“The public doesn’t understand how the system works, so we look for things we do understand, like banks not making loans and people spending money to redecorate their offices, or sponsor a ballpark, or buy a corporate jet, or pay out annual bonuses. These things are immaterial to the reality of the problems facing the banks, and no one is going to solve this crisis by cutting back on expenses, but this is where the focus is now.”

“The public doesn’t understand how the system works, so we look for things we do understand, like banks not making loans and people spending money to redecorate their offices, or sponsor a ballpark, or buy a corporate jet, or pay out annual bonuses. These things are immaterial to the reality of the problems facing the banks, and no one is going to solve this crisis by cutting back on expenses, but this is where the focus is now.”

— Andy Bateman, CEO of Interbrand

“The super-boom got out of hand when new products became so complicated that authorities could no longer calculate the risks and started relying on the risk management methods of the banks themselves. Similarly, rating agencies relied on the information provided by the originators of synthetic products. It was a shocking abdication of responsibility. Everything that could go wrong did.”

“The super-boom got out of hand when new products became so complicated that authorities could no longer calculate the risks and started relying on the risk management methods of the banks themselves. Similarly, rating agencies relied on the information provided by the originators of synthetic products. It was a shocking abdication of responsibility. Everything that could go wrong did.”

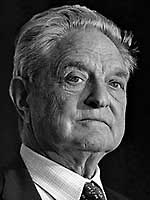

— George Soros, writing in the Financial Times

![]() “Like it or not, the company stands a better chance of repaying taxpayers with the Mets than without them.”

“Like it or not, the company stands a better chance of repaying taxpayers with the Mets than without them.”

— Tom Van Riper, Forbes, defending the CitiField sponsorship

“The public mood has remained angry at banks, and banks seem to be realizing that the public and politicians are demanding more specific information.”

— Matthias Rieker, WSJ

“Compared with the trillion-dollar rescue packages under negotiation in Washington, the problems facing credit unions look like a rounding error.”

“Compared with the trillion-dollar rescue packages under negotiation in Washington, the problems facing credit unions look like a rounding error.”

— Steven Syre, The Boston Globe

“I really believe in the credit union movement. Credit unions have some great advantages, they just haven’t seized the advantage.”

“I really believe in the credit union movement. Credit unions have some great advantages, they just haven’t seized the advantage.”

— Arkadi Kuhlman, CEO of ING

“I know some of you are sitting here and you might say, ‘How can you come to this room and talk about credit unions?’ The fact of the matter is, business as usual has to change.”

“I know some of you are sitting here and you might say, ‘How can you come to this room and talk about credit unions?’ The fact of the matter is, business as usual has to change.”

— State Sen. Malcolm Smith, recommending NY Bankers learn from credit unions