW responded with a moving, yet funny, video titled, “Retirement is about exploring your wide open future.” It cleverly depicts Zetsche saying good-bye to colleagues, climbing into a waiting high-end Mercedes where a driver takes him home as he wistfully looks out the window at company landmarks. As he is dropped off at home, the subtitle reads “Free at last!” and Zetsche enters his multi-car garage where the grille of a vintage Mercedes can be seen. Then comes the sound of a motor starting and out comes the ex-Mercedes chief at the wheel of a low-slung burnt-orange BMW i8 roadster and he roars off for some fun!

While these two brands have a long-standing rivalry, this was a clever approach to keeping that competition alive while also showing a genuine respect for a leader who had a tremendous impact on the industry. The final words of the video are: “Thank you, Dieter Zetsche, for so many years of inspiring competition.”

Read More:

- Aspiration Financial Reinvents Itself With Bold Brand Position

- Top 9 Digital Consumer Trends for Financial Marketers

- Clever Ads Can Backfire on Financial Marketers Who Overlook Gaffes

- Dare to Swear? In Financial Marketing, The @#$% Line Is Blurrier Than You Think

How Far Should You Push the Envelope in Social Marketing?

Taking a stand on one side of an issue or the other can be risky, but in today’s landscape, not taking a stand at all can be even riskier.

Most important is to focus on what matters to your customers. People want to get behind a social cause. Calling out the competition by name can help differentiate a brand, but it can also bring to light important social issues or causes that consumers might not have been thinking about. Whether your customer base is older or younger, affluent or living paycheck-to-paycheck, it’s crucial that you take the time to learn what’s important to them.

Here are three suggestions for successfully connecting with consumers.

1. Start with employee welfare and satisfaction. This is one of the most important initiatives banks and credit unions should focus on as part of a successful CSR strategy. The top concerns consumers have regarding businesses in general, according to Mintel research, include paying a living wage, safe working conditions, equal opportunities for employees, and affordable healthcare.

2. Maintain brand identity. Whether a financial brand is marketing in just one channel or many, a clear brand identity is the cornerstone of any successful campaign. Whatever that identity or persona may be, social media is an opportunity to reiterate it as well as highlight why it is different from the competition.

3. Match the message with the channel. The inherent benefit of social media is that brands can have a two-way conversation with followers as a way to foster loyalty and generate interest from prospects. Unlike direct mail and other traditional channels used for brand awareness or consideration, social media is a way to showcase a brand’s personality. While there are solid positives to aggressive use of social, the negative is that a consumer’s opinion of a brand can shift drastically with just one post — but also because of a post from a competitor.

As challenger brands and others continue to use social causes and culturally relevant issues to make their brand stand out from the rest, they have reset the bar for acceptable levels of competition. In order for brands to succeed in social media, there needs to be a healthy balance of genuine and creative content mixed with a bold brand voice that’s not afraid to push the envelope.