More proof that PR is overpowering financial advertising messages comes from — of all places — Nielsen, the TV ratings people. Understandably and quite predictably, Nielsen set out to prove that financial institutions would benefit from more advertising.

Their theory was that financial institutions that do not advertise are risking the perception that they have failed or are failing. Their conclusion: “Consumers are more likely to have confidence in financial brands if they see ads for them during the economic downturn.”

Go figure…

Despite the headline they slapped on their research, “Ads Raise Confidence in Ailing Financial Brands,” their findings suggest essentially the opposite.

When asked what factors would increase confidence in the safety and soundness of their financial institution, respondents cited:

- Reading positive stories in the press about that institution (44%)

- Seeing regular advertising for that institution (25%)

- Receiving regular mail or email offers from that institution (25%)

- Regularly seeing internet offers/advertising from that institution (21%)

It looks like PR and positive publicity are about twice as effective as advertising.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

Services that scale with you.

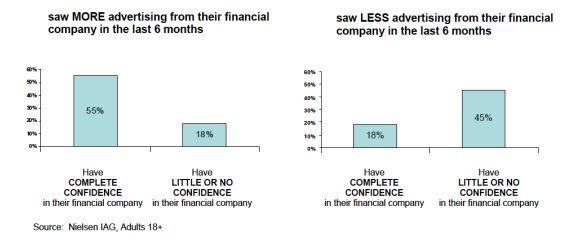

Nielsen draws another interesting conclusion from their research. The study found that “55% of consumers who say they had seen more advertising for their financial institution reported having ‘complete confidence’ in the financial health and soundness of their financial company, while only 18% said they had ‘little or no confidence.'”

The truth is that people are hyper-sensitive to news about financial institutions right now. They are tuned-in. Whereas they may have never noticed an ad from their financial institution(s) before, they now pay attention with keen interest. “What are they saying?” This applies to all media, marketing and communications channels — not just advertising.

Richard Khaleel, an EVP at Nielsen, summed it up this way: “‘Out of sight’ can mean ‘out of business.’ The current economic climate makes it more important than ever for financial institutions to bolster confidence.”

True. But does that mean advertising is the way to go about it?

Key Takeaways:

- People crave more communication from financial institutions, but you should think twice before applying the arguably self-serving advice Nielsen is offering.

- If you think advertising is the answer, then advertising better be your problem.

- People have always responded to ads with skepticism and incredulity. Common sense should tell you that — right now — ads from financial institutions are lacking in credibilty as much as they ever have.

- PR has always overshadowed ads in terms of credibility. But now, it’s more true than it ever was.

Bottom Line: Crank up your PR machine.