According to McKinsey, 83% of CEOs globally believe marketing can be a major driver of growth. This is obviously a new phenomenon, given that marketing traditionally was viewed as a “cost center” that would spend resources on advertising, branding and other mass media options. Unfortunately, despite the raised status of marketing, 23% of CEOs do not feel that marketing is actually delivering the growth needed by the organization.

“23% of CEOs do not feel that marketing is actually delivering the growth needed by the organization.”

Financial marketers need skills and a mindset that is vastly different from marketers of the past. Winning or losing is happening almost instantaneously, and will be determined by how well marketers embrace change, are willing to take risks, and will disrupt themselves.

In a world where information, devices and technology are all interconnected, where data is collected wherever the consumer is, and where marketing performance is reaching perfection, marketers have an opportunity to be at the epicenter of the customer experience. Despite all of the technology and digitization, human traits like creativity, imagination, intuition and ethics will be more important than ever. But the application of these traits will need to be done with a future sense three-five years out.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Marketers Becoming Unifiers

In the past, the Chief Marketing Officer often had an ad agency background and brought unique perspectives on creative and media that allowed them to be relatively independent of the rest of the organization. Today, the CMO needs to build partnerships across the organization. This includes building alliances with functions such as sales, product development, data processing, finance and even human resources.

Some of these partnerships will not come easy. McKinsey found that only half the CFOs surveyed believed marketing delivered on the growth objective, with four in ten believing marketing funding should be cut during a downturn in business. Making matters worse, only 3% of board members have a marketing background, making top level support questionable.

Tomorrow’s CMO needs to bring together disparate parts of the organization for a set of unifying objectives where marketing has a prominent role. Marketers need to move well beyond the language of a creative ad executive, using the analytic and financial language of the rest of the financial institution. According to McKinsey, “Sought after by peers for advice, [unifying CMOs] have a seat at the table when critical decisions are made, have broad profit-and-loss (P&L) responsibility, and are often involved in defining the company’s strategy.”

The most important partner for a successful CMO is the CEO. Leveraging new sources of insight, analytic tools and new marketing technology, the CMO makes sure the CEO understands exactly how marketing is driving growth and an improved customer experience. Often, these insights are being included in widely distributed corporate reports, including the annual shareholders report.

This partnership with the CEO and other C-Suite executives increases the CMO’s power. Often, the CMO is assigned responsibility for functions such as product innovation, customer service and the customer journey. A gap that still exists is the comfort level of the CMO to take risks and responsibility for results.

Left Brain vs. Right Brain

Scientific theory once believed people were either prominently left-brained or right-brained. If a person was considered mostly analytical and methodical in their thinking, they were said to be “left-brained.” If a person tended to be more creative or artistic, they were thought to be “right-brained.”

Later research revealed that the human brain doesn’t actually favor one side over the other. The networks on one side aren’t generally stronger than the networks on the other side. In fact, whether a person is performing a logical or creative function, they are receiving input from both sides of their brain.

That said, people do tend to play to their strengths and continue broadening their mental horizons over time. Unfortunately, in most cases, CMOs and CFOs tend to be at opposite ends of the spectrum.

For CMOs to succeed in the C-Suite, they must demonstrate the financial accountability of the marketing function. According to McKinsey, “The best marketers use advanced analytics to help quantify the impact that marketing spend has on short- and long-term value. They build business cases with metrics that reflect meaningful financial value such as ROI, customer lifetime value, revenue run rate as opposed to metrics like gross rating points, customer satisfaction scores or brand equity.”

The success of these efforts is usually measured by continuing to have a seat at the C-Suite table and being able to retain (or expand) budget during challenging times.

Read More:

- 4 Toughest Digital Marketing Challenges Financial Brands Face Today

- Major Content Marketing Trends For Banks & Credit Unions

The Value of Digitization

Successful CMOs are increasingly aware that the easiest way to the heart of both the CEO and CFO is through marketing technology and digitization. However, marketing is increasingly challenged by the inability to harness the vast volume of data available with the teams currently in place.

To respond to this challenge, modern marketing departments either have their own data analytics team or have a strong partnership with an outside vendor who can provide these services. By providing ancillary support to the IT area of the organization for marketing related needs, it is less likely the CMO will need to beg for data from the CIO or CTO.

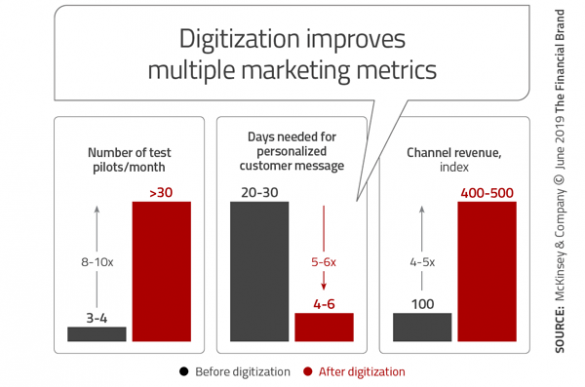

The value of digitization of data for marketing purposes is starting to pay off. For instance, in another McKinsey report, it was found that marketing should invest in, collect, and analyze available data to support their decision making. These metrics are powerful in proving value to doubters in the organization.

Remaining Cultural and H.R. Challenges for Financial Marketers

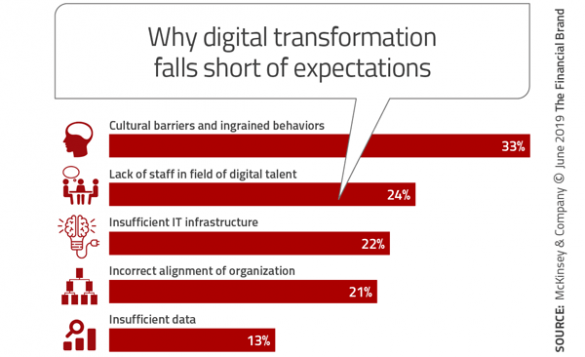

While successes have been documented in all industries around technology, data, analytics and the digitization of insight, challenges remain. The greatest challenges found revolve around legacy cultural issues and the ability to find new talent.

This surprises many who believe the gap may be around technology or data. In almost all research conducted by the Digital Banking Report over the past five years, the primary roadblocks are not around the availability of data or the tools to harness insights. The blockade continues to be around the attitudes and behaviors of those who use the technology.

Can bankers and credit union executives understand the value of using customer insights for an improved experience as opposed to simply the reduction of costs? And, can we find and deploy retrained or recruited talent to drive results?

A roadmap for team transformation must be developed, usually leveraging a step-wise approach to new roles and responsibility rather than taking on these changes all at once. In addition, the development of internal training around new and/or expanded roles will be necessary before the need becomes urgent.

Getting a seat at the boardroom table in the C-Suite will depend on multiple factors. The most important transformation will need to be in the CMOs themselves. While robots and software may do some of our work, this will allow us to focus on things that cannot be automated.

To embrace change CMOs must begin engaging with what might be … not just with what currently is. Leaders must move away from comfort zones and immerse themselves in the future as seen three-five years out. And while data and advanced technology will be important, the importance of human wisdom, judgment and sensibilities will never be greater.

It’s time for financial marketers to climb the organizational ladder.