The number of branches in the U.S. are declining at the fastest pace on record, as reported by The Wall Street Journal. That may be understandable given the growing preference for digital banking. But consider other findings by J.D. Power that fully digital bank customers are the least satisfied — even Millennials. Is it because digital banking apps are poorly designed or because digital banking consumers are more demanding? What’s missing?

In an era of hyper-personalization and competitive pressure, the experience banks provide consumers is the product — not a checking account, mortgage or credit card. Speed and convenience are important, but consumers are also seeking meaningful insight and advice on demand. They want and need to be understood as individuals, and they expect service based on their unique needs. Those needs aren’t being met by traditional financial marketing campaign methods, regardless of the channel.

Wave after wave of segmented direct mail, media buys, mobile push campaigns, and email have numbed consumers into disinterest. In fact, we know from our own report that the average response rate for any campaign is less than 1%. By sending messages that are irrelevant, banks and credit unions teach customers and prospects to ignore them.

We also know from a past survey that when retail financial institutions don’t engage in a personalized way, they are not building customer value. Quite simply, banks and credit unions that aren’t using contextual data in real-time to create personalized engagements are missing opportunities to strengthen customer relationships. Their target audiences may be tuning them out.

Read More: The Psychology of Personalization In Banking

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

To Grow Share of Wallet, Think Relationships

Banks must take steps to move away from traditional marketing approaches and move towards the more holistic concept of 1-to-1, personalized engagement that is always on. Successfully interacting with consumers isn’t only about product push – it’s about understanding needs, building trust, and reinforcing relationships.

A constant stream of “Do you want this product of the month?” messaging does not build a relationship. Banks ands credit unions must strive to understand a consumer’s journey and match the needs of that household at every specific touchpoint to improve trust and satisfaction scores.

It’s not about selling to the consumer – it’s about value creation for both the consumer AND the financial institution.

Are you creating value with every interaction? Whether you are servicing a customer, nurturing the relationship, determining risk, proactively working to retain a customer, or selling to a them, how will those interactions affect customers and customer lifetime value (CLV)?

For example, will sending a simple “Happy Birthday” message help deepen a relationship with a consumer? It might. It depends on the context of your relationship with that consumer at that point in time. (Hint – banks are successfully doing this.)

In the digital age, every point of engagement with a consumer — from a service call to a marketing email, to using the mobile app — serves as a “moment of truth” for banks and credit unions where the consumer relationship is put to the test over and over again. And every touch generates a trail of data that is useful in building relationships and CLV. Therefore, each time you engage with a consumer, you should be delivering the most relevant messaging or taking the best action for deepening the relationship and increasing value.

But, with so much data and so many possibilities, how can banks and credit unions determine which message is the most relevant and what actions will grow the relationship? For the answer, look to a combination of real-time analytics and decisioning to help recommend the next best action you should take … and best messaging to use.

Next Best Action Optimizes Engagement

A “next best action” approach allows banks and credit unions to know when to sell and when to serve. Or to know when doing nothing at all is the best decision. It even gives them the power and flexibility to adapt and change offers in real time, because recommended actions are influenced by the context of the consumer engagement.

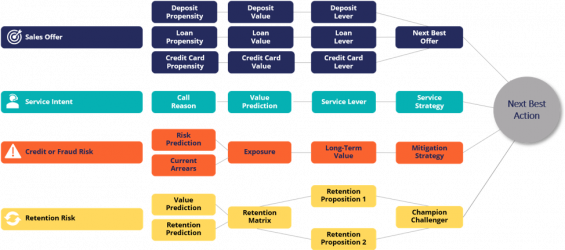

Start with strategies that place the consumer at the very center. Instead of a product-centric approach, it’s consumer-centric: Your strategy will first make the decision about which recommendation is best for a consumer in each potential category across products, attrition scenarios, service interactions, and risks. At a simple level it looks like the graphic below.

This type of personalized, 1-to-1 engagement is made possible by having a centralized decisioning authority that can quickly analyze historical and real-time data from all channels (even the ones you don’t own). It analyzes the data, evaluates potential strategies, and recommends the best action to take in that moment to generate 1-to-1 recommendations and create the personalized, insightful experiences that today’s consumer wants.

If you’re thinking this means predictive models will be used for every single offer or message, you’re right. If you think that’s impossible, you couldn’t be further from the truth. Machine learning has been able to automatically create self-learning models to complement data scientists for years, and can scale to meet modelling demand for institutions of all sizes. It’s possible to calculate thousands of concurrent propensities — and do it efficiently, in real-time.

Banks and credit unions can use next-best-action analytics to drive insight-based recommendations and steer clear of mass segment offers that may alienate consumers. Analytics allows you to proactively initiate retention or sales conversations at the moment an issue may arise.

Read More: Financial Services Entering New Era of Customer Engagement

Two Examples of Improved Engagement

The Commonwealth Bank of Australia (CBA) relies on an AI-powered customer decisioning layer to deliver what they call “next best conversations” across 18 channels. Every time a consumer engages with the bank the system calls a Customer Engagement Engine (CEE) to determine if there is a next best conversation for the customer, and returns a response within 160 milliseconds. This happens an amazing 20 million times every day.

By leveraging AI-based decisioning, CBA has seen a 10x increase in home lending lead volume and is the number one ranked bank in customer satisfaction for retail, business, and online banking. They were also selected as a 2018 Model Bank Winner for Customer Engagement.

The Royal Bank of Scotland (RBS) is also seeing outstanding results from adopting a 1-to-1 approach with each of its 17 million customers. RBS integrated personalized next best action recommendations into its web, branch, contact center, and outbound channels, which gives them the real-time intelligence and guidance they need to initiate high-value conversations. This approach has directly impacted revenue, increasing mortgage retention to 20%.

Put The Consumer in The Center

To succeed, financial institutions need to move away from traditional marketing of products to AI and centralized decisioning tools that engage seamlessly with consumers and create valuable relationships. When banks take a personalized, next-best-action approach — and put the consumer in the center of every interaction — they are better able to deliver the type of individualized engagement that customers are expecting.