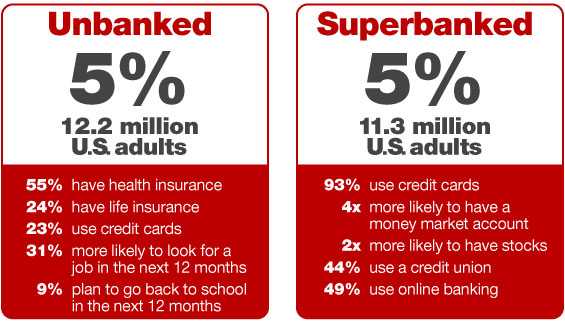

There are almost as many unbanked consumers in the U.S. as there are superbanked. A study from Scarborough Research puts the number of unbanked adults around 12.2 million, or about 5%. The total of superbanked adults is just about the same size, at 11.3 million.

The Scarborough study, “A Look Into Atypical American Banking,” set out to explore the demographics of consumers at the far extremes of either end of the retail banking spectrum: those who don’t use banks at all, and those who use banks a lot.

Scarborough defines unbanked consumers as those who do not use a bank or credit union. Superbanked consumers are considered those who have multiple accounts at financial institutions. More specifically, Scarborough defines superbankers as having a checking, savings, money market account and CD, and at least one of the following: stocks, options, bonds, mutual funds, money market funds, second home, investment property or other similar investments.

You can review Scarborough’s complete “Atypical Banking” study for free at the company’s website.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Who Are The Superbanked?

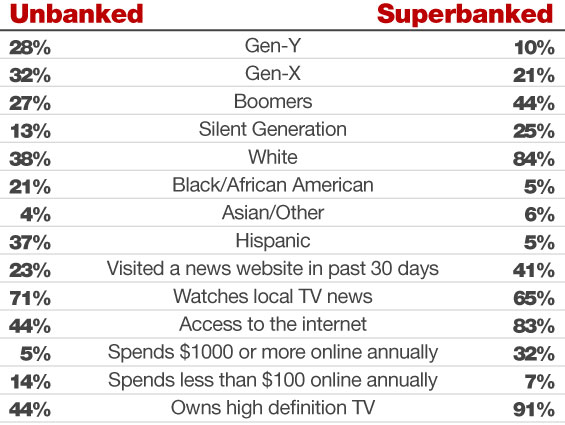

- 93% of superbanked consumers have used any credit card in the past three months. They are 25% more likely than all U.S. adults to do so.

- 75% have a money market account.

- 49% have used online banking in the past 30 days.

- 87% listened to radio in the past week.

- Superbanked consumers are twice as likely to have stocks or stock options and four times as likely to have money market funds.

- 43% of superbanked consumers with annual household income of under $50K are retired.

- 89% own a home.

- They are 64% more likely than all U.S. adults to have at least a college degree.

- Superbanked consumers are 22% more likely to be married.

- The top local markets for superbanked consumers are Fort Myers in Florida (7% of residents live in a household that is superbanked), San Francisco (7%), and Orlando (7%).

Who Are The Unbanked?

- Unbanked consumers are 11% more likely to be women, and 38% more likely to be unmarried.

- 45% of unbanked consumers have children under the age of 18 living in their household.

- 32% belong to Generation X.

- 23% of unbanked consumers have used a credit card in the past three months.

- They are more than twice as likely as all U.S. adults to use a prepaid wireless/cell phone plan.

- 7% used a check cashing service in the past year.

- Unbanked consumers are 94% more likely to watch music videos.

- The markets with the most unbanked consumers are Harlingen in Texas (17%), Fresno (17%) and Memphis (11%).