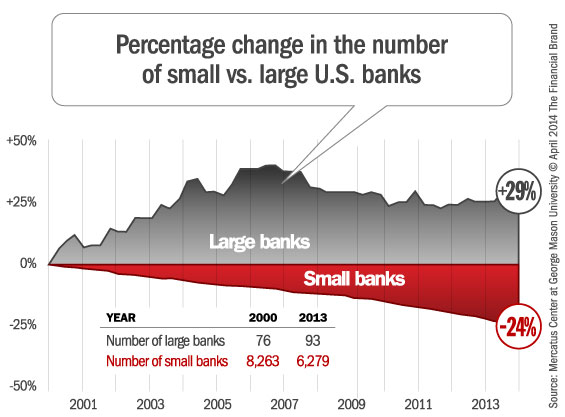

Anxiety is running high, and questions about the future of smaller banks and credit unions come up nearly every day at conferences and in board rooms around the country. The graph below, from The Mercatus Center at George Mason University, illustrates that the concern is warranted. The number of small banks (those with $10 billion or less in assets.) in the U.S., their share of banking assets, and their deposits have all declined substantially since 2000.

An FDIC report, Community Banks Remain Resilient Amid Industry Consolidations, focused on institutions with assets between $100 million and $10 billion. The institutions facing the most immediate pressure from tougher regulation, higher capital requirements, aggressive competition for deposits and loans, etc., are those with less than $500 million in assets — banks and credit unions alike.

Most of these studies point to historic data as sobering evidence of the future challenges facing small institutions. Others cite the economic and operational impact of the new regulatory environment as the primary cause for concern. But there are forward-looking factors — demographics, urbanization, consolidation, competition, etc.) that must also be considered if smaller institutions will reverse this path of decline. Two of those factors — demographics and urbanization — will have an undeniable impact.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Demographics & Urbanization

Markets large and small are experiencing demographic changes. Shifts in variables such as age, ethnicity and employment status can drastically alter a market profile, and an institution’s prospects for ongoing profitability. Small banks need to be especially troubled by the aging population.

In 2012, an estimated 43 million Americans were 65 or older. Approximately 10,000 Baby Boomers will turn 65 every single day for the next 16 years. By 2030, over 72 million Boomers are projected to represent 19-20% of the total population. Why is this important?

On the one hand, this may seem to be an opportunity for small banks and credit unions. After all, the customer experience delivered by most small institutions is generally aligned with the needs and preferences of the Silent Generation and Baby Boomer segments. On the other hand, it is important to remember that every customer segment has different priorities, expectations and lifetime value. Customers 65 years of age or older have migrated from asset accumulation to asset depletion. While they may hold higher deposit balances, their need for loans, credit cards, etc. diminishes. They become less profitable. Moreover, small institutions are already starting to feel the impact of long-time, loyal older customers dying and their accounts transferring to children and grandchildren in other parts of the country.

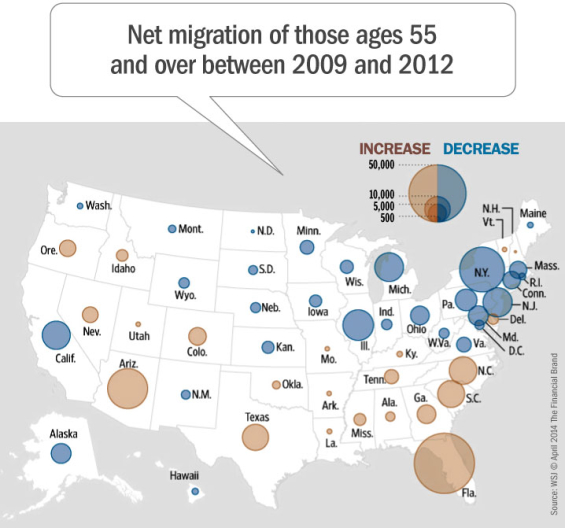

These issues become even more important when you factor in urbanization – the increase in population in cities and towns versus rural areas. As younger customers migrate to urban areas for employment or educational opportunities, small town/rural communities end up with a disproportionate percentage of the older population. This trend is exacerbated by the migration of older adults to smaller communities where cost of living is less.

Census data shows that in recent years, older Americans have been moving from pricier areas in the Northeast and California to cheaper climes, such as Florida, Arizona and the Carolinas. There is already a disproportionate percentage of credit union and small bank customers concentrated in small town/rural and small metro markets. The net result of these migration patterns is the shrinking base of profitable customers.

Evolve… or Die

Will small banks and credit unions survive? Yes. There will be fewer of them as consolidation continues, but they won’t disappear. But their survival hinges on how successfully they evolve. Business as usual is not a viable strategy, as margin compression erodes profits and attrition shrinks the customer base. The mantra must be: Evolve or die! Community institutions must be nimble in their response to these challenges, continually adjusting and refining their growth strategies to reflect market realities.

In the short-term, small banks and credit unions must become hyper-local; leveraging a comprehensive understanding of your local market and your customer to offer the customer experience and suite of products that is aligned with your unique profitable customer segments.

Earlier this year, digital marketing agency iCrossing was tapped by TDBank to develop a campaign that emphasized the bank’s commitment to local and personalized banking. The video content created for the campaign was hosted by individual store managers and contained footage from inside the location and the community around it. This brief video below explains how they did it.

But thinking at the hyper-local level isn’t just for big banks with big budgets. Take Rock Valley Credit Union in Rockford, Illinois, a working class town of approximately 150,000 about 75 miles northwest of Chicago. Rock Valley designed a term loan for elective or cosmetic surgery (i.e.: liposuction, bariatric surgery, hair transplants, etc.).

They realized the demographics in their area were changing; the population was aging, so the credit union responded to a demand in the market with a product that would help members avoid paying for these procedures using high interest rate credit cards. Would this work in every community? Of course not. But it was consistent with the needs/preferences of their market.

Now in the long term, small institutions need to practice the “Three R’s”: Research, Refine and Reposition.

Step 1: Research Your Markets

Every day, every decision you make, every dollar you allocate, must be rooted in the fundamentals of your market. And in many cases, those markets have shifted exponentially since 2008. Consider assessing the following market characteristics:

- Long term trajectory of your markets

- The degree to which urbanization may be eroding (or growing) your markets,

- Whether and where jobs are being created or lost

- How age (older or younger) may be changing your channel usage patterns

- What your competitive climate will look like in five years

Step 2: Refine

After having done the research, ask yourself what needs to be changed (refined). Look at your products, your processes, your branch network and evaluate what must evolve.

- Has your target audience changed given changes in your markets?

- Does your message need to be modified given these changes?

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Step 3: Reposition

You need to routinely reposition yourself to ensure that you’re playing your best hand. If you are in a rustbelt community in the Midwest, that may mean marketing the products and services that help customers rebuild their financial lives after a painful recession and slow recovery — speaking directly to their unmet emotional needs about how to move forward. If you are in a high tech community like the Silicon Valley, or Raleigh-Durham, or Austin, you may need to speak to more aspirational needs.

The way small banks and credit unions will survive (and perhaps thrive) is to continually deploy the 3 steps outlined here; recognizing that it is a journey, not a destination. Your ability to move swiftly on these 3 steps and to be agile in making needed adjustments is key to survival.

Final Note

The quote that opened this article was taken from remarks by George W. Mitchell, member of the Board of Governors of the Federal Reserve System… on March 14, 1966! So as you can see, the survival of small bank/credit union has been the subject of debate for a very long time. The challenges may seem greater, and the stakes may in fact be higher. But even the smallest banks in the smallest communities can find ways to move forward and prevail.