The 2017 Financial Marketing Trends report provides an unequaled perspective into the allocation of budgets, prioritization of strategies and the challenges faced by financial marketers. The research also provides a clear delineation of these insights by size and type of organization, and the gap in capabilities and digital maturity between the largest organizations and local banks and credit unions is widening.

Given the lower cost of analytic tools, the availability of digital marketing platforms and the decreasing cost of digital communication, we don’t believe these gaps need to exist. In fact, there are some who believe that smaller organizations could actually generate better results than their larger counterparts because of the potential for 1:1 engagement.

As in 2016, looking at priorities, budget allocations, and where marketing efforts were focused tells an interesting story. Despite a theme of wanting to improve targeting, personalization and the measurement of results, the commitment to these objectives is not reflected in investments made. This is most evident in the allocation of resources for data and advanced analytics.

To succeed, financial organizations must stop this continued ‘marketing insanity.’

Marketing Priorities Vary by Size and Type of Organization

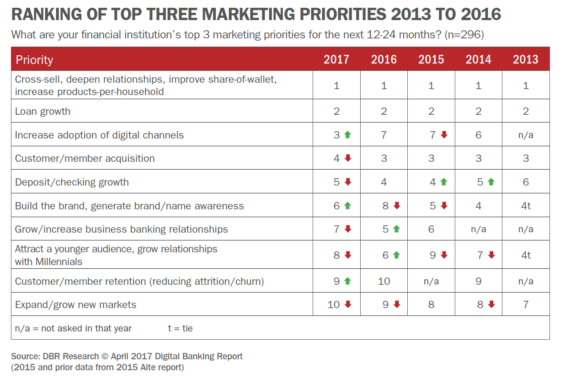

As has been the case in every year of the survey, ‘deepening current relationships’ and ‘increasing share of wallet’ has been the most mentioned ‘top three’ marketing priority (mentioned by 54% of the respondents), increasing in importance from 49% in 2016. Loan growth decreased in importance a bit in 2017 (mentioned by 45% of the respondents), but retained the number two spot as a top three priority as it has each year of our research.

After being the third most mentioned top three priority since the inception of the survey, ‘acquiring new customers/ members’ fell to the fourth position in 2017, replaced by the priority of ‘increase adoption of digital channels’. The number of respondents who mentioned the importance of increasing the use of digital channels jumped from 20% in 2016 to 35% in 2017.

The increased emphasis of ‘increasing adoption of digital channels’ is deceptive however. While an overwhelming 63% of large and regional banks made the adoption of digital channels a top 3 priority, the mention is almost twice as much as smaller organizations (35% for community banks and 27% for credit unions).

While the commitment to digital channels by smaller organizations did double compared to 2016, this lack of emphasis creates a situation where it is harder to catch up, both in commitment and in brand positioning. Other research indicates that larger organizations are becoming increasingly the choice of the digital consumer.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Marketing Allocation Not Aligned With Goals

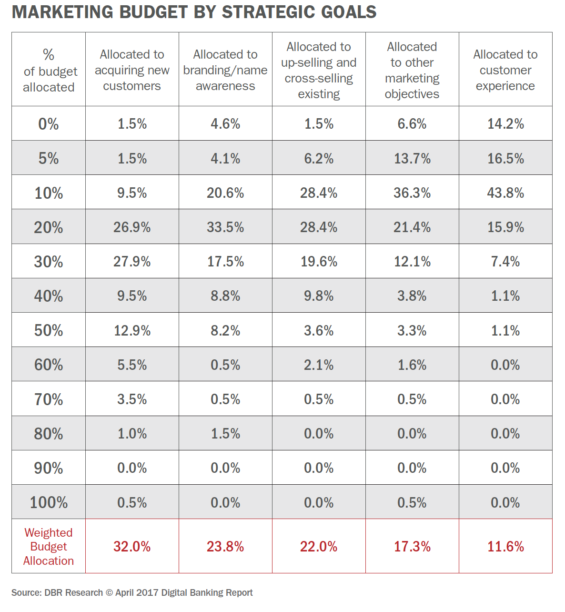

As was the case in our 2016 survey, marketing budget allocation did not correlate with marketing objectives. For instance, when we did a weighted average of responses by strategic objective, we found that an average of 32% of budgets were allocated for new customer acquisition. The next highest goals (branding and cross-selling) received 23.8% and 22% of financial institution’s budget on average.

While some of this allocation variance could be attributed to a higher cost to reach prospects, it is more likely that the budget allocated to generate sales from current customers is underrepresented. This seems to be a continuation of old bank marketing practices.

Interestingly, while there is a great deal of discussion in the industry around the importance of an improved customer experience, only 11.6% of organizations’ budgets were allocated to this objective (beaten by the ‘other’ category). This may be because some organizations don’t budget for CX initiatives independently or it is possible that it is not a marketing expense at some organizations.

When we consider that most respondents put a very low priority on branding, the allocation of budget to branding was very similar to other key objectives. The question is whether the allocation to branding is a conscious expenditure or whether this category becomes a catch-all for marketing expenditures that are difficult to allocate. This conundrum would explain the inability to measure the ROI of branding efforts.

Media Allocation Reflects ‘Mad Men’ Mentality

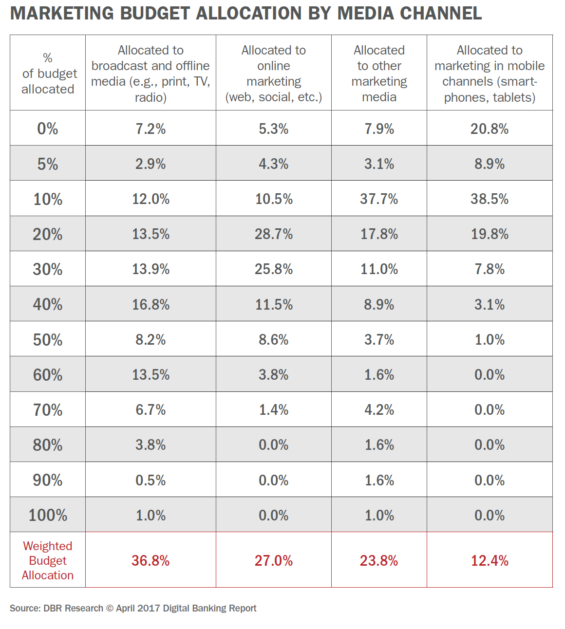

When we asked bank and credit union executives globally about how much they allocate to various communication channels, it is clear that old habits are hard to break. For instance, while financial institutions have reduced their offline marketing budgets, a whopping 36.3% of marketing budgets still go to mass media (TV, print, radio, etc.). Worse yet, over 30% of the organizations allocate over 50% of their budgets to offline channels.

The good news is that online channel use is increasing in banking, with an average of 27% of budgets going to web, social and other online channels. That said, over 50% of organizations surveyed committed less than 20% of their marketing budget to online marketing.

Finally, similar to 2016, virtually no organization committed more than 40% of their budget to mobile marketing, with the average budget allocation being 12.4%. Compared to 2016, fewer organizations ignored the channel altogether, with more organizations committing 10%-20% of their budgets to mobile.

Marketing Budget Changes by Tactic

When we surveyed bank and credit union executives regarding changes in budgets for 2017, there is some encouraging news. 43.9% of the financial institutions surveyed will be reducing or not doing print advertising, with another 39.5% reducing or not doing TV/radio and 36.3% cutting or not doing outdoor advertising. This is similar to what is happening across all industries in the mass media categories.

In contrast, 48.2% of respondents indicated that they are going to increase their email budget, with 29.5% increasing direct mail spending (21.3% will be reducing their spending on direct mail). The number of organizations increasing the use of direct mail in 2017 comes after 31% of FIs increased their budgets for this channel in 2016.

As part of the digitization of the branch network, 48.9% of FIs indicated an increase in branch digital merchandising this year, compared to 33% who said they were going to increase spending in 2016.

In the online channel marketing categories, there were increases projected in every category. Financial organizations were the most bullish in the categories of paid search (56.4% up), paid online (51.9% up) paid social (56.7% up) and paid mobile (47.6% up).

Of the ‘other’ marketing categories, 58.1% of organizations believed they were going to increase spending on cross-sell and onboarding initiatives in 2017, compared to 67% in 2016. This slight drop in emphasis is surprising given the focus being placed on retention and building share of wallet by banks and credit unions.

A bit concerning is that only 54.9% of organizations were expecting to increase budgets for data analytics in 2017. This number is a bit higher than in 2016 (51%) but still does not reflect the level of commitment expected given the overwhelming need for better targeting and measurement of marketing initiatives.

This continues the ‘marketing insanity’ of ‘talk but no action,’ plaguing the financial services industry. With more consumers expecting personalized experiences and organizations being challenged by new competitors and products, legacy financial organizations will find it increasingly tough to compete with data-driven, digitally astute and highly targeted fintech start-ups.

Moving Financial Marketing to the Future

Given the tremendous advance in analytic tools available and the processing power generated by cloud-based architectures, the banking industry needs to take a major step forward to meet the expectations of an increasingly discerning customer base. In short, the industry needs to move from using data to build great internal report of past events – to using data to build great customer relationships and experiences based on future needs.

This includes a major shift from acquiring new customers to using advanced analytics to provide contextual recommendations to current customers. This will change both the marketing priorities as well as the media channels used in the future.

But none of these advancements can be achieved without investments in advanced analytics and marketing automation tools. Financial organizations of all sizes must leverage the digital technologies available to improve targeting, messaging and experiences.