Experience is a driving factor for consumers to keep doing business with a company or leave them for another. And not only do poor user experiences lead to attrition, but they also lead to negative reviews that can stick with a company for years.

Many financial institutions are finding this out the hard way as consumers and businesses increasingly rely on digital and self-service channels to conduct their banking. But it’s not too late to start transforming the user experience now. That’s because an NCR survey, conducted by The Harris Poll in February 2021, found most consumers still trust their banks and credit unions with their data more than big techs.

Key Statistic:

86% of U.S. banking consumers say they would be more comfortable with their financial institution having access to their personal data than a big tech company, such as Amazon, Apple or Google.

But how can financial institutions capitalize on that trust and bring forward the best possible user experience in all channels?

The following three tips will position banks and credit unions to win in a world where captivating experiences are critical to driving retention and loyalty.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Tip 1: Make Design a Priority

Design involves understanding people and helping them solve problems. It’s about enhancing the experience consumers have when interacting with a brand or a product to ensure they find value.

When thinking about digital design, financial institutions should be maximizing their data to determine what’s most important to consumers — their challenges, and where they are in their financial journey. And financial institutions should be analyzing that data to determine the features people are using most frequently or may be most likely to use in the future.

Knowing what consumers are doing when they log in to their mobile app every morning is essential to designing for their needs. Consumers should never have to dig for the features they use most. The digital experience should be intuitive, features should be easy to find, and there shouldn’t be obstacles in the way of completing the task at hand.

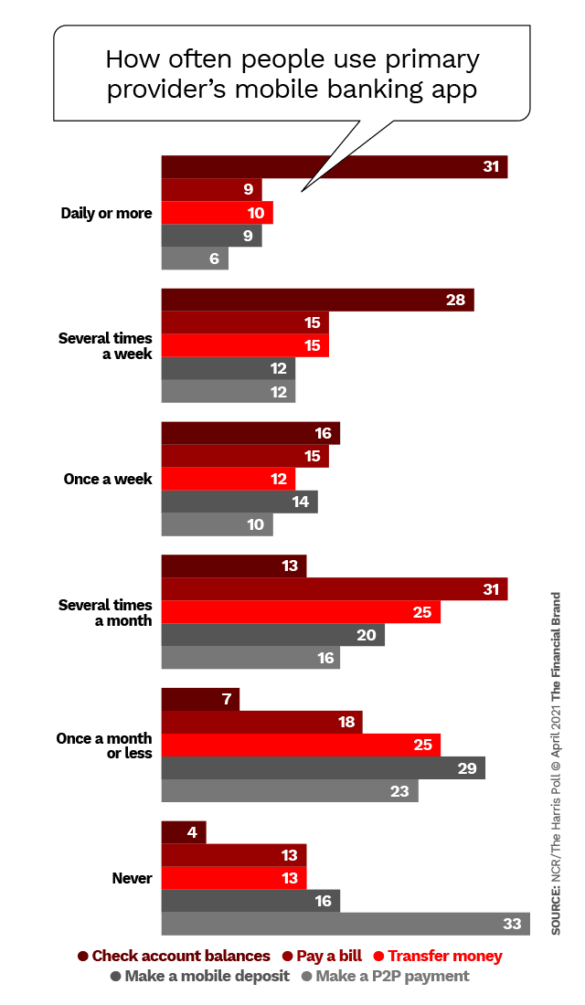

The NCR survey also analyzed what mobile app features U.S. consumers are using most frequently. Not surprisingly, of the five banking activities listed, consumers who use their primary financial institution’s mobile banking app are most often logging in to check their balances, with 59% doing so several times a week up to daily or more.

Additionally, roughly one in four mobile banking app users are logging in several times a week or more to pay a bill (24%) or transfer money (25%), tasks that were reserved for branch visits and paper checks not all that long ago.

Prioritizing the design of the digital experience to make the most frequently used features most prominent will eliminate friction and create happier consumers. Another consideration is to customize design elements by age group. Increasing the size and visibility of buttons and font (especially on mobile) for the 65 and older generation, for instance, can make a huge impact.

This leads to the second point about personalizing the experience.

Tip 2: Personalize the Experience By Customer Segment

As digital and self-service interactions have rapidly increased, so have consumer expectations for personalized interactions, advice and guidance. Financial institutions can no longer deliver the same message or solution to every person if they want them to stick around.

Presenting an incentive to enroll in online statements to a person who already receives them implies the financial institution doesn’t know its consumers. As does displaying imagery of a winter wonderland to a target consumer based in Arizona. In a world where financial institutions have access to an abundance of data on their customers’ or members’ behaviors and habits, these are simply unacceptable experiences.

Equally, marketing the same products and services to every demographic is unwise. Consumers in different stages of their lives or financial relationships are going to have different needs. A high-net-worth individual will have different demands than a college student or a new account holder.

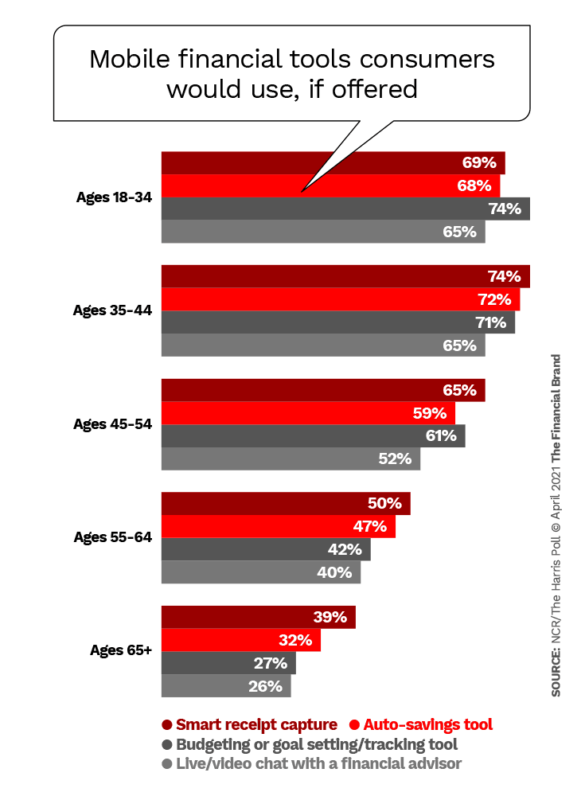

This is where segmentation can be incredibly beneficial in creating the individualized experiences consumers need. Instead of presenting the same experience across their entire user base, imagine delivering a slightly different experience based on demographic information. Not surprisingly, generational differences in what consumers want are significant.

For example, 74% of U.S. banking consumers age 18 to 34 would be very/somewhat likely to use a budgeting or goal-setting tool if their primary financial institution offered it, but only 27% of banking consumers 65 and older say the same, according to the NCR survey.

For the younger age group, it would make perfect sense to actively market the budgeting tool and provide access to it in the primary navigation. But for those 65 and older, it would be advisable to showcase a different product.

With nearly half of U.S. banking consumers (47%) willing to switch to a different primary financial institution that could better anticipate their needs than their current institution, according to the NCR survey, providing personalized experiences is fundamental. Institutions must pay attention to peoples’ generational and life-stage differences to recommend products and provide relevant financial advice based on their unique needs.

Tip 3: Create Consistency and Visibility of Data Across Channels

Consumers don’t think of their banking relationships in terms of channels. They expect a seamless experience regardless of how they interact with their bank or credit union. And financial institutions must recognize the need to reduce friction across all channels and touch points.

As an individual moves from one channel to another — mobile to branch, for instance — the context and history of their engagement need to move with them. Their data shouldn’t be lost if they begin in one channel and end in another. Think of the person who starts an account application online but abandons it before finishing.

That person also shops mortgage rates online but never takes action. The next time that person enters the branch or calls customer service, those data points should be visible to the banker so the banker can better serve the consumer.

When people moves from one channel to another to complete a transaction — starting a mobile cash withdrawal from their mobile device and finishing it at an ATM, for instance — the experience should also be consistent and frictionless. They shouldn’t feel like completely different experiences. As they transition from one channel to another, the next step should be clear, and both channels should have the same look and feel with the same branding.

This past year has been one of rapid change. It’s proven the critical importance of being able to quickly modify user experiences. And it’s intensified the need to accommodate consumer demands and provide consistent and personalized experiences in every channel. This is all part of the shift toward digital-first banking and will require flexible, agile technology to keep up.

Additional Resources:

Accelerate: Insights from NCR

3 Steps to Embracing a Digital-First Approach to Banking

3 Simple Truths to Maximize Your Financial Institution’s Data