Overall customer satisfaction with banks in Canada has declined this year, due largely to irritations caused by fees, according to the J.D. Power & Associates “2012 Canadian Retail Banking Customer Satisfaction Study” released today.

The primary cause of these souring statistics? An increase in changes to fee structures. 27% of customers said they were subjected to fee changes, compared with only 17% in 2011. Overall satisfaction with fees has dropped 4.1% since last year.

Satisfaction Scores Drag Loyalty and Advocacy Down Too

Any decline in satisfaction scores directly impacts loyalty and advocacy metrics, both of which have dropped year over year across Canadian banks. Compared with 2011, advocacy (the percentage of customers who say they will “definitely” recommend their bank to family and friends) had declined by five percentage points, while customer loyalty (the percentage of customers who say they will “definitely” reuse their bank in the future) declined by four percentage points.

Loyalty and advocacy rates were also negatively affected by consumers’ eroding perceptions of their bank’s brand image stemming from concerns over reliability and financial stability.

“Not only are customers frustrated with changes to their fee structure, but many are also confused by the changes, leading to the lower satisfaction,” said Lubo Li, senior director of the financial services practice at J.D. Power. “Banks could try to offset the dissatisfaction with these changes by proactively communicating with their customers and ensuring that they fully understand what the changes are and why they are occurring.”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Impact of Customer Satisfaction on ROI

| High Satis. (800+) |

Med. Satis. (<799) |

Low Satis. (<599) |

|

|---|---|---|---|

| Intended Retention (% definitely will not switch) | 70% | 40% | 15% |

| Intended Advocacy (% definitely will recommend) | 59% | 20% | 5% |

| Intended Loyalty (% defintiely will reuse) | 63% | 27% | 8% |

| Commitment (% high commitment) | 61% | 20% | 4% |

| Number of Products with Primary (mean) | 5.3 | 4.7 | 4.2 |

| Average Share of Deposit Balance with Primary Bank | 86% | 79% | 74% |

| Average Share of Investable Assets with Primary Bank | 69% | 62% | 57% |

| Average Share of Borrowing Accounts with Primary Bank | 68% | 61% | 55% |

Investment Advisors Can Boost Overall Satisfaction

Financial advisors, included for the first time in J.D. Power’s 2012 study, may have positively impact overall satisfaction. Using J.D. Power’s scoring system, satisfaction levels average 735 when no advisor is assigned. But this score jumps to 824 when the advice provided by a financial advisor completely meets customers’ needs (and plummets to 700 when a financial advisor provides advice that only partially meets their needs). Customer satisfaction declines even further to 585 when the advice does not meet their needs at all.

“Offering assigned financial advisors is a risk, but one that pays off with highly satisfied customers if the advisor takes the time to fully understand and address the needs of customers,” said Li. “If the right personnel are not on staff, it may be better not assigning anyone.”

Study Which Banks Are Strong, Which Are Weak and Where

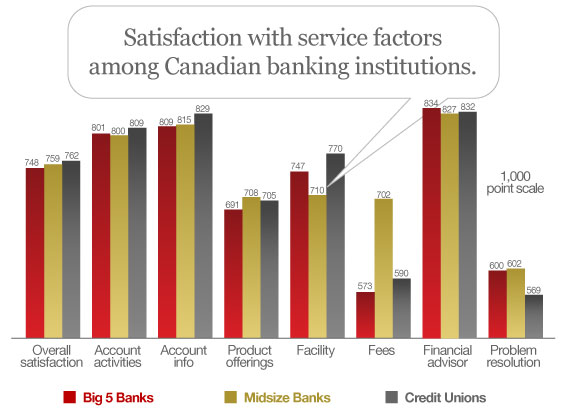

The J.D. Power study, now in its seventh year, examines customer satisfaction with their primary financial institution in three segments:

- Big 5 Banks,

- Midsize banks

- Credit unions

In all segments, customer satisfaction is measured across seven factors (listed in order of importance):

- Account activities

- Account information

- Facilities

- Product offerings

- Fees

- Financial advisor

- Problem resolution

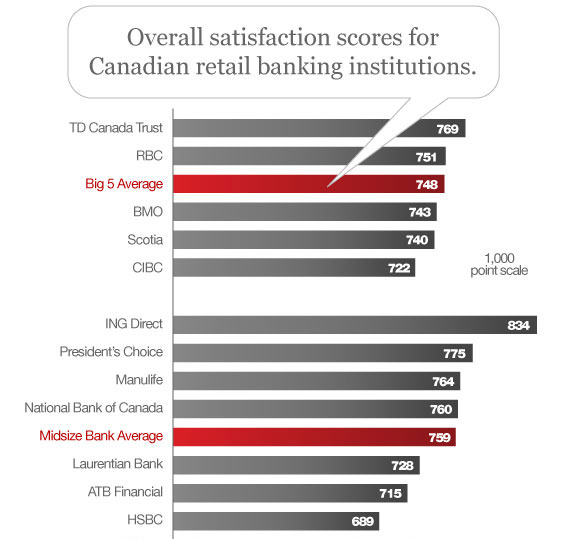

TD Canada Trust ranked highest in overall customer satisfaction among Big 5 Banks for a seventh consecutive year, achieving a score of 769. TD Canada Trust performs well in all seven factors.

Among midsize banks, ING Direct Canada ranked highest in overall customer satisfaction with a score of 834. ING Direct Canada performs particularly well in four out of seven factors: fees, account information, account activities and product offerings. ING Direct is the dominant online banking brand in Canada.