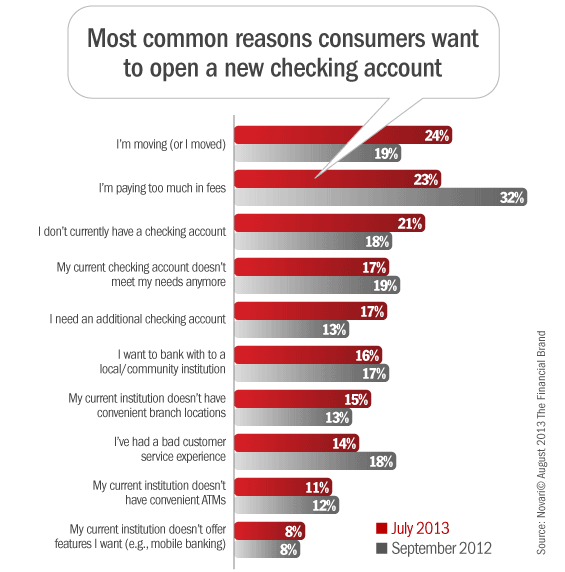

Bank Transfer Day, an organized effort to encourage consumers to switch banks over runaway bank fees, seems like a distant memory. Ten months ago, we asked consumers shopping for a new bank or credit union on FindABetterBank about the reasons they’re shopping, and nearly one-third indicated that high bank fees were a key factor in their rationale. But today, less than one-quarter of bank shoppers on FindABetterBank cite high bank fees as a reason why they are for shopping for a new bank.

Why is this?

Banks haven’t reduced or eliminated bank fees. In fact, in many cases, fees have actually increased. Also, most mega-banks have done away with free checking. The primary reason people get wound up about bank fees seems more related to media coverage than anything else. Most people are unaware exactly how much bank fees cost them each month because they don’t even bother to look at their bank statements.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

So if it’s not because of fees, why are shoppers looking for a new checking account now? Relocating (for work or personal reasons) has always been a primary driver of bank switching, and summertime is peak moving season. Other notable differences between this year’s query and the one fielded September 2012 include a decline in the percentage of shoppers indicating they’re switching because of a bad customer experience. There has also been increases in the number of shoppers currently without checking accounts and those looking for an additional account.