Financial institutions have been pouring money into mobile budgeting tools, AI-driven app features, and slick, new branch designs, all to create a better customer experience that will result in increased engagement. In today’s digital world, every bank’s marketing efforts should be an extension of that same engagement strategy.

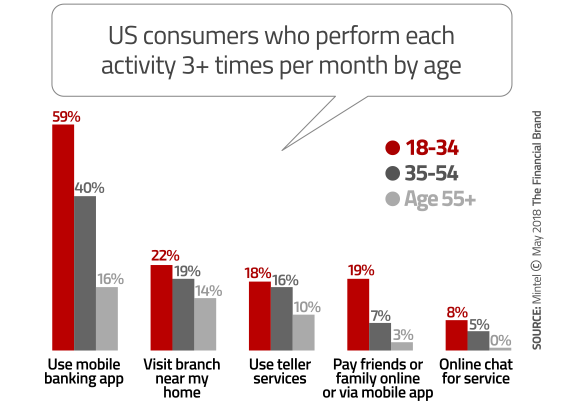

As consumers increasingly use digital tools to simplify and streamline their financial behavior, the number of available touchpoints a bank can have with their audience is growing. Young consumers are especially engaged, and not just through their smartphones. Research from Mintel has found that Millennials are more likely than older consumers to interact with their bank or credit union three or more times per month in a variety of settings, including visiting a branch close to their home, using their mobile banking app, and chatting with a customer service representative online.

Across both digital and in-person channels, the more touchpoints there are, the more important the customer experience at each of those touchpoints becomes. At the same time, marketing must move beyond the promotion of basic banking products, and instead focus on the value proposition of the valuable customer experience at each touchpoint.

Read More:

- The 5 Biggest Mistakes Financial Marketers Make in Digital Channels

- Financial Marketers, Are You Listening: Stop Buying New Customers!

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

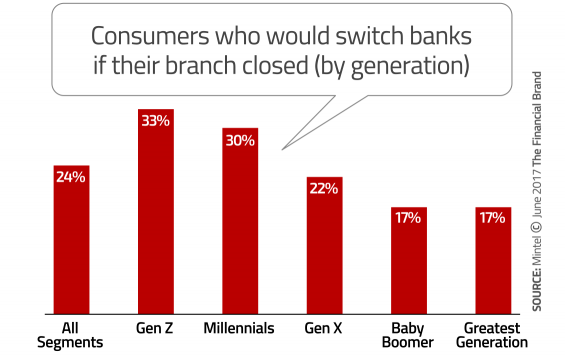

1. Apps

The mobile banking app experience can be the key to customer retention for a banking provider. In a survey conducted in 2017, Mintel found that young consumers are more likely than older consumers to change their banking provider if their current institution closes the branch they use the most. This means that banks and credit unions need to make every effort to not only ensure a digital presence among these young customers, but also ensure that this digital experience is valuable enough to maintain the relationship should their local branch close its doors.

The current state of mobile banking app marketing typically falls into two camps: either it aims to encourage customers to download the app or it announces new app upgrades or features. Promoting an app and its functionality has its benefits, but consumers need to know why it will make their lives better. To really have an impact, mobile app marketing should convey an experience that will seamlessly fit within a customer’s day-to-day needs.

The following examples illustrate this point. One email was sent from PNC in March with the subject line, “PNC Mobile Banking can help make your life easier.” Despite an estimated volume of over 2.0 million, this email achieved an average read rate around 21.6%.

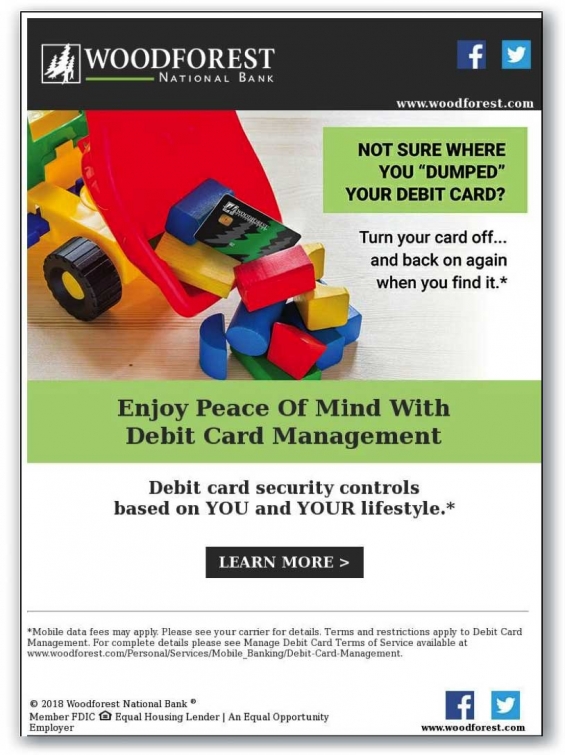

On the other hand, the other email below from Woodforest National Bank, a privately held bank headquartered in The Woodlands, Texas, was sent to over 1.0 million customers with the subject line, “Manage Your Debit Card With Our Mobile App.”

This email achieved an average read rate of 39.0%, according to Mintel estimates.

The difference between these two subject lines is the reference to a specific interaction that a customer would typically have with their banking provider, rather than a generalized, potential benefit of the app.

An email subject line should be a teaser to what someone is going to get out of opening that email. Even if the body of the email mentions all of the app’s most noteworthy tools and functionality, the subject line should still convey one specific benefit that enhances the customer’s banking experience in a tangible way.

2. Branches

Given the value that branches still provide to the overall banking experience, it’s no surprise to see many large institutions working so hard to revitalize the branch experience. Across the country, branches are transforming from teller windows to advice centers and from cubicles to coffee bars. If the overall reason for visiting one’s local branch is changing, the marketing should also change. Instead of the branch being somewhere your customers have to go in order to open an account or complete a transaction, the branch should be somewhere they want to go to get a more hands-on approach to their finances. At the very least, the branch should be an enjoyable and seamless part of one’s weekly or monthly routine.

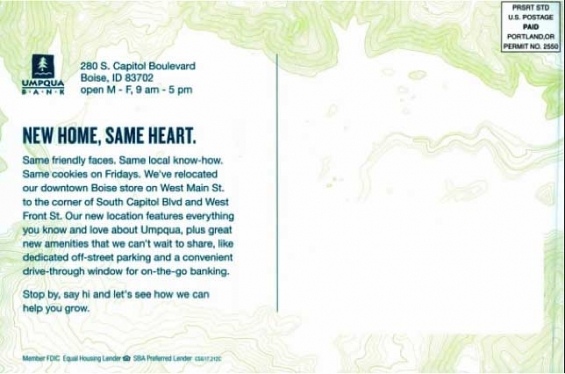

Not all branch enhancements have to be rooted in technology either. Umpqua Bank introduced one of its newest branch locations with a direct mail postcard to local customers with the simple greeting, “Hello!” The bank also made a point to highlight some of the more convenient and enjoyable elements of this particular branch experience, including cookies on Fridays, dedicated off-street parking, and a drive-through window.

Today’s digital consumer visits their bank branch for much different reasons than they did five or 10 years ago. If your marketing is going to ask customers to visit their local branch, it must also convey how this interaction is genuinely unique from any digital channel.

3. Customer Experience (CX)

The customer experience can extend beyond bank branches and mobile apps. The key to customer retention could be as simple as a more entertaining or interactive experience. Some banks are even approaching customer engagement through the creation of new holidays or one-day only events.

In 2017, Bank of America declared that October 17 would be officially known as “Pay Back a Friend Day,” through a social media-driven marketing campaign to promote the use of its mobile banking app and Zelle. Capital One also capitalized on the hype around some of these lesser-known holidays and launched an interactive campaign to coincide with National Superhero Day (April 28, 2018). The goal around Capital One’s campaign was to encourage conversations about money by asking people to identify with one of various different money-related superheroes.

Consumer expectations are at an all-time high. We have brands like Amazon, Uber, and Netflix to thank for that. In addition to creating an “on-demand” generation of consumers, brands such as these are reinforcing the notion that we should have access to their products or services at any time and from anywhere. The banking industry is no different.

Digital consumers, especially younger digital consumers, have an expectation to be able to interact with their money on their own terms and in their own time. Successful bank marketing will reflect those options and provide a clear value proposition around the experience rather than the product alone.

Lily Harder is the Vice President of Research for Mintel Comperemedia. Lily specializes in the financial services industry, researching and presenting on the latest industry trends, competitive intelligence insights, and newsworthy developments. She is also responsible for leading a team of senior industry analysts that produce both custom and syndicated competitive intelligence reports. Lily earned her BA in Economics from Northwestern University and her MBA from ESADE in Barcelona, Spain.