There are many inside banking industry who assume consumers hate their bank. Not true. Consumers may hate the idea of “banks” (generally speaking), but most American households have longstanding relationships with their primary financial institution, and most aren’t anywhere near as crabby about it as the mainstream media frequently insinuates.

According to a survey of 3,000 consumers from Fiserv, 52% of them say they have maintained their checking account with their primary financial institution for at least a decade or more. And 76% score their primary financial organization an “8” or higher on a satisfaction scale ranging from “0” to “10.” More than one in four consumers gave their banking provider a perfect “10.” Credit unions scored significantly higher than banks.

However, these higher overall satisfaction ratings are tempered downward by lower satisfaction scores among young households. In the Fiserv research, far fewer early-age Millennials rated their primary financial organization an “8” or higher — 65% vs. 76% for all ages. (Note: Early Millennials are defined as ages 18 to 24 and late Millennials are defined as ages 25 to 35.)

Reality Check: While many financial marketers like to depict their competitors as skeezy, money-grubbing, mustache-twisting villains, most consumers are actually pretty happy with their financial institution. Many marriages don’t score this high on the “satisfaction” scale, nor do the relationships last as long. But there’s less forgiveness in banking — if you make any missteps, watch out. The number one reason consumers will switch banking providers is a lousy customer service experience, and one mistake can be all it takes to tank a relationship.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Fractional Marketing for Financial Brands

Services that scale with you.

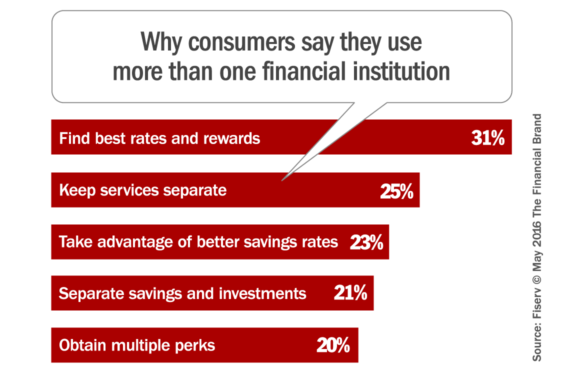

Consumers are increasingly looking to find options that will allow them to customize multiple different financial services in ways that meet their specific needs. If everything they desire is not available at a single bank or credit union, they are willing to work with many different providers if that’s what it takes. The Fiserv study found that consumers today maintain relationships with an average of 3.7 financial institutions. Fiserv concludes that consumers who are working with multiple institutions generally have a more focused strategy intended to maximize their rewards, rates and results.

Reality Check: Before you get all excited about becoming your customers’ “sole, exclusive financial partner for life” — where you hold all their banking products under your roof — keep in mind that a quarter of all consumers aren’t interested in single-source aggregation, no matter how badly you might want it. These consumers deliberately spread their financial relationships around, either to keep separate accounts for different needs, or to avoid putting all their “eggs in one basket.”

Make It Faster

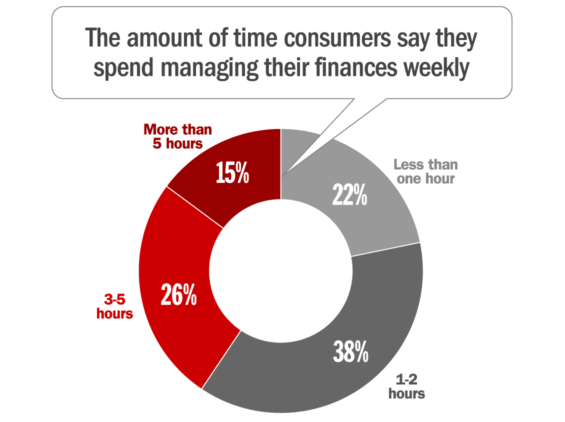

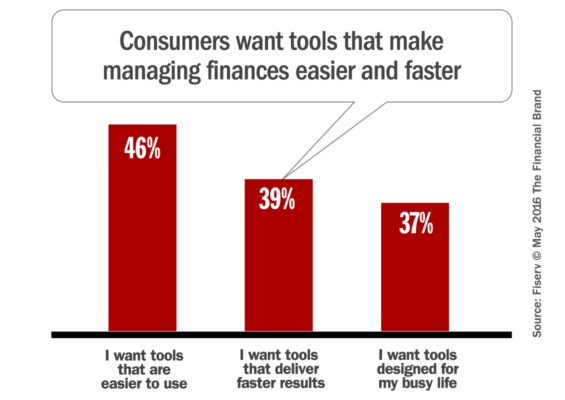

When it comes to financial tools and services, consumers are clear: they want it fast, easy to use, and secure. Three in four households want real-time balances on all their accounts and 72% want instant posting of transactions. This need for speed is even more pronounced among Millennials, with 80% of early Millennials and 83% of late Millennials desiring real-time balances, and 84% of early Millennials and 86% of late Millennials wanting instant posting of transactions.

Reality Check: The way consumers feel about banking is akin to scrubbing the toilet — it’s an unsavory, life-draining chore. The Financial Brand has stressed this point repeatedly over the years. The faster you can make banking for consumers, the less time they’ll have to think about it. Save consumers time and they’ll love you for it.

Retail Banking Channel Shifts

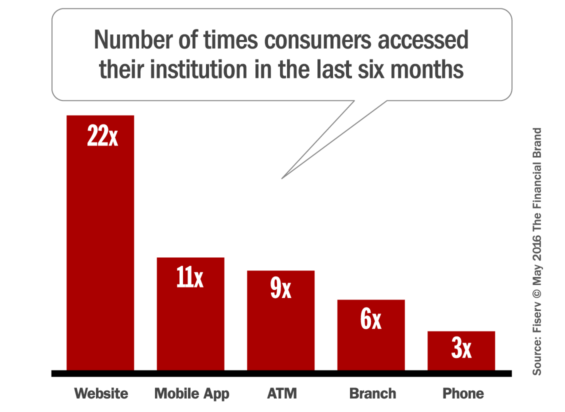

The way consumers manage their finances has shifted. By a wide margin, consumers now use their bank or credit union website as the most common method to track and access their financial lives; digital channels — particularly mobile — continue to grow.

Reality Check: Despite the rise of the mobile channel, study after study continues to show most consumers are still visiting a branch about once a month. The more trips to the branch you can spare people, the more time you should be able to save them… while lowering your operating costs.

Less than half of all participants in the study said they still use a checkbook to keep track of their finances. However, many people still rely on the trusty old branch for anything they perceive to be more complex (e.g., account opening).

The Knowledge Gap: Be Their Financial Friend

On average, U.S. adults rate themselves a “B” for short-term responsibilities like paying bills and sticking to a budget, but this drops to a “C+” for long-term goals like saving for college or retirement. 48% admit that they do not have anyone they rely on for advice on managing their household finances.

However, 53% of consumers view financial institutions as partners in managing their finances, suggesting that banks and credit unions have an opportunity to fill this advisory role — a “financial friend” consumers can turn to for insights, input, answers and advice.

“Tasks such as paying bills, budgeting or saving for retirement are a fundamental part of people’s daily lives,” said Mark Ernst, EVP and Chief Operating Officer at Fiserv. “Most consumers look to their bank or credit union as a partner, and financial institutions have a significant opportunity to provide the financial advice and tools they need to help them achieve their dreams.”

Participants in the study identified a wide variety of tools, support, information and strategies that would be very helpful in navigating the necessary – but cumbersome – financial management task.