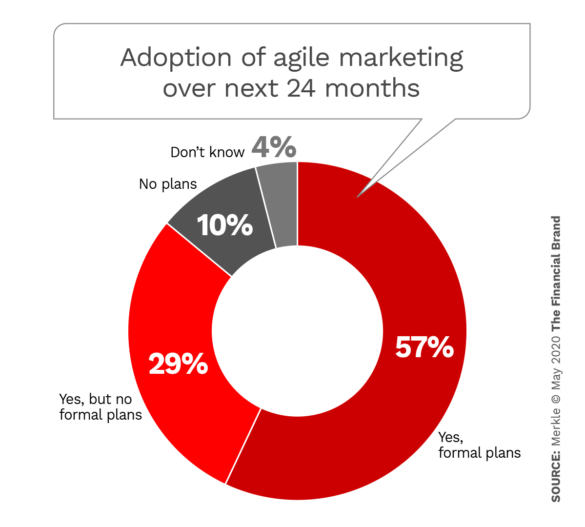

Agile development, most commonly associated with software, is making major inroads into financial marketing, with large and midsize financial institutions leading the way. 85% of marketing executives are planning to increase their use of agile methods within the next two years, according to a survey by marketing agency Merkle. Of the 400 marketers polled, just over half (57%) have formal plans to increase adoption of agile methods.

In a marketing context, agile means “using data and analytics to continuously source promising opportunities or solutions to problems in real time, deploying tests quickly, evaluating the results, and rapidly iterating,” as described in a McKinsey article.

Merkle’s survey findings were tabulated just before the coronavirus pandemic flared up in the U.S., making it likely that some of the tools and methods common to agile development may already have assisted financial marketers to deal with the disruption resulting from the crisis. In fact, nearly nine in ten marketers (89%) say they already use agile methodology for some functions or with some of their teams, according to the survey report.

That high rate of adoption would seem to leave little do. However, Margie Chiu, Senior Vice President, Business Strategy at Merkle, tells The Financial Brand that it’s common for financial institutions to pilot agile marketing at a smaller scale, so it’s plausible that adoption can still be meaningfully increased by rolling it out to more teams. Chiu also notes that as with any emerging trend, there’s “definitely a possibility that some respondents are self-reporting a greater level of agile adoption” than is the actual practice.

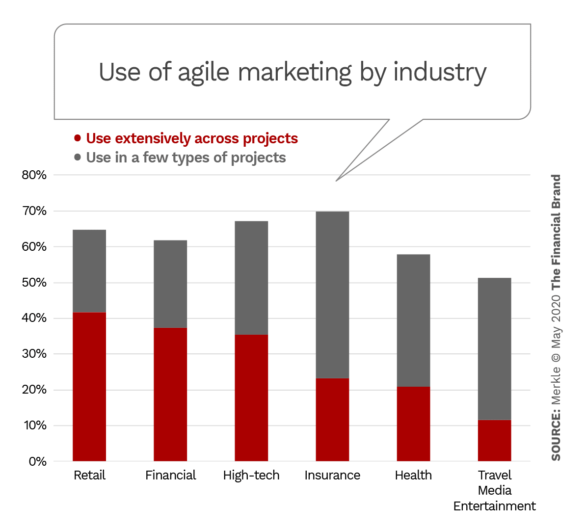

Among six industries Merkle studied, financial services ranked ranked second, behind only retail, in terms of “extensive use” of agile marketing.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

What Agile Marketing Typically Entails

In software development agile methods are common to small digital startups. In marketing, however, extensive use of agile marketing is more typically found among the two largest of three revenue-size breakouts used in the Merkle analysis. Companies with annual revenues below $500 million were much more likely to use the approach “in a few areas” rather than “extensively.”

Chiu maintains that any marketing activity can be performed with an agile approach by adhering to four core principles:

- Customer-centric

- Data-driven

- Grounded in small experiments (or tests)

- Deployed through cross-functional teams.

Examples of bank and credit union marketing projects that can benefit from agile marketing include revamping the online account opening process, streamlining of campaign planning and deployment, and improving the lead nurturing and management funnel, according to Chiu.

At scale, an agile — and large — marketing organization can run hundreds of campaigns simultaneously and come up with multiple new ideas every week, McKinsey notes. The opposite of agile would be a bank taking eight weeks to put together a new email offer, including running it by Legal and Compliance.

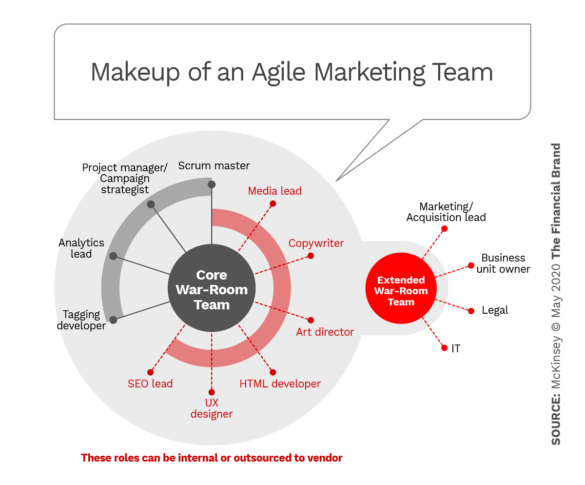

The diagram below presents the agile marketing concept visually. It was created well before the pandemic and would now have to be implemented remotely in most cases.

People are the most important factor in setting up agile marketing, McKinsey states. Financial marketers need to bring together “a small team of talented people who can work together at speed.” Team members should have skills across multiple functions, be freed from their “day jobs” to work together full time, and be co-located in a “war room” — now virtual.

Overseen by a “scrum master,” these teams conduct tests in one- to two-week “sprints” to validate whether the proposed approaches work, At the end of each sprint, the team debriefs to incorporate lessons learned, which are then communicated to key stakeholders.

Agile marketing teams must have clear lines of communication with other groups in an institution. “At one bank trying to establish a war room,” McKinsey states, “there was significant resistance to providing representatives from legal and the controller’s office because of competing priorities.”

Read More: Financial Marketing Demands Incredible Agility

Marketing leadership must take the initiative if agile is to be used on more than an occasional project. “To maximize the value of agile marketing requires an enterprise-wide, cross-functional approach,” states Merkle’s Chiu. Since marketing initiatives typically require the contribution of various teams (e.g., IT, Data, Site/Digital, Analytics, Advertising, CRM, Contact Center, Branch/Store), she adds, Marketing is in an ideal position to serve as the “hub” of an agile approach.

A key point Chiu made in response to a question from The Financial Brand is that agile marketing doesn’t mean workarounds or shortcuts that would put a bank or credit union at risk with regulators or otherwise. Quite the contrary.

“We consider the approach ideal for this industry in that it favors the use of data (versus opinions) and tests the water through small experiments (versus big bang rollouts).” She says a frequent recommendation for financial institutions is to integrate a representative from Compliance early in the process so that any concerns and potential risks can be addressed before a significant amount of work is completed.

Barriers and How to Overcome Them

Although Merkle’s research shows adoption of agile marketing is growing, the agency probed what factors keep Marketing from incorporating agile methods and practices to a greater degree. “Lack of expertise” was the top people/process reason cited by about two out of five marketers (39%). The next two biggest roadblocks were “Concerns about disruption to business” and “Lack of executive support,” both at 33%. Only 12% did not see the need for agile marketing.

Chiu observes that disruption is often a concern because marketing departments have to juggle multiple competing priorities and make the most out of limited people, time and budget resources.

“It’s not uncommon for teams to hesitate adding potential ‘risk’ by introducing a new way of working,” says Chiu.

The work-from-home mandate imposed by the COVID-19 crisis noted earlier would appear to be a serious challenge to agile work of any sort, given the in-person nature of the “war room” concept.

“While it’s true that agile works best when the teams are co-located in a common physical location,” Chiu states, “we have seen success with teams that operate remotely.” She says that the proliferation of collaboration and team communication tools has helped greatly. However, remote agile teamwork requires more frequent check-ins; the adoption of a workflow management tool that ensures visibility, transparency and progress tracking, and a skilled project lead/scrum master.

Why New Privacy Rules May Be a Marketing Boon

In a separate series of questions to the same group of marketers, Merkle probed how recently established privacy regulations — notably the California Consumer Privacy Act (CCPA) — are impacting marketers’ ability to deliver a superior customer experience. More than nine of ten (92%) were confident of their ability to comply with these new regulations.

That’s impressive given the scope of what CCPA, which took effect Jan. 1, 2020, gives consumers:

- The right to access information a company has about them.

- The right to request that the company delete that data.

- The right to opt-out of the sale or transfer of the data to third parties.

Although the survey results were not broken out by industry, Sandra Swindle, Senior Vice President, CRM Technology Delivery for Merkle, says that because financial institutions have been dealing with regulations that require inventorying data, they will be in a better position to more quickly adapt to CCPA-type compliance than other industries.

A surprising survey finding was that just over two thirds of marketers (67%) see recent privacy regulations positively impacting marketing. As the Merkle report states, “With this new era, marketers have a greater understanding of where their customer data comes from, allowing them to drive better personalization.”

Regulations like CCPA will “reduce the noise of consumers who are not interested in the products that are being offered,” Swindle notes, “and will allow marketers to focus their dollars and engagements on those consumers who are interested.”