This annual comprehensive scan of the marketing landscape in retail banking reveals financial marketers’ strategies, priorities and challenges in 2014.

2014 marks the fourth year The Financial Brand has fielded its annual “State of Marketing in Retail Banking” study, and the second that research was conducted in partnership with Aité Senior Analyst Ron Shevlin.

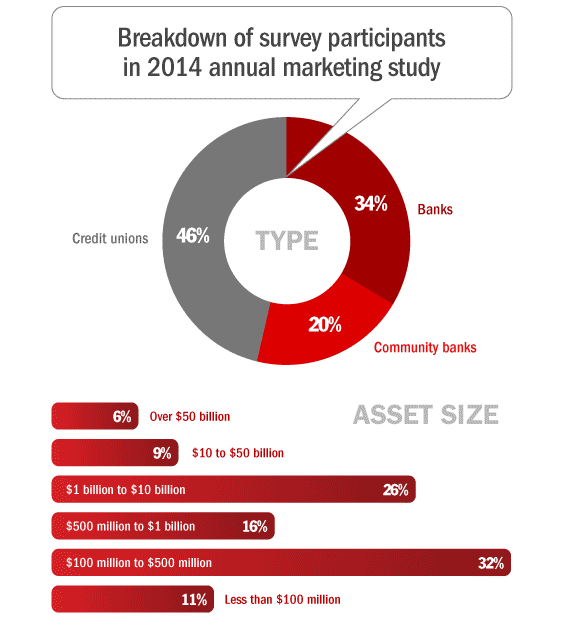

Roughly 300 financial institutions from around the world took the annual marketing survey this year — 54% banks and 46% credit unions. Nearly 3 out of every 4 hailed from the United States, but we also saw responses from Canada (8%), Europe (7%), Australia (4%) among other countries.

Those who completed this year’s survey will receive a complimentary copy of the “2014 Retail Bank & Credit Union Marketing Trends Report,” along with a complimentary copy of the Aité Group report based on the mobile strategy section — a bundle of insights worth thousands of dollars.

Also, those who attend The Financial Brand Forum 2014 will receive the “2014 Retail Bank & Credit Union Marketing Trends Report.”

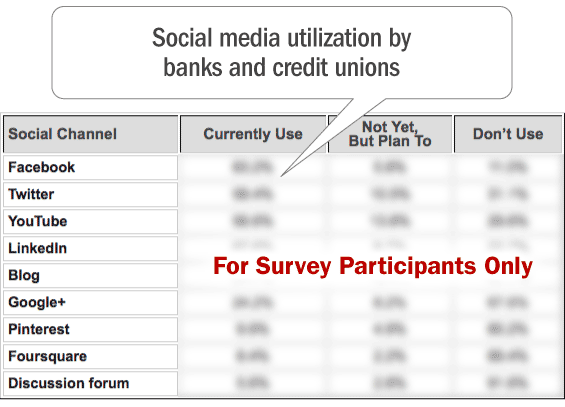

Note: We’ve obscured some charts and tables. These are available only to survey respondents. Why? Because we need more participants in the study. Nearly 1 million people read The Financial Brand, and yet only 300 took this year’s survey — even though the data benefits everyone, and everyone wants to see it. In subsequent years, more and more of the survey’s results will be unreleased. The bottom line? If you don’t take the survey, you’re not going to see the results. But if you take the survey, you’ll get a robust report analyzing the data at a deeper level than what you see here in this article, including year-over-year trends and comparisons.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Financial Marketers Face Regulatory Burdens as Their To-Do List Grows

Every year, marketers say their #1 problem is insufficient budgets and/or manpower. No change there: 33.8% cited this as a “major challenge” in 2013, up ever so slightly to 34.0% this year.

In 2013, financial marketers ranked “regulatory and compliance” issues as their ninth biggest challenge. This year, it’s jumped straight up to #3, with nearly 50% more citing it as a “major challenge” than in the year prior.

Similarly, financial marketers are more concerned that their institution is taking on too many initiatives in 2014. They ranked this as their #7 most significant challenge in 2013, whereas this year it’s the #2 thing that’s troubling them most.

Generally speaking, financial marketers remain comfortable with managing social media and achieving brand clarity. Very few believe that the lack of consumer trust in the banking industry is a serious concern, and almost no one is worried about their rates and fees.

| What marketing challenges will you face in 2014? |

Major Challenge |

Minor Challenge |

Not a Challenge |

|---|---|---|---|

| Insufficient budget(s) and/or manpower | 34.0% | 45.4% | 20.6% |

| We have too many initiatives | 32.3% | 46.8% | 20.9% |

| Regulation and compliance issues | 31.2% | 47.7% | 21.1% |

| Difficulty measuring performance and/or proving results (ROI) |

30.8% | 57.4% | 11.8% |

| We are risk adverse and/or slow to adopt new ideas |

29.8% | 39.2% | 31.1% |

| Limited data analytics tools/capabilities | 28.2% | 51.7% | 20.2% |

| Our I.T. infrastructure is inflexible and limiting | 28.0% | 47.5% | 24.6% |

| Takes too long to make decisions internally | 25.9% | 47.0% | 27.1% |

| Silos | 24.3% | 41.7% | 34.0% |

| We have inadequate MCIF/CRM database(s) | 23.9% | 39.3% | 36.8% |

| Getting employee support for marketing/branding/sales initiatives |

18.2% | 53.4% | 28.4% |

| Our brand is ill-defined or lacking differentiation | 17.0% | 43.6% | 39.4% |

| Figuring out social media | 16.5% | 50.4% | 33.1% |

| Lack of senior management buy-in and/or support for marketing/branding initiatives |

9.3% | 33.9% | 56.8% |

| The lack of trust in the financial industry | 6.8% | 36.3% | 57.0% |

| Our rates/fees/products aren’t competitive | 4.6% | 42.0% | 53.4% |

Marketing Budgets Are Increasing, But Not As Much As Last Year

The average increase to marketing budgets in 2013 was 12.7%, dropping significantly to 8.0% this year. Meanwhile, the median increase in marketing budgets also dropped — from 6.7% last year to 4.9% in 2014. Over two thirds of financial institutions increased their budgets in 2013, but only 3 in 5 are doing so in 2014.

| % | Budget Changes in 2013 | Cut in 2014 |

No Change in 2014 |

Increased in 2014 |

|---|---|---|---|---|

| 22.2% | Cut in 2013, then… | 13.3% | 10.0% | 76.7% |

| 10.4% | No change in 2013, then… | 14.3% | 35.7% | 50.0% |

| 67.4% | Increased in 2013, then… | 18.7% | 23.1% | 58.2% |

Top 3 Strategic Marketing Priorities

Survey participants were asked to rank their top three marketing priorities over the next 12-24 months. The data in the table signifies the number of respondents who ranked that priority either #1, #2 or #3 on their list. Two years ago, “loan growth” was #2 on the list, but it’s been in the top spot for the last two years. In 2013, no one wanted deposits; this year, everyone wants them. Last year, only 3.1% of financial institutions said their top priority was “expanding/growing new markets,” but that number shot up significantly in 2014, with one in five institution’s ranking now it #1. At the bottom of the list? Reducing customer attrition.

Most Critical Products & Services to Promote in 2014

In the survey, this question presented respondents with a randomized list of financial products and services, asking them to check those that their bank/credit union will concentrate on promoting most heavily in the next 12-24 months.

Even though financial marketers cite “loan growth” as their most important strategic goal this year, they rank “mobile banking solutions” as the most critical thing to push (69% in 2014 vs. 63% in 2013).

Comparing 2014 to last year, auto loans fell two spots in the list, as did credit cards. Fee-based checking accounts, savings accounts and term deposits all rose a couple spots over their 2013 rankings.

For the second year in a row, prepaid cards came in dead last, and PFM is still not a priority for most institutions.

| Rank | Product or Service | % |

|---|---|---|

| 1 | Mobile banking solutions | 68.9% |

| 2 | Mortgage loans/refinancing | 67.3% |

| 3 | Home equity loans/lines | 50.6% |

| 4 | Auto loans/refinancing | 50.6% |

| 5 | Online banking/bill pay | 48.2% |

| 6 | Business lending | 46.6% |

| 7 | Credit cards | 43.8% |

| 8 | Business banking services | 43.8% |

| 9 | Free checking accounts | 38.3% |

| 10 | Financial education | 25.5% |

| 11 | Checking accounts (fee-based) | 20.7% |

| 12 | Retirement products | 16.7% |

| 13 | Interest checking accounts | 16.3% |

| 14 | Savings accounts | 14.7% |

| 15 | Youth/kids accounts | 14.3% |

| 16 | Certificates/term deposits | 13.9% |

| 17 | Other non-interest income services | 13.2% |

| 18 | PFM | 12.8% |

| 19 | Prepaid cards | 6.0% |

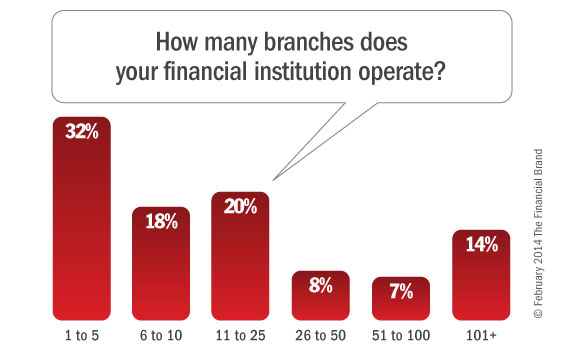

Branches

Most of the survey’s participants have modest branch networks. Half have ten or fewer. But many plan on opening more branches in the future. None of the respondents said they would be “closing many branches” in 2014.

Measuring Marketing ROI & Performance

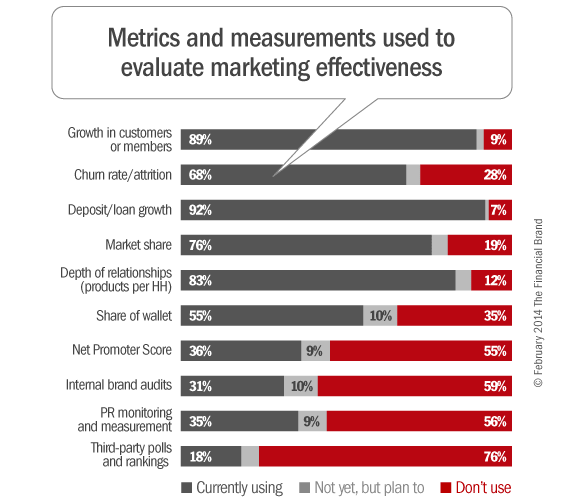

Nearly all financial institutions use deposit growth and loan volume to gauge the effectiveness of their marketing efforts, although a surprising 7% admit they don’t use that metric. Nearly 9 out of 10 respondents said they monitor growth in their customers (or members). The third most-common metric bank and credit union marketers look at is depth of relationship” (products or services per consumer/household).

Nearly all financial institutions use deposit growth and loan volume to gauge the effectiveness of their marketing efforts, although a surprising 7% admit they don’t use that metric. Nearly 9 out of 10 respondents said they monitor growth in their customers (or members). The third most-common metric bank and credit union marketers look at is depth of relationship” (products or services per consumer/household).

Very few financial institutions use third-party studies and ranking systems like JD Power, which is understandable because such systems usually only rate the Big Boys.

Fewer than half of all financial marketers use Net Promoter Scores, conduct internal brand audits/assessments, or monitor their PR efforts (assuming they conduct any public relations activities at all).

Tools Used to Build & Manage the Brand

| — Yes — | — No — | Not Yet, But Plan To |

|

|---|---|---|---|

| Brand guidelines/manual or booklet for employees |

48.7% | 31.1% | 20.2% |

| Design guidelines, brand standards manual or style guide |

62.3% | 23.6% | 14.1% |

| New employees receive brand orientation/training |

46.6% | 36.0% | 17.5% |

| On-going/regular brand training for all employees |

31.7% | 47.3% | 21.0% |

Online Channels Thrive While Print Dies

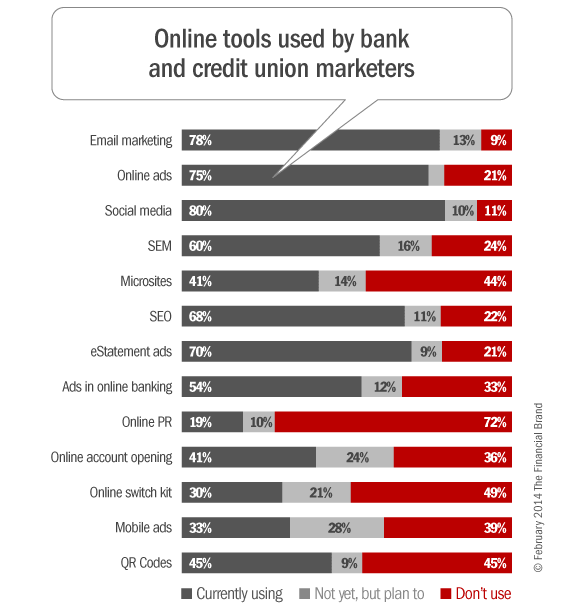

When asked which marketing and media channels will be more or less important in the upcoming year, bank and credit union marketers clearly prioritize online and digital. Roughly 3 out of 4 say online and mobile advertising will be more important in 2014. Social media and email marketing are also rising in importance.

Over one-third of survey participants said print advertising would be less important this year. Same thing for brochures and other in-branch sales collateral. One in six respondents said TV and radio advertising would be less important this year, and an equal number flat out dismiss it as “not important” at all.

Financial marketers see billboards and outdoor advertising as the most useless media channel — 27.3% say it is not an important part of their marketing mix.

Guerilla marketing, database/MCIF marketing and the application of a CRM system have the most financial marketers scratching their heads in 2014.

| Media Channel | More Important |

Less Important |

Not Important |

About the Same |

Not Sure |

|---|---|---|---|---|---|

| Online advertising | 77.8% | 1.6% | 4.1% | 15.0% | 1.6% |

| Mobile advertising/marketing | 71.9% | 1.0% | 6.3% | 14.6% | 6.3% |

| Social media | 65.1% | 2.1% | 5.6% | 23.6% | 3.6% |

| Email marketing | 60.8% | 6.2% | 5.7% | 24.7% | 2.6% |

| Onboarding program | 59.6% | 1.6% | 3.6% | 29.0% | 6.2% |

| Data analytics, big data | 50.8% | 4.7% | 8.8% | 25.9% | 9.8% |

| Database/matrix marketing (MCIF) | 46.6% | 1.6% | 3.7% | 33.5% | 14.7% |

| Guerilla/word-of-mouth campaigns | 43.5% | 4.2% | 8.4% | 34.0% | 10.0% |

| Public relations, community events | 40.8% | 5.2% | 1.6% | 51.3% | 1.1% |

| CRM system | 34.4% | 4.8% | 6.4% | 38.6% | 15.9% |

| In-branch video merchandising | 28.1% | 9.9% | 15.6% | 38.5% | 7.8% |

| Direct mail | 26.6% | 15.6% | 8.3% | 46.4% | 3.1% |

| Incentives/giveaways | 24.9% | 13.0% | 7.8% | 50.3% | 4.2% |

| TV/radio advertising | 22.8% | 16.1% | 16.6% | 42.0% | 2.6% |

| Outdoor/billboard ads | 16.0% | 17.0% | 27.3% | 35.6% | 4.1% |

| Sales collateral and brochures | 13.5% | 24.4% | 2.1% | 56.0% | 4.2% |

| Print advertising | 8.3% | 36.6% | 14.4% | 39.2% | 1.6% |

Utilization of Online Marketing Tools

Adoption of Social Media Channels

The overwhelming majority of financial institutions now have a presence on Facebook. More than half use Twitter and Facebook, and roughly two-thirds are using LinkedIn. A quarter of all respondents say they maintain a blog, and an equal number claim to be using Google+. Less than one in 10 are using Pinterest and Foursquare.

Twitter, YouTube and blogs top the list of social channels that financial marketers aren’t currently using but plan to in 2014.