Community bank and credit union marketers spend a lot of time and energy trying to figure out the best way to attract Millennials. You can’t blame them. Millennials’ annual spending power is expected to surpass Baby Boomers by 2018. That doesn’t mean it’s time to overlook Boomers.

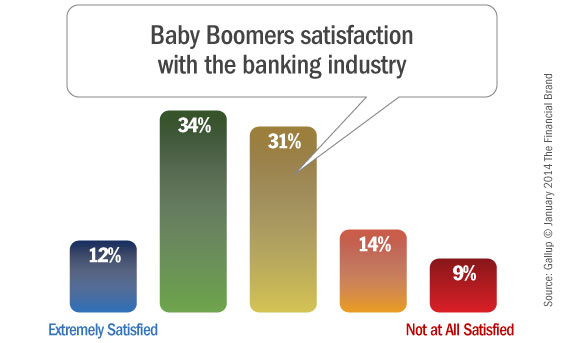

You might think you are doing a pretty good job with the Boomer segment. Think again. According to a recent study published by Gallup, roughly one quarter of all Boomers are unhappy with the banking industry. The study also revealed that 12% are “actively disengaged” with their primary banks. (Gallup defines actively disengaged as “emotionally detached, antagonized and actively seeking out opportunities to tell others about their negative experiences.”) It’s not good.

In the report, “Baby Boomers Put More Money Than Trust in Banks,” Gallup estimates that if banks could convert those disengaged customers to fully engaged it could yield industry-wide growth of nearly $82 billion in deposits and a whopping $443 billion in investable assets. There are clearly opportunities to address critical service gaps and adjust your communications strategy to better reach this large and lucrative segment.

Fractional Marketing for Financial Brands

Services that scale with you.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Who They Are? Think Beyond Stereotypes

While this is good advice regarding every generational segment in a post-recession economy, it is especially true for Boomers. If current marketing collateral is any indicator, bank marketers carry many misconceptions about Boomers.

According to AARP, an American turns 50 once every 7 seconds. Well known celebrities like Sandra Bullock and Robe Lowe turn 50 this year, Oprah Winfrey and Jerry Seinfeld turn 60. A growing number of prominent figures over 50 project an image that reflects a high value on youth and freedom. Boomers are making 50+ look better than ever.

What do Boomers value?

- Individual

- Choices

- Prosperity

- Ownership

- Self Empowerment

- Experimentation

- Community Involvement

Boomers are often separated into two camps: the first (born 1946 to 1955), who shaped the cultural change of the 1960s; and the second (born 1956 to 1964), who came of age during the post-Watergate era. Together they make up 25% of the U.S. population with approximately 75 million people. There are important, often subtle, nuances separating the two camps, but collectively they are redefining aging. They are leading adoption of technology and consumption of media. Most importantly, they are doing everything on their own terms.

What Boomers Need

Boomers are under-funded for retirement. Charles Schwab says that 60% of Boomers have less than $100,000 saved for retirement, and 36% have less than $10,000. Yet other studies also reveal that Boomers plan to work well past 65 — one in 10 think they’ll never stop working — and not just out of economic necessity.

Boomers have greater credit quality and purchasing power. So, in addition to having a robust program to help Boomers plan for, and navigate their retirement, financial institutions should look at the following:

- Auto loans – The oldest of the Boomers has become the cohort most likely to buy a new car, replacing the 35-to-44 year old age group from just five years ago. They are working longer, they are buying cars longer – and, for Boomers, cars still represent freedom, youth and individuality.

- Home equity for home improvement – Boomers own more home value than other generations and while selling existing homes may still seem risky to them, home renovations may be the responsible alternative.

- Small business – Entrepreneurs age 55 to 64 launched 21% of new business formation in 2011. More than ¼ of those self-employed in the U.S. are 65 or older according to data from the U.S. Bureau of Labor Statistics, and that trend is expected to continue.

Take the time to look closely at the Boomer segments among your customer base and within your market and go through the exercise of identifying your product and service gaps.

How To Engage Boomers

Engagement implies that marketers must stop looking at their Boomer customers/members as passive receivers of messages. The economic melt-down altered how many view bankers in general, and financial planners in particular. Boomers expect interactivity and communication; and it cannot just be a one-way path.

Market to their state of mind. Like with any demographic segment, you have to become familiar with psychological and emotional elements of the Boomer lifestage. Boomers are older; they are not old. For the youngest of them, 50 isn’t the new 30, it is the new 50. The recession may have left them at a financial low, but they want to look good, live longer…and live younger. Talk to your customers and you’ll discover:

- They’re looking for new experiences and expect their banks to keep up with the times.

- They are not brand loyal. They grew up in a time of freedom and experimentation.

- They expect you to know who they are. Personalize across all channels.

- They are active in social media. You should be too.

- They are active, on-the-go. Streamline your customer experience – in person, online, or by phone.

Take another look at your marketing collateral and make sure you aren’t marketing to Boomers with the same images and language you used with their parents. And please make sure to replace terms like “seniors”, “golden years”, etc., with age-neutral language.

Optimize your website for mobile and tablet use. 71% of Boomers bank online at least once per week, and their use of smart phones and mobile technologies will grow exponentially over the next few years. According to Google’s mobile banking trends report consumers have almost zero patience for a web site that is not optimized for mobile. The report found:

- 40% of consumers will move to a competitor’s site if yours is not mobile optimized;

- 48% become frustrated and feel you do not value their business when a site does not work well on a mobile devise;

- 1 in 6 people said a poor mobile experience prompted them to switch financial institutions.

BusinessWire’s survey of the best mobile optimized bank web sites included large money center banks such as Chase, Bank of America, BB&T and Well Fargo. What makes these sites winners time and again are their functionality, ease of use, security/privacy and quality & availability.

Remember mobile marketing. Boomers are a huge, barely tapped segment for mobile marketing. Technology has given Boomers the support they need for their on-the-go lifestyles. In the past three years, their use of mobile has rocketed with social networking up 1,113%, product information searches up 567% and listening to music, up 266% . Their growing comfort with the technology is an open invitation for digital marketers.

Actively support referrals. Word of mouth is the top influencer for Boomers purchase of financial products – and if Boomers don’t trust you, they won’t share you with their friends and family.

As a proud and feisty member of the Boomer generation, and as a self-determined business owner, I invite readers to remember that this information is offered simply as an introduction to this generation, not a specific profile of every segment within it. A “one size” marketing approach never fits everyone. What works for me wouldn’t necessarily work for a 65-year-old woman living in a condominium raising her grandson. Know your market and test your messaging. Customer segmentation is still the best way to determine how to deliver the right message, to the right customer, through the right channel, at the right time.