Banks and credit unions face more competition than ever before, not only from each other but from the spate of fintechs, neobanks and other alternative financial providers that have made significant inroads. In a time when it’s harder than ever to catch the consumer’s eye, effective marketing and advertising go a long way in customer acquisition and retention. With that in mind, here are seven financial marketing trends to be aware of for this year and beyond.

1. ‘The Revolution Will be Somewhat Televised’

With more people cutting the cable cord than ever before, as well as an increasing number of services that allow viewers to skip through commercials, it’s no surprise that ad spending on television has been steadily falling the past several years.

In its place, advertisers are increasingly throwing money at digital channels, and that’s what banks and credit unions should be doing too. Even during a pandemic, digital advertising spending grew 12.2% year over year in 2020, according to a report commissioned by the Interactive Advertising Bureau and conducted by PwC.

That’s not to say financial institutions should be abandoning TV, but with more consumers than ever before doing research on products through digital channels, it is vital for financial marketers to target this area.

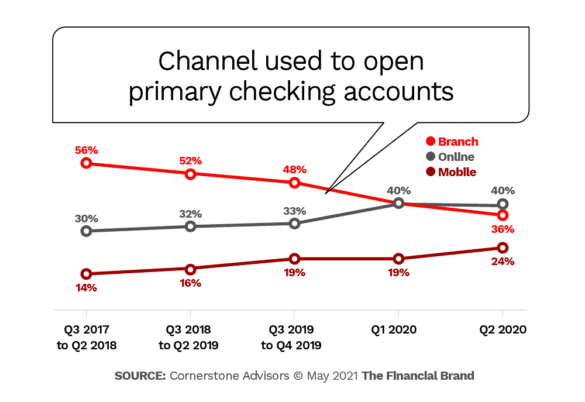

The chart below demonstrates the increasing importance of digital channels. Consumers now open accounts online more often than in-branch. That means digital advertising will be a key cog in helping potential new customers find you.

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

2. Harnessing Big Data

With all the data that financial institutions have (and can obtain) on their customers, they should be able to anticipate and meet their needs. That is the promise of big data, and tools exist now to deploy it more effectively than ever.

Banks and credit unions can efficiently use transaction data to spot consumer behavior trends. When that happens in real-time, as is increasingly possible, the institution can provide the exact type of resources needed at any given moment. It’s a balancing act, of course, between highly personalized and timely offers and a consumer’s privacy wishes.

By relying primarily on first-party data, financial marketers can be more likely to maintain the proper balance. It’s important to get it right because consumers increasingly expect personalized offers and communications — something of value, in other words — in exchange for use of their data.

Key Takeaway:

The more banks and credit unions can use customized messaging, the more they will stand out from the rest of the marketing noise

3. Informative, Interactive Content

Everyone reading this knows how important content marketing is. Yet, simply creating bland content for the sake of it will not move the needle. Instead, financial marketers need content that helps answer questions and breaks down complicated financial products into understandable bites.

Using web search insights and research data to find out which finance topics customers are struggling to understand “is arguably the most powerful starting point when planning finance content,” according to Smart Insights.

Doing so means you will not only be helping users and potential new customers, but creating search-friendly content as well. Making content interactive is also a big plus. Interactive content lets users personalize and participate in it, which makes it more engaging and effective, and gives it a longer lifespan as well, according to the Content Marketing Institute.

4. Social Ads Skyrocketing

Financial institutions have something of a love-hate relationship with social media. They know they must be on these platforms, but often don’t know the best way to engage on them. When it comes to advertising on social media, banks and credit unions need to target the platforms that will reach the most potential new customers. If they do that they certainly will have plenty of company.

Advertising spending overall on social media platforms was on a tear in Q4 of 2020. According to Socialbakers, social ad spending worldwide increased 50.3% compared with the same period in 2019.

Startling Fact:

North American brands invested in social media ads like never before, posting a whopping 92% increase in fourth quarter 2020.

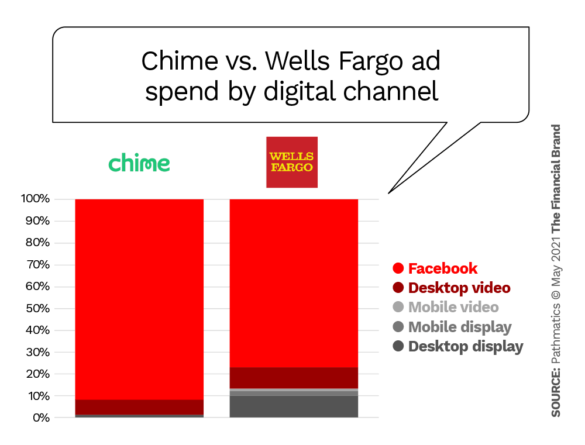

One major U.S. neobank – Chime – is using Facebook to great success. Though Facebook in recent years has changed how banks can advertise on its platform, Chime has succeeded using a particular strategy: Targeting females over males, targeting users from states with large populations, and Android users over iOS users, with ads featuring links directly to a sign-up page. The chart below shows how Chime focuses an overwhelming portion of its social strategy on Facebook, even more than Wells Fargo, itself a big user.

5. Cookie Crumbles

Big tech has not been very popular with the government in recent times. It seems like every other day some tech executive is being dragged before a House subcommittee to be interrogated. The main reason behind this is privacy concerns, even though consumers still willingly throng to these megasites. But privacy is a growing concern, which Google acknowledged by announcing in 2020 it will stop supporting third-party cookies in its Chrome web browser, and that it will create more privacy-minded ad-targeting tools.

This means financial marketers no longer will be able to use third-party data to target ads through Google technology, though advertisers can still use their own first-party data with Google’s existing Customer Match product, according to The Wall Street Journal. That product ingests information a consumer gives to a brand, such as an email address, and determines whether it matches data Google already has.

This can be a boon to marketers, who will need to become more innovative and reach consumers without relying heavily on cookies, hyper-targeted ads, or mass amounts of data.

6. Out of Sight, Out of Mind?

Between subway ads, Twitter promos, TV commercials and more, it seems you can’t go anywhere without coming across an advertisement for a fintech or neobank. Varo Bank even bought a Super Bowl ad. But what about traditional banks and credit unions?

It could be that more established names have a need to advertise less due to brand recognition, and that, conversely, neobanks, have to create brand recognition, often nationally, in an increasingly crowded field. Neos often have deep pools of investor capital to draw upon, as well.

Still, banking providers can’t rely on brand recognition or a large branch network to do their advertising for them. With more fintechs ingraining themselves in the consumer’s mind, often with distinctive names, the harder it will be for financial institutions to gain that mindshare back.

7. Diversity & Inclusion

With the current social climate in America today, the importance of diversity and inclusion should be apparent to any marketer. And it probably is. But do banks and credit unions do enough in their marketing in this regard? According to a University of Houston study, the answer is no. The study found that payday lenders are more likely to feature people of color on marketing materials, while mainstream banks and credit unions are more likely to feature white customers.

The study notes that, “while African Americans make up roughly 12% of the Texas population, almost 35% of the pictures on payday and title-lender websites were of African American models. … On the other hand, at mainstream banks, almost 30% of the websites did not have a single picture of an African American model. Almost 75% of mainstream banks did not feature a single picture of a Latino individual.”

Although the data is only for one state, nevertheless, for financial marketers, statistics like this show there is a great opportunity to reach a large, untapped segment of the population that is currently being underserved.