Traditional financial marketing is often lackluster. Banks and credit unions tend to be a conservative group, running marketing campaigns that stay on the safe side instead of letting loose with an out-of-the-box idea.

Financial marketers want to be creative, but they also don’t want to run the risk of upsetting anyone, whether customers, senior management or regulators. Unfortunately that natural leaning puts these institutions at a disadvantage compared with newer competitors — the digital-savvy fintechs and neobanks that prefer more daring ideas. They aren’t regulated as closely (if at all) and enjoy a significantly greater sense of freedom that seems to fuel creativity.

Additionally, they’re marketing mainly to younger consumers, who are naturally more open to new ideas.

But regardless of the constraints, some banks and credit unions have released truly innovative campaigns. In this gallery, we present a selection of marketing efforts that really stand out, from both traditional and digital-only players. These original ideas include a mini dating show, a clothing line, a masterclass on investing, a documentary and even the famed Dakar Rally.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

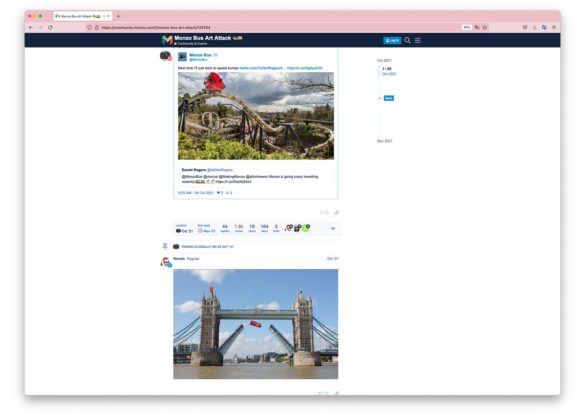

Digital Bank Monzo and the London Bus

Talk about meeting people where they’re at. U.K.-based Monzo added entire buses to its marketing repertoire and it got popular fast.

The buses also got their own Twitter account.

The iconic double-decker buses aren’t the only thing that made the campaign unique, however. To get people to interact with Monzo and its Twitter accounts, the digital bank encouraged people to photoshop the Monzo bus in creative and interesting ways. Whoever submitted the best was featured on the Monzo bus Twitter account.

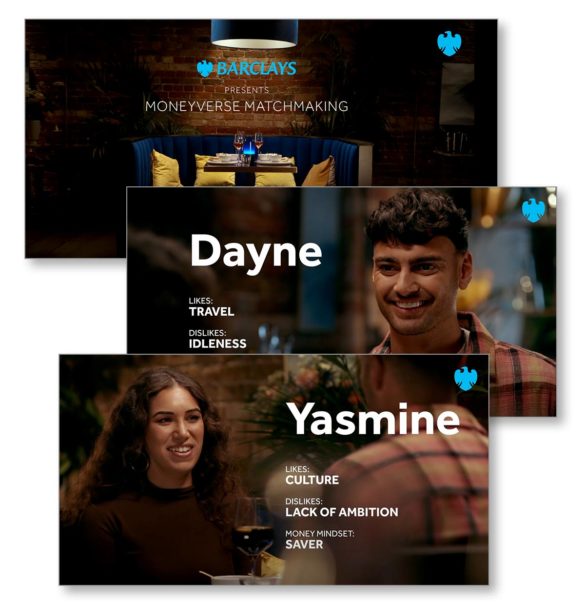

Barclays and ‘Moneyverse Matchmaking’

Barclays Bank U.K. took a different approach to advertising in a video format. Instead of sponsoring a television show, it produced its own mini dating-show, called “Moneyverse Matchmaking.”

This isn’t the only video marketing based on real-life scenarios used by Barclays. In February 2022, it released the first episode of ‘Street Talk.’ In the short video, one of its employees asks people on the street if they knew homebuying terms and what they meant (e.g. ‘stamp tax’ and ‘gazumping,’ a pair of U.K. terms), as part of its financial education programs.

Community First Credit Union’s Mega Coloring Book

Florida’s Community First Credit Union is often open to unique marketing ideas, says Jennifer Forgét, Vice President of Marketing at Austin Williams.

One of those ideas was used during the credit union’s sponsorship of the June 2021 Seawalk Music Festival. They wanted something interactive to involve festivalgoers, and decided on a “massive coloring book,” Forgét says.

“This ginormous coloring book gave people the opportunity to complete the phrase ‘Just Be __________,” Forgét explains. ‘Just Be’ was the name of the marketing campaign Austin Williams designed for Community First. “At night, the coloring book was blacklit — all of the coloring and the crayons were a neon color.”

Read More: In a Risky Move, Credit Union Boldly Touts Itself as a ‘Side Bank’

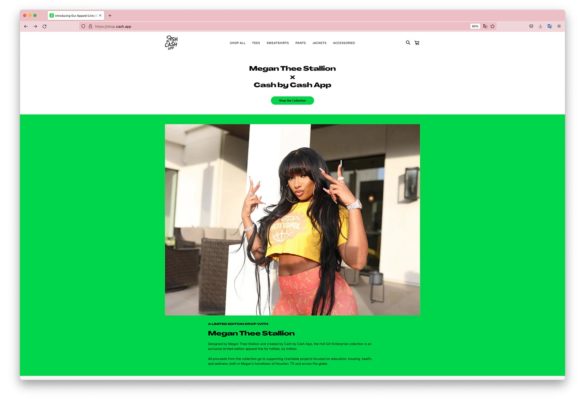

Fintech CashApp’s Clothing Line

If there is a way to win over Gen Z customers, it’s with a trendy clothing line, specifically one that features a partnership with rapper Megan Thee Stallion. That’s the idea Block’s marketing team came up with for its CashApp P2P product.

But, the clothing line isn’t just a set of run-of-the-mill $5 t-shirts with a logo on it. The clothes do have CashApp branding, but are also designed with a younger consumer in mind.

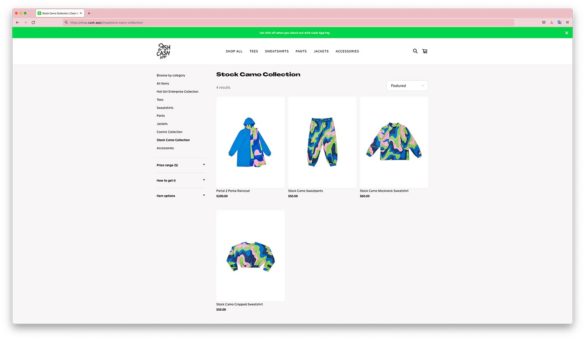

The clothing line features sweatshirts, pants, t-shirts and matching collections, such as the Hot Girl Enterprise Collection (see above), Cosmic Collection and Stock Camo Collection (photo below).

Fintech Abeg and the ‘Big Brother’ Remake

Abeg — a payments company based in Nigeria — didn’t go with just a billboard or a squad of mobile app influencers to get its name out there. Instead, it sponsored the sixth season of Nigeria’s take on the American classic reality television show ‘Big Brother’ — called ‘Big Brother Naija’. The show is the most popular and most-watched reality show in Africa, according to TechCrunch.

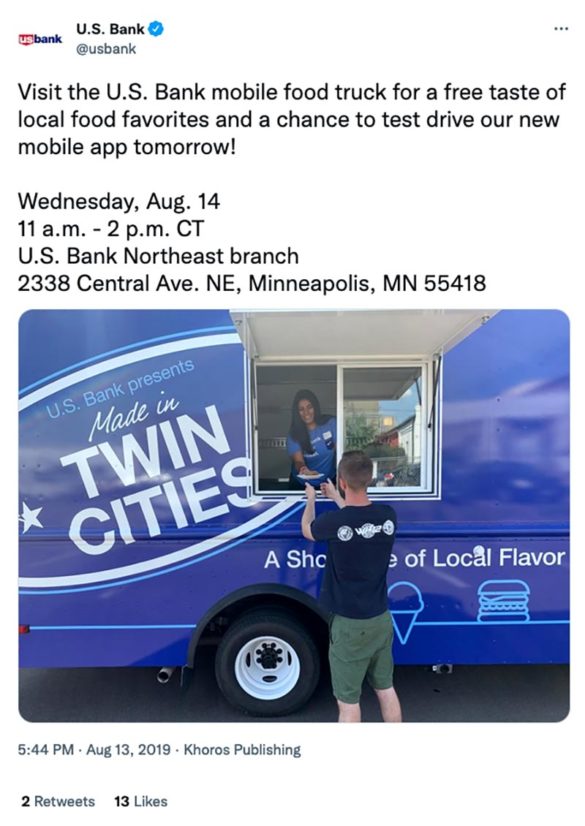

U.S. Bank’s Food Truck and ‘Good Truck’

Before the ‘Good Truck’ was born, U.S. Bank had a food truck — called ‘Made in Arizona’ — which rolled around the Grand Canyon State for several months, featuring food from local restaurants. The big Minneapolis-based bank introduced similar trucks in other markets.

When Covid-19 hit the U.S., the bank quickly turned the food trucks into what it refers to as its ‘Good Truck’ campaign. Before long, there were five Good Trucks around the country, delivering flowers to school staff and free lunches to healthcare workers.

Read More: The Serious Strategy Behind TD Bank’s Funny Brand Ads

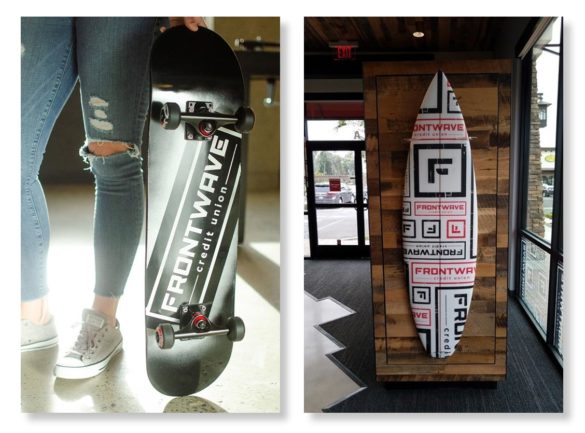

Frontwave Credit Union’s Branded Merch

Getting a novel marketing campaign started doesn’t always take a massive strategy overhaul or a crazy idea. Sometimes, it’s all about finding a fun and new way to interact with people day to day.

Southern California-based Frontwave, in partnership with marketing firm Strum, launched a line of merchandise with the credit union’s name and logo. There were of course shirts and water bottles in their ‘Team Store,’ but there were also handmade skateboards and surfboards — cool stuff for their part of the world.

SoFi’s Big Bet with ‘Sofi Stadium’

Sofi became part of the talk of the town during the 2022 SuperBowl when the Cincinnati Bengals met the Los Angeles Rams in the newly built, state-of-the-art Sofi Stadium, which opened in late September 2020 in Inglewood, Calif.

Other institutions have bought stadium naming rights, but the fintech’s gutsy investment — $625 million for a 20-year contract — paid off big time. The SuperBowl alone justifies the expense. Approximately 112.3 million people watched the event.

Learn More: Why SoFi’s Tech + Bank Deals Could Disrupt Traditional Banking

Unify Financial Credit Union’s Sleek Mobile Branch

UNIFY Financial Credit Union wanted to introduce a mobile branch to its market, but wanted something more than an RV with their name on the side. Design and marketing company Adrenaline took the idea and ran with it.

“We asked Adrenaline to push the envelope, to show us something a little bit different,” says UNIFY’s Corporate Communications Manager Neil Kochan. ” They knocked it out of the park.”

See more: 14 Eye-Catching Mobile Bank Branches

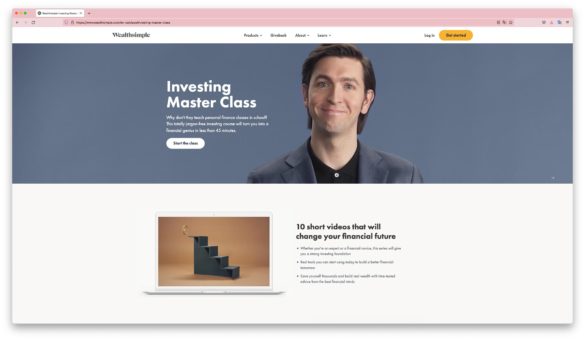

Fintech Wealthsimple’s Magazine and Masterclass

If you need to learn how to cook or how to write your next novel, you can turn to online classroom Masterclass and find expert advice from the best of the best in that industry. There’s a suite of experts teaching classes including Gordon Ramsay, Mariah Carey and even Bill Clinton.

But, there’s not a class specifically for financial health on the Masterclass website. Wealthsimple, the personal investing and wealth management fintech, decided to fill in the gap on its own website.

The fintech’s ten mini-videos dive into the topics of investing, saving, finance automation, financial advising and more.

Wealthsimple doesn’t stop there. It also has its ‘Wealthsimple Magazine’, an online publication that displays articles in a visually-appealing setting (almost as if you’re scrolling through a New Yorker magazine) for anyone to quickly learn how to best invest their money.

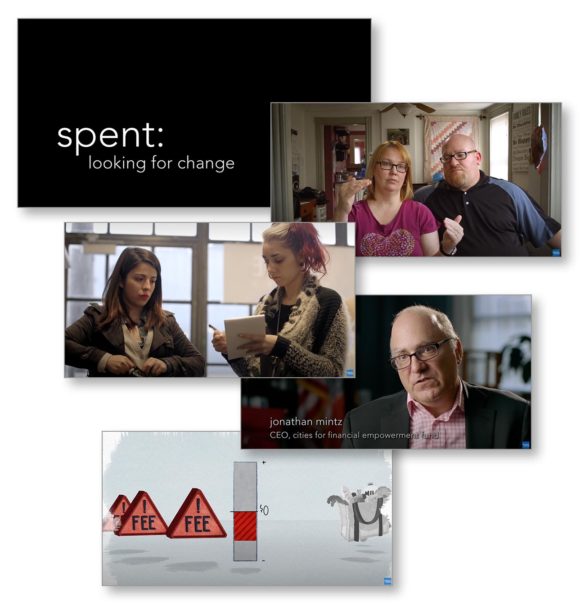

American Express’ 40-Minute Documentary

Not every marketing campaign has to be a one-and-done investment that peters out after six months. Some, like the American Express-produced documentary, “Spent: Looking for Change,” have a strong influence for much longer than that.

The documentary, produced in 2014, has been watched nearly 2 million times and has 11,000 likes.

“Spent: Looking for Change” follows four American families who are living paycheck-to-paycheck. It illustrates the need for a financial system that serves unbanked and underbanked populations who seek out payday loans and pawn shops just to get by.

Few bank marketing departments can tackle their own full-length documentary, but the production (which can be viewed on the Documentary Storm site) demonstrates the scope possible by unconventional thinking. A much more modest effort could be equally effective on the right banking-related topic.

Read more about AmEx: Is AmEx’s Consumer Checking Move Defense, Offense Or Both?

Guerilla Classic: Fintech WePay’s Frozen Block of Money

Back in 2010, WePay shocked the marketing world by dropping a 600lb block of ice with dollars frozen in it at the doorstep of the PayPal conference in San Francisco. It was taking direct aim at customer complaints that PayPal would freeze their money without warning.

Over a decade later, it still resonates among marketers as a brilliant guerilla marketing campaign.

Of course, this isn’t the right choice in every instance. However, getting the attention of customers can sometimes mean being literal and bold.

Fintech ConnectPay’s Global Rally Truck

We’ve talked about mobile branches, food trucks and a bus plastered with the name of a neobank that travels London.

Arguably, ConnectPay’s truck is next-level.

Outside of the United States, the Dakar Rally — an off-roading endurance rally — is a major event. Originally run between Paris and Dakar, Senegal, it is now held all over the world, from South America to the Middle East.

In January 2022, it was held in the Saudi Arabian desert, where fintech ConnectPay finished twelfth with its sharp looking ‘Tatra Jamal’ truck.