“Rarely is throwing money at a problem the best way to overcome it. And never is that truer than in developing a differentiating experience for customers or members of financial institutions.”

That observation comes from a new report from software company Total Expert that explores customer experience maturity, comparing industry leaders with CX laggards. Ultimately, the message the company is trying to impart is that it takes banks and credit unions thinking creatively to solve their problems — especially smaller, community institutions.

Total Expert surveyed over 200 executives in the banking industry to find out how they are working to improve their customer experience model. Those surveyed came from a mix of banks (56%) and credit unions (41%). Another 3% came from other types of institutions. 22% of the respondents came from institutions with less than $500 million in assets, while 60% had assets greater than $1 billion — and almost a fifth (18%) were in between.

Read More:

- Why Many Bank Innovation Efforts Fizzle (And How to Change That)

- What Does Banking Need More: Customer Experience or Product Innovation?

The Five Stages of CX Maturity

Given the rapid infusion of fast-evolving marketing technologies, financial institutions aren’t all moving at the same speed. Some banks and credit unions are behind the curve in terms of their use of customer experience tools, while others are rolling out new tech and features.

Although there aren’t universal metrics for determining where financial institutions are in this journey, Total Expert took a stab at categorizing them, breaking banks and credit unions into the following segments:

Banks by asset size in each category

| wdt_ID | Segments | Less than $500 million | $500 million-$1 billion | More than $1 billion |

|---|---|---|---|---|

| 1 | Starters | 10% | 0% | 1% |

| 2 | Managers | 25% | 39% | 28% |

| 3 | Achievers | 45% | 26% | 52% |

| 4 | Accelerators | 15% | 30% | 18% |

| 5 | Leaders | 4% | 5% | 1% |

Credit unions by asset size in each category

| wdt_ID | Segments | Less than $500 million | $500 million-$1 billion | More than $1 billion |

|---|---|---|---|---|

| 1 | Starters | 0% | 7% | 0% |

| 2 | Managers | 39% | 14% | 17% |

| 3 | Achievers | 44% | 36% | 50% |

| 4 | Accelerators | 13% | 43% | 29% |

| 5 | Leaders | 4% | 0% | 4% |

Starter

Although very few marketing teams reside in this stage — which is the beginning of the tech journey — there are a few banks and credit unions that are still new to the dialogue. These institutions are working with limited data and don’t have a team dedicated to working with customer experience. Their messaging is often very generalized and not distributed by customer segments.

Manager

Institutions in the Manager category — second largest behind Achievers — are more adept than Starters at getting feedback from customers. They have begun to segment their customers demographically. Manager institutions are starting to develop an enhanced multichannel engagement that can target customers individually.

Achiever

This middle ground, Achiever, is where the great majority of banks and credit unions lie. Automation starts to kick in as the institution weaves CRM data into its digital banking plan. The customer experience is greatly improved from the two previous stages as the financial institution spends time on regularly conducting feedback surveys and incorporating the results.

Accelerator

If a financial institution is in one of the last three stages, they are likely piggybacking on the concepts and technologies that innovative banking providers have already established and tried out on customers. Institutions in the Accelerator space are starting to get more creative with their automation technology as they construct customer personas based on the data they are gathering.

Listen In: Unleashing Robotic Automation for Growth

Leader

While there are a few more institutions that are in this Leaders stage than in the Starters stage, very few banks and credit unions reside here. Banking providers in the Leaders category already have a filled-out CRM system with customized 1-to-1 omni-channel experiences and technology.

Don’t Underestimate the Small Players:

Larger banks and credit unions inevitably have more resources, which can help in the technology race. However, smaller financial institutions are showing they can hold their own, despite constraints of lower budgets and fewer team members.

Going From a Starter to a Leader

Regardless of which category they are in, banking providers can easily scale their operations to meet the expectations of an “Accelerator” or, better yet, a “Leader”. And it should start with three major steps.

1. Quickly Deploy New CX Technology

The importance of technology to the banking industry was foretold back in the 1960s when Intel Co-Founder Gordon Moore introduced his theory — eventually coined “Moore’s Law” — that the evolution of technology would double every two years (more technically, his theory was based on the number of transistors in a computer’s integrated circuit). In many ways, his prediction has come true.

Leaders in the banking industry recognize this and many are trying to adapt. Total Expert’s report found that four out of five respondents are working to implement new technology, 73% are tying new processes into their infrastructure and over half (51%) are partnering up with fintechs to build out their technology stacks. Almost one out of two (48%) are establishing new team roles specifically to support a digital customer experience.

Some institutions may argue that the cost is not justifiable — how does one build a budget around new technology if it is evolving so quickly that it costs more to upgrade than just see what comes out next?

While a valid question, the report finds that investing in the right technology now still has a pay-off if the budget is centered around retaining existing customers. For instance, the report found that acquiring new customers can cost up to five times more than retaining current customers. And investing in ways to keep even just 2% of customers equates to as much as a 10% cost reduction.

Major Savings:

It’s important to look to the future and the next segment of customers. However, onboarding new customers is as much as five times more costly than keeping existing customers happy.

Whereas Starters are slowly chipping away at implementing new technology, adding new processes and procedures as well as partnering (and not adding new roles focused on customer experience), 100% of Leaders found the technology and new processes a key method for success, and 83% say it’s critical to add new team members.

2. Spend Time on Data To Figure Out Personalization

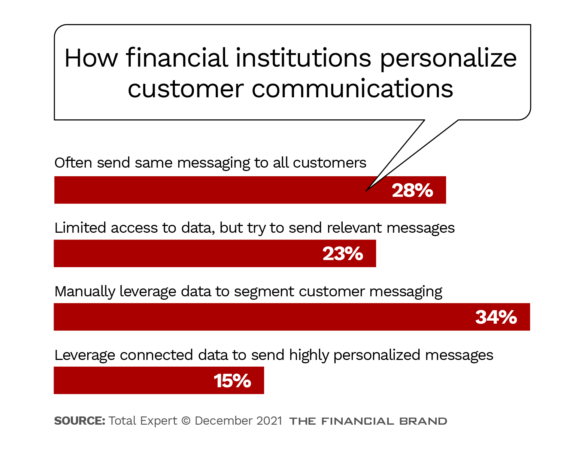

Messaging is a key method for getting customers the banking information they need, but there are still many institutions that mass distribute the same text messages to consumers without a personalized touch.

The individualized element is crucial. People get easily frustrated by marketing communications that lack relevance to their financial situation. They benefit from messaging that helps them better understand their finances.

Yet, all of this is difficult if banks and credit unions haven’t used consumer data to create customer personas. Total Expert even goes on to say that it is, by far, the “single greatest challenge facing financial institutions upgrading member-customer experience.”

3. Upgrade Customer Engagement Infrastructure

Lastly, one of the best ways for financial institutions to level-up consumer journeys is to find unique ways of engaging people. However, the Starters in the banking industry are failing to take these steps. Total Expert found that 0% of Starters “have customer engagement strategies in place,” and even at the next level, over half (56%) of Managers are not maximizing their customer engagement strategies.

Examples of customer engagement strategies that the report cites are notifying customers of low online and mobile banking usage, low debit/credit card transaction volume, online application abandonment as well as account fraud notifications. The Accelerators and Leaders in the financial world have already built all these push notifications into their banking apps.