A few banking institutions have adopted “cause-based marketing” — aligning themselves to various degrees with groups involved in social causes. Aspiration Financial, by contrast, is more like a social cause — or a group of them — aligned to financial services. The company has an attraction to socially conscious consumers, frequently under 35, who also appreciate a good deal.

“These are people who are thinking about values, morals and ethics in all aspects of their lives as consumers, whether it’s buying a cup of coffee or a car, or signing up for an account with a financial institution,” says Andrei Cherny, Co-Founder and CEO of the company. “We’ve created a category around ‘socially conscious consumer finance’.”

Aspiration offers consumers a three-fold appeal.

First, get better than average returns. Second, say goodbye to common annoyance fees. And third, do all of that while secure in the knowledge that your money is not being used to fund anything to do with fossil fuels, and with the knowledge that Aspiration donates 10% of revenue to charitable causes. One of these is the Aspiration Opportunity Fund, which backs microloans of up to $5,000.

Consumers holding Aspiration deposit accounts or mutual fund shares are also invited to contribute to a range of causes, as well, from an anti-poverty fund to a water conservation fund to health aid and research.

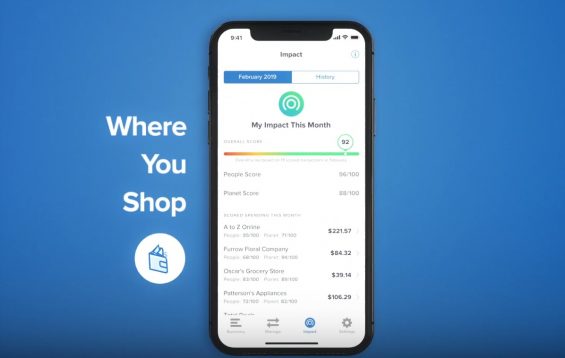

The company’s slogan, branded right on its debit card, is “Do Well. Do Good.” Three years ago, Aspiration introduced the “AIM Score” — Aspiration Impact Measurement — which provided account holders with a numerical grade on “how the businesses where you shop treat people and the planet.”

Besides offering a niche banking alternative to American consumers, Aspiration, a completely online company, has taken a unique approach to banking-fintech partnerships.

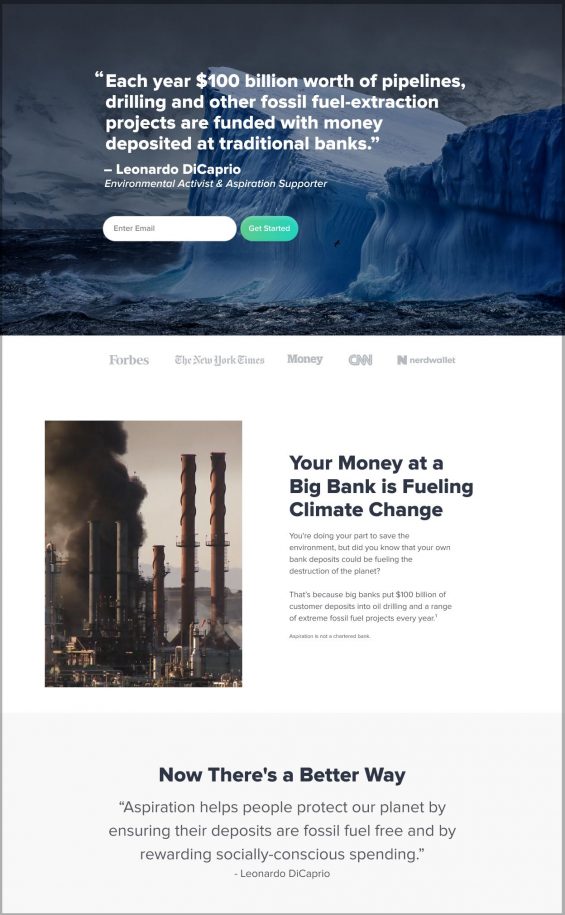

The company’s concepts have attracted big name investors with interest in sustainability issues, among them actor Orlando Bloom, Los Angeles Clippers coach “Doc” Rivers, and the Omidyar Network, a foundation created by eBay creator Pierre Omidyar and his wife, Pam. Latest is actor and investor Leonardo DiCaprio, through his foundation, “dedicated to the long-term health and wellbeing of all Earth’s inhabitants.” In March DiCaprio made an investment in Aspiration and joined its advisory board.

“He’ll be helping to spread the word,” says Cherny.

Read More:

- Eight Challenger Banks Traditional Institutions Should Worry About

- How Banking Firms Can Build ‘Purpose-Driven’ Brands

- Loyalty Advantage Now Favoring Digital Banks and Big Tech Firms

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Green, Fair, and Transformative

Aspiration would seem to be in the right place at the right time as freshman Representative Alexandria Ocasio-Cortez and her Green New Deal have burst on the scene.

Cherny downplays that point. He says that “ESG” — shorthand for investing that considers companies’ environmental, social, and governance record — has been around for some time.

“Aspiration can bring that same kind of approach to financial services writ large,” he says. “This is a trend that’s been going on globally.”

On Twitter, Aspiration has picked up on some of the New Left’s remarks in Congress, but it’s been chiefly along the lines of an invitation to join its efforts. In retweeting a comment about Wells Fargo and oil finance, for example, the company observed “And here’s a solution for everyone who cares what their money does: Join Aspiration. Our customers’ deposits don’t fund pipelines and oil drilling. #MovetoGreen”

Aspiration began operations in 2015 but has made several major gearshifts in the way that it operates and the way it offers deposit accounts. Cherny, while acknowledging that some aspects of the change have been bumpy in the transition, believes Aspiration is better situated than ever to realize the hopes of the founders and their backers.

One element of that better deal is Aspiration’s “Pay What Is Fair” model, which applies to both deposit and investment services. Each month customers can choose to pay what they feel their service has been worth, including $0. Seriously. Cherny says many do pay something, but the company doesn’t disclose those numbers.

Read More: 4 Ways Social Media Can Help Financial Marketers Celebrate Community

Revamping a Successful Deposit Account

Since inception, Aspiration has raised over $100 million in deposits from over a million consumers, and Cherny says the company adds over 100,000 consumers a month.

Note that Aspiration is not a bank, although it looks and acts a lot like one to consumers. The company’s promotions make it clear that it aspires to be an “unbank,” with such statements as “Big banks use your deposits to fund oil drilling and pipelines — and pay you almost zero on your money.” When they conceived Aspiration, Cherny and co-founder Joseph Sanberg had in mind the large institutions that had lost the faith of many Americans during the financial crisis.

The company’s initial offering was the Aspiration Summit Account. This was an interest-bearing transaction account featuring as much as 1% APY interest and fee-free or fee-refunded use of ATMs. The underlying accounts as originally designed were held by Radius Bank, a Boston-based online-only bank.

Cherny says this one-step-removed approach to deposits, necessary in the absence of a banking charter, wasn’t completely satisfactory in terms of flexibility.

“We were like a lot of neobanks in that we were initially offering our deposit products through third-party bank sponsorship,” says Cherny. “Ultimately we saw the limitations of that, in terms of what we could bring to our customers and the kind of freedom to innovate that was really important for Aspiration in the long term.”

Turning Around a Banking Industry Tool

In order to do what it had set out to do originally, Aspiration craved more control. Reinvention was in order. “For the better part of 2018 we were going through a process to be able to offer our customers an ability to have all of the features and functionality, and FDIC insurance, that they would expect from a checking account,” says Cherny.

The mechanism chosen was to set up the deposit accounts as cash management accounts — a staple of broker dealers who offer consumers a place to park funds between trades. To be able to offer such accounts, Aspiration actually sought additional regulation — how many fintechs do that? The company became a FINRA-regulated broker-dealer in order to be able to offer cash management accounts.

Offering deposit insurance still takes a bank or credit union charter, however. To obtain that coverage, Aspiration went to banks themselves, but in a new way. The company joined a deposit sweep program offered by Promontory Interfinancial Network. Accounts offered by Aspiration look and function much like typical transaction accounts, but the funds are ganged together for the regular daily sweeps. This provides pass-through deposit insurance coverage via Promontory’s participating depository institutions. The funds are split into fully insured slices in the process so that Aspiration depositors have full coverage for their funds.

This new account, called Aspiration Spend & Save Account, launched in February 2018, replacing the Summit Account that was linked with Radius Bank. Consumers had to opt in to the change.

“We’ve seen well over 80% of our depositors elect to move over,” says Cherny. “That’s much higher than we had expected.”

As noted earlier, there have been rough spots, as can arise with any financial services conversion, and today consumers make their voices heard in very public ways. Through the transition period, numerous complaints were posted on NerdWallet and elsewhere. “We have a passionate customer base — and a vocal one,” says Cherny. In response, the company’s customer service team was tripled to accommodate the new deposit relationship.

Read More:

- Challenger Banks’ Big Hurdle: Building Consumer Trust

- What Financial Marketers Can Learn From Nonprofits

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

What Aspiration Offers Consumers Today

“Our move was predicated on being able to have the freedom and flexibility to innovate and own the consumer relationship for the long term,” Cherney explains “I think other challenger brands will be grappling with this issue as well.”

Aspiration Spend & Save expands on the original Summit Account. The account has two sections, the “Spend” and the “Save,” the latter of which pays up to 2% APY. The spending account can be accessed via debit card and other electronic transfers as well as through a billpay option that produces and mails paper checks. (Account holders can also order and use checks.)

The debit card now offers cashback rewards on all purchases, plus extra rewards for spending at businesses with strong social conscience and environmental practices. The company’s mobile app scores consumer’s purchases along the lines of the AIM score in order to provide an idea of how one’s purchases impact the planet. (The raw data used for Aspiration’s ratings comes from several ESG-oriented research organizations.)

“Now we control the economics of the account,” says Cherny. Aspiration has striven to be fee-free with the exception of the self-determined monthly fee, but some charges, such as wire transfer fees, had to be passed along.

Now, says Cherny, the company is eliminating markups where it can’t eliminate a charge. “Now, if it costs 82 cents to process a wire, that’s the charge,” says Cherny.

Where Is Aspiration Going Next?

Financial wellness is a strong interest. Cherny thinks banking institutions have a lot to learn about naming accounts, for example. Spend & Save’s name came from that feeling. He wonders why a country that faces a continuing retirement savings problem sticks with vague and uninspiring terminology like “401k account.”

“There’s a huge need to have financial institutions use human terms,” says Cherny.

While for the present Aspiration will continue to concentrate on building direct relationships with consumers, Cherny sees a future where offerings could be repackaged to be offered as an employee benefit.

As noted, Aspiration is not a bank, though Cherny says the Comptroller’s fintech charter — under legal challenge — would be of interest.

“We would take a very hard look at it,” he says. “But it’s not there yet, and frankly it doesn’t feel like we’re that close. It’s more of a theoretical discussion now.”

Credit in some form is something Aspiration is looking at.

“As we continue to grow and scale, we want to be able to have Aspiration be the place where consumers can meet all of their financial needs,” says Cherny, “a place to make their financial home.”