More than ever, marketing content is reaching consumers at an unprecedented pace, creating a fragmentation of focus and a decreasing attention span. Although there are no official figures, it is estimated that the average person is exposed to between 6,000 to 10,000 ad messages every single day. So, even under the best circumstances, a marketer must compete with thousands of other messages when trying to communicate the benefits of a brand, product or service and motivate the consumer to take action. They must also compete with ad blockers.

But that is not the biggest challenge. Consumers want experiences that are fast, seamless and personalized to the way they want to engage. They want ways to simplify their life, selecting organizations that are empathetic to their individual goals. They want experiences that are frictionless and potentially even surprisingly enjoyable. If an organization can’t deliver this level of experience – physically and digitally – consumers will disengage.

There is no amount of great marketing that can offset a bad experience.

A New Value Proposition:

If the pain of a bad experience is greater than the value of the product or service, the customer will either abandon their purchase or leave an established relationship. Switching providers is easier than ever.

Think about your personal experience. Have you ever been captivated by an ad or some other form of marketing only to be disappointed by the experience? In most cases, the amount of effort you are willing to exert to begin or continue a commercial relationship is directly correlated to the perceived value you will receive.

If the value isn’t significant, or the pain of the experience is too much, you may not even complete the buying process. If you do purchase, and the customer experience continues to be less than desired, your engagement with that brand will diminish or disappear altogether. Financial marketers need to recognize that traditional advertising and marketing are no longer enough. The best way to attract and engage a consumer is with an exceptional experience.

( Read More: The Future of Customer Experience in Banking is Personalized )

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Power of a Positive Experience

When was the last time you saw an ad for Uber, Airbnb or Tesla? You probably haven’t, since these brands have made the decision to invest relatively little in traditional advertising or marketing. Instead, they rely on innovative design, unique user experiences, and word-of-mouth to drive new business and create loyalty.

Especially during the pandemic, consumers adopted new habits and created loyalties with organizations that made their life easier. They used Instacart to simplify grocery shopping, Uber to deliver meals, Amazon for daily retail needs and Netflix for entertainment. Many wondered whether these changes – many of which accelerated trends that were already in motion – would be temporary or permanent. Research indicates this accelerated shift to better digital experiences is sticking.

Great Experiences Can Cut Marketing Cost:

Many leading brands benefit from word-of-mouth marketing as opposed to purchased media to drive sales.

The shift to better experiences is occurring in financial services as well. Acorns provides an easy way to save. PayPal and Venmo provide a seamless way to make payments and transfer funds. And, Robinhood took design cues from social platforms and gamified stock trading. In most cases, the advertising and marketing is modest, with a significant reliance on word-of-mouth.

A Move From Functional to Emotional

Marketing will be much more effective if we get customer experiences right first. This is because consumers increasingly value brands that deliver the type of experience they desire – and are already receiving from other leading brands. The key may be to shift from functional to emotional experiences.

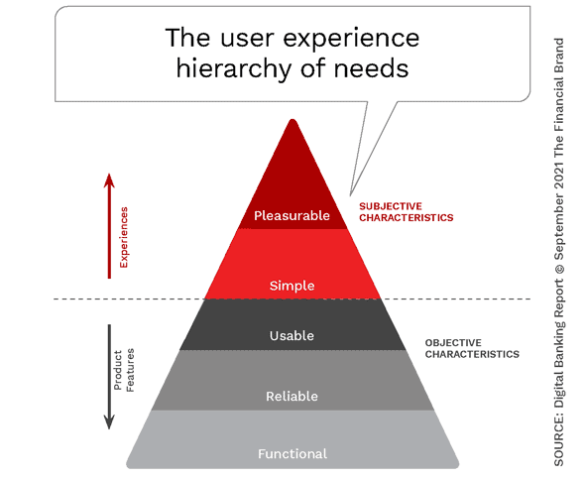

In his book, “Designing for Emotion“, Aaron Walter designed a pyramid of user experiences similar to Maslow’s hierarchy of human needs, where we start with basic functional user experiences and we aspire to deliver enjoyable or even pleasurable experiences. As with Maslow’s pyramid, the highest level is hardly ever achieved. I have made some adjustments to Walter’s pyramid, below, but the concept is the same… we want to move up from basic design features to create memorable moments.

The levels of the user experience pyramid include:

- Functional. It meets the basic requirements to support the product. The experience can be completed by the consumer in an acceptable amount of time with modest effort. There is a clear call to action and assistance may be available if the process is not understood.

- Reliable. The experience is consistent across all channels at all times. The use of data and insights are leveraged for an improved experience.

- Usability. The highest of the objective characteristics, this level usually leverages user testing to determine if the design and underlying processes flow without a high level of abandonment. Is it easy for the consumer to find what they need and take the desired action?

- Simple. Does the experience lack the friction that may slow down or confuse the user? Is the process accessible for all customers? This level requires a rethinking and restructuring of back-office processes with a focus on speed of execution. Don’t make the consumer do a task that you can do for them (think prefill of data).

- Pleasurable. On this level, users will not only engage on a frequent basis, but will encourage others to do the same. They will do word-of-mouth marketing that will provide a multiplier effect on traditional marketing efforts. There is a level of uniqueness and creativity that significantly exceeds expectations (think about the first time you exited an Uber without taking out your wallet or phone). Personalization makes an experience more pleasurable.

Don’t Settle for ‘OK’:

The challenge is that many organizations don’t move beyond ‘reliable’ or ‘usable’ experiences.

The user experience that can move market share is when an experience is simple, easy and enjoyable … like Uber. It’s the difference between being able to open a new account or apply for a loan in a few steps that takes less than three minutes and a process that takes more than ten minutes. It’s the difference between ‘just’ simplicity and a user experience that is accessible for all and empathetic to the individual needs of the consumer.

We need to strive to create pleasurable experiences that customers will share with others.

( Read More: Beyond Personalization: Three Reasons to Focus on Customer Journeys )

Collaboration Between Technology and Marketing

Financial marketers will have a much greater potential for success if they can complement their creative with a focus on exceptional product and service experiences. It’s worth restating: In a digital world, where speed and simplicity are expected, no marketing can offset a substandard user experience.

According to an article in the MIT Technology Review, “Every financial institution is looking to digital transformation to meet rising customer expectations for speed and convenience, lower its operating cost, and fend off competition, including from tech companies moving into financial services.” Some are spending over 10% of yearly revenue on technology investments, according to Bloomberg. This level of investment is needed since most financial institutions are playing catch up to customer expectations.

The User Experience Pyramid is Dynamic:

The customer expectation for each level of the user experience pyramid continues to increase.

The levels of the user experience pyramid are not static. The digital economy is creating a cycle of digitization with better and faster digital products, services and devices along with huge pressure on organizations to use technology to transform operations. The pandemic was a wake-up call to organizations that thought that simply providing ‘digital access’ was enough.

An article by Jack Ashdown states, “Perhaps one of the most interesting fields of customer experience creativity will be the fusion of advertising with user experience design within brand experiences. So, rather than a battle for supremacy – perhaps customer experience strategy will become the focal point for increasing collaboration between technology designers and advertisers.