According to the 2016 State of Financial Marketing survey, marketing ROI, automation, digital marketing and data analytics are among the top marketing issues troubling C-level executives in the banking industry. CMOs, however, have a different list of top concerns; they worry about marketing resources — both budget and bandwidth. How could the perspectives of these groups be so different, and what needs to be done to close this critical gap?

From the research, it’s clear that financial services marketers must be doing something to address the C-suite’s questions. If not, budgets probably wouldn’t be increasing the way they are. Spending on digital media by US financial institutions exceeded $7 billion in 2015, a 14.5% gain over 2014, according to a report from eMarketer. A robust 11.7% compound annual growth rate is projected between through 2019, at which point the banking industry’s spending on “digital marketing” will top $10 billion annually.

The question is, are marketers doing the right things? Or, more bluntly, is there a digital marketing strategy? Is it linked to the organization’s overall strategy? And has all of this been effectively communicated to the C-Suite? No, according to the survey.

For instance, the vast majority of non-marketing executives believe that their organization’s social media marketing investment is not effective, while CMOs have a rosier view.

“Call it the ethos of the modern digital marketer, or call it youthful ignorance,” says digital consultant Jeff Sauer. “There is very little thought given to the strategies behind most digital marketing efforts. Most efforts employ a spray-and-pray or ready-fire-aim approach.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

Services that scale with you.

How Did We Get Here?

There are four critical issues that have fueled the current disconnect between CMOs and their peers in the C-suite.

1. Linking Data To Results — Banking has always been awash in customer and transactional data. Digital advertising has created another tidal wave of data — who is opening e-mails, visiting and clicking on our website and landing pages, starting an online application? Unfortunately, 53% of non-marketing executives cite “lack of analytics” as a major marketing challenge. The reality is that most financial marketers don’t have the ability to synch these diverse databases, nor do they possess the analytical horsepower to harness this volume data (at least not in meaningful ways).

2. Inability To Link Marketing Activity To ROI — Nearly half of financial marketers confess that they struggle to quantify their impact. Unsurprisingly, that leaves 47% of marketers unsure how they should best determine the appropriate marketing budget for their institution. They are also severely challenged to create a business case for critical marketing and sales automation that would allow for more effective measurement of results and ROI.

3. Knowledge Gaps — The digital marketing landscape is changing blindingly fast, and most financial services marketers struggle to keep up. They are not effectively leveraging outside resources and subject matter experts, impeding their ability to develop a truly contemporary and cogent digital strategy. More commonly, they fall back on the “next shiny toy” approach to building a digital marketing program. Hence, 38% of non-marketing executives cite digital marketing strategy as a major concern.

4. Sitting With the Big Boys? Or At The Kids’ Table — Only 40% of financial institutions in the survey said they have a C-level marketer. This doesn’t mean that marketing is not discussed at the executive table; 56% of non-marketers agree “our C-Suite regularly engages in strategic marketing discussions.” The problem is that non-marketing execs don’t typically view marketing leaders as true peers. The top dog in the marketing department is frequently excluded from C-level discussions. However, it’s fair to question whether marketing leaders have earned this privilege.

What the Heck is Digital Marketing Anyway?

There’s no real consensus about what “digital marketing” is or isn’t, so let’s get that out of the way before we try to get everyone on the same page.

Digital marketing is made up of four distinct elements, all working together to craft a positive customer experience that (hopefully) achieves strategic objectives and generates ROI. Here they are:

1. Digital Advertising — This is what most non-marketing executives think of first when they think of “digital marketing.” Digital advertising consists very visible media — paid search, display, online video and social — that our customers and prospects hopefully see and interact with. As Marilois Snowman, CEO of Mediastruction points out, “Digital advertising plays a critical role in filling the top of the marketing funnel, generating leads for the sales force, and keeping conversations going with customers.”

2. Marketing and Sales Automation — When many non-marketing executives think of CRM, they get a furrowed brow and worry about a multi-million dollar black hole. Most marketers understand that some type of automation is needed in order to effectively use customer insights to deliver the right message and product to each customer, turn interactions (leads) into closed sales, then track and measure the resulting revenue. Products like HubSpot and SalesForce get lots of mention (commensurate with their marketing budgets) but there are many other simpler, less expensive systems designed for financial institutions that do most of what is needed.

3. Marketing Analytics — Data analytics rivals automation as the “black sheep” of digital marketing. Most CEOs and CFOs are disciples of analytics and customer insight. They just don’t think that those in marketing are effectively doing it; 53% of non-marketing executives cited “limited data analytics tools/capabilities” as a major marketing challenge.

Compounding the problem, analytical resources and customer data warehouses are often placed in departments beyond marketing’s grasp — e.g., finance or IT. Marketers are frequently left with a stand-alone “Marketing Customer Information File” (MCIF) without any of the analytical horsepower to turn the data into actionable insight. Financial institutions must find ways to combine their various rich pools of customer data, and create cross-functional teams to effectively mine them. This includes the voluminous data that can be generated from digital advertising and automation campaigns.

4. Digital Delivery — Consumers are increasingly accessing the bank through digital channels, and prospects are beginning their engagement process by visiting landing pages, websites, and online account opening programs. All of these elements need to be designed with the consumer’s needs, priorities and behaviors in mind, and they must be integrated with other channels.

Digital delivery is — at least in principle and theory — a marketing function. But typically most or all of this responsibility is considered a function of Operations. It’s imperative your financial institution take a cross-functional approach to these areas, with the organization’s overall strategy and consumers’ needs balanced at the center of the plan.

The Road Forward

So how do C-suite executives become comfortable that marketers have a command of their data, that customer insight is driving their plan, that they are using automation to customize and personalize the experience, and finally, that they have an overarching digital marketing strategy pulling all this together? Here’s how.

1. Link Insight To Action — Most marketers are already using data and analytics to drive action. For instance, we’re using customer data to create trade area targeting for direct mail and digital advertising. The next time you are making an executive presentation, don’t just show the creative materials! Start with the hypothesis you were testing and the data you used to select the target audience, offer, medium, and message.

Of course no marketing team has enough analytical resources. But the only way you’re going to get more resources is to work effectively with what you already have. Then you must clearly explain what you did and how it added value to the client and organization.

2. Close The Loop — The most common refrain heard from the C-xuite is that marketers are more focused on activities than actual results. Marketers talk in terms of CPM, clicks, reach, frequency, and engagement, while the C-suite is looking for unit sales and dollar costs, net household growth, topline revenues, etc.

Financial marketers need to close this communication gap by linking online data with “offline” sales results. A good place to start is creating low cost test-and-learn scenarios that can be optimized then scaled. This allows you to constantly be measuring the impact of your actions, refining your strategy, improving results, and ultimately “closing the communications loop.”

Read More:Marketing ROI – The Big Black Hole

3. Automate — Financial marketers can’t be successful without marketing automation. There are automated compliance review systems like Kadince. Or a bulk email provider like ClickRSVP. Or a lead nurturing system like HubSpot. Or a campaign management system like Net-Results. Maybe even a full-fledged marketing automation system like Marketo. Wherever you are on this continuum of sophistication, you need to ensure that the C-suite understands where you are today, what results you are generating from it, where you need to go next, and how the organization will benefit.

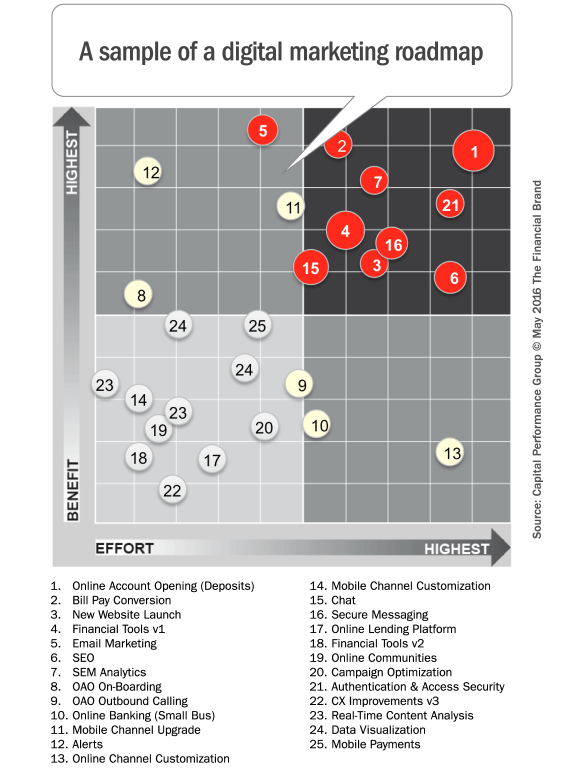

4. The Digital Roadmap — You need to begin with your organizations strategy and your primary customer’s needs and behaviors, then “map out” the digital advertising, automation, analytics, and delivery enhancements that will bring it all to life. Pay particular attention to the benefit generated and effort/dollars expended. This “roadmap” would ideally extend out at least three years, remaining flexible enough to accommodate emerging technologies and evolving customer behaviors.

5. Communicate — All of these steps need to be encapsulated in better communications between the top marketing executive and the rest of the C-suite. Be sure you get the subject of marketing on the executive agenda — at least quarterly. And don’t just give an update on the current campaign and show creative materials; that won’t get you invited back very often. Talk about where you are on your Digital Marketing Roadmap, how consumer insight is driving your current programs (and results). Tell them how automation is making your efforts more efficient and trackable, and how your “closed loop” measurement is linking activities with results.