Bank and credit union customer support has been overtaxed not only by the extraordinarily high volume of questions from anxious, frustrated consumers, but from concerns among some employees about their safety when working in a contact center environment.

The situation has grown more difficult, and often tense, as the impact of the pandemic has spread. And it will likely grow worse before it gets better. Two reasons:

- Financial institution employees deemed “essential,” such as branch and contact center workers, are beginning to object to being put at risk when many of their colleagues are not.

- The spiraling economic impact as a result of having 41 states in some form of lockdown is causing financial anxiety among millions of people.

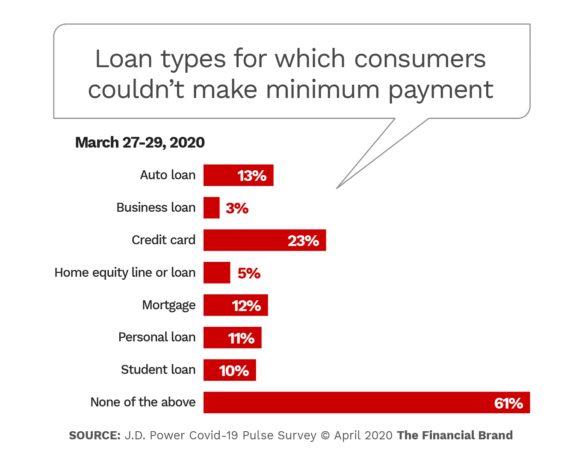

You don’t have to look much further than the jobless claims in the U.S., which rose to nearly ten million for the two-week period ending April 4. The CARES Act’s expansion of unemployment benefits will provide some relief for people newly out of work due to the coronavirus pandemic. However, Americans are now much more concerned about their finances. March 2020 data from the Federal Reserve Bank of New York found that 15% of households see an increased chance of missing a minimum debt payment over the next three months, up from a 12-month average of 12%. That’s consistent with the range of responses J.D. Power received in its Consumer Pulse Survey for the same month. Credit card payments, as shown below, are a particular concern.

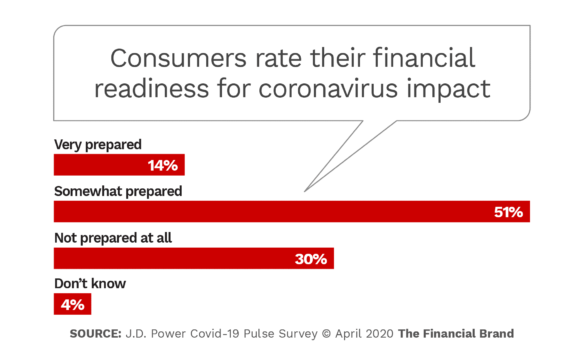

Overall J.D. Power found that nearly a third (30%) of consumers feel they are “not prepared at all” financially for the impact of the pandemic. 17% of respondents have less than $200 savings to draw on (including investments but not home equity) and 32% have less than $1,000.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Customer Response Challenges

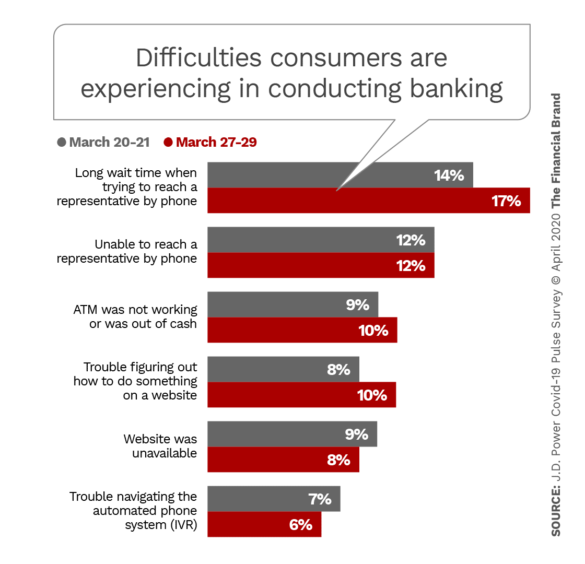

In the chart below, nearly a third of consumers report having difficulty getting through by phone to their financial institution, and the trend is growing. As Accenture notes, over half (57%) of financial institution customers rank call support as their initial channel preference for flexible communication with an opportunity to ask, explain, reason or negotiate. The problem, the firm states, is that institutions were ill-prepared to handle the sudden increase in call volumes, combined with the need to protect a workforce in a high-risk environment and attempt to shift quickly to a remote-from-home operation.

Much as many financial institution home pages refer to extensive call center delays, many consumers clearly still want to talk to a person.

PwC sums sit up the situation succinctly in a report: “The COVID-19 pandemic could be the most serious challenge to financial institutions in nearly a century. … They’re working to keep their distribution channels open, despite social distancing advice and supervisory and compliance functions that were never designed for remote work.”

Worse than that, call centers in their typical configuration are considered high-risk areas during a pandemic. “Contact centers are typically crowded work areas where headsets, desks, keyboards and screens are shared by agents on different shifts,” states consulting firm DMG. Many contact center workers are hourly, and often are among the lowest-paid employees, and are not usually considered essential.

Now they are.

Contact center employees “are facing a tough decision,” DMG states. “This group of employees must decide if they are going to put themselves at risk by going to work or if they will stay away from their crowded offices for an unknown number of weeks.”

Read More: When Opening Accounts in Branches Becomes Impossible

Some Big-Bank Responses

The Charlotte Observer, reporting on how three Wells Fargo employees (one in a contact center in Iowa and two in a Charlotte customer service facility) tested positive for the COVID-19 virus, observes that “The pandemic has created a tricky balancing act for financial institutions: How do you assist millions of customers who need help, and in some cases are obligated to it, while maintaining workplace safety in a pandemic for jobs traditionally done in person?”

Financial institutions have responded so far by hiking pay for in-person workers, staggering shifts, spacing out workers from each other and cleaning offices and branches more intensively.

Wells Fargo spokesman John Hobot was quoted by In These Times as saying: “Some Wells Fargo employees who support critical operations, including contact centers, must be onsite in order to serve our customers. As the situation evolves quickly, we continue to explore alternatives, and are taking significant actions to ensure the safety of our team while ensuring customers are provided the services they need.” One step the bank is taking is to make sure all call center employees are spaced six feet apart.

In an email response to online publication Vice, Wells Fargo said that employees on the front line who make less than $100,000 will receive a temporary pay bump. Eligible employees will receive an additional $200 per paycheck for five pay periods beginning in the second half of April.

At Bank of America, call center workers are getting double overtime during the pandemic, according to the Charlotte Observer.

Truist told the newspaper that it is increasing the capacity for its call center employees to work from home, and is also spreading its workers across more sites to space people out and has ended desk sharing.

Why Not Just Have Everyone Work from Home?”

There are literally hundreds of companies providing cloud-based contact center platforms that enable workers to handle customer queries from anywhere (see Resources listing below for some of them). Yet various sources note that a high percentage of call center operations in financial services and other businesses still use in-house solutions. Changing that is not an overnight switch for most.

Wells Fargo, for example, states flatly that “not all jobs can be done from home,” according to Vice. While the megabank is “exploring innovative ways to allow some contact center employees to work from home,” this has to be done in accord with “regulations requiring that contact center lines be recorded.”

In addition, financial institutions have to be sure that networks and phone lines and devices are secure when used from home. It’s not an inexpensive proposition. Bruce Morehead, SVP and Chief Information Officer at Columbia Bank, told the Charlotte Observer that it could cost between $3,000 to $5,000 to convert a call center worker to work-from-home, and could take weeks.

Financial institutions that have made progress in becoming digital enterprises, can move more quickly, however. And if they were created from scratch as digital-only banks, like Utah’s TAB Bank, the process can be brisk. TAB was able to move from 10% of its employees working remotely to 96% in three weeks in the first quarter of 2020, according to Bank Director. TAB Bank’s President Curt Queyrouze said that basically all they needed were some extra virtual private network connections, and some $400 laptops for employees who only had cell phones at home.

For most institutions, however, starting a work-from-home program for customer contact employees will be tough. But it’s not impossible, DMG observes. The consulting firm offers some specific suggestions:

Some Suggestions for Quickly Ramping Up Work-from-Home Customer Service

- Speed is essential. Assemble a group of effective contact center leaders and empower them to make the necessary decisions and investments.

- Get help. If you do not already have a cloud-based back-up contact center infrastructure solution in place, reach out to some of the more than 100 contact-center-as-a-service (CCaaS) vendors and ask them to help you quickly.

- Don’t worry about doing everything perfectly. Get the basics in place so that agents and supervisors can help your customers while working from home. But do not compromise on customer security or privacy.

- Configure and deliver secure PCs, headsets and other tools to employees who are going to work from home.

- Conduct video-based training sessions with employees who are working from home.

Chatbots and Live-Chat Options Could Help

While the trend toward chatbot interactions among financial institutions has been growing, the interactions are predominantly for simpler tasks like updating addresses or locating ATMs. Some, like Bank of America’s Erica, a virtual assistant powered by artificial intelligence (AI), are much more capable. However, it takes a great deal of time to “train” a bot in all the types of questions consumers might ask.

Recognizing that, Kasisto, a provider of conversational AI platforms for financial institutions, announced and unusual offer. In a blog on the company’s site, CEO, Zor Gorelov explains that the company is currently “analyzing millions of interactions and is building a new COVID-19 skill that will be available to our customers globally at no charge.” He says that because the company’s virtual assistants are already trained in the language of banking, the COVID training can be done rapidly. He also states that many of the institutions the company works with are experiencing a 20-30% increase in engagement levels with their virtual assistants.

For consumers who still want to connect with a real person, another option marries digital and human to enable personal service during a time of social distancing.

Wisconsin-based Incredible Bank is one of more than 100 community financial institutions using this human-plus-digital capability to good effect during the pandemic. The forward-thinking bank uses Banno Conversations, a feature available at no cost to users of Jack Henry & Associates’ Banno Digital Platform. Kathy Strasser, COO of Incredible Bank explains in a webinar how the application enables her call center employees to work from home. The app is integrated into the bank’s digital banking platform and is authenticated back to the core, according to Bryan McCarty, Digital Strategist at Jack Henry.

In an email, McCarty explains that if a consumer discovered an unfamiliar transaction, when they connect with their banker through the live chat function, they can easily “attach” a transaction from within the app so the representative can see it inside the conversation thread and resolve the matter much more quickly. That frees up time for other conversations.

Some Contact Center Vendor Offers & Other Resources for Banks & Credit Unions

Avaya

90-day free licenses to assist financial institutions transition to remote contact-center agents. Avaya has also announced the launch of global COVID-19 technical hotlines for customers and partners who are looking for 24×7 support and guidance to help transition to remote workforce deployment models.Cisco Webex

Offering a cloud contact center short-term (90 day) subscription option that can be deployed in less than a week for up to 1,000 concurrent agents. No minimum volume requirement.Harland Clarke

Burst feature designed to add short-term, scalable contact center capacity. No long-term commitment required. Partial outsourcing available.Nice inContact

Offering until April 15, 2020 use of the company’s CXone cloud contact center platform for institutions to move agents to at-home operation within 48 hours.Serenova

Offer to get contact center agents working from home in 48 hours with its CXEngage Rapid Response Program.Sharpen

Offer to get contact centers up and running remotely within 48 hours with Sharpen Quick Start.Vonage

3 free months of Vonage Business Communications and a Quick Start solution for re-assigning contact center agents to work from a home office.Report: “COVID-19: Responsive customer service in times of change” Accenture.

Article: “Managing Contact Centers Through the COVID-19 Pandemic” DMG Consulting

Report: “How Retail Banks Can Keep the Lights on During the COVID-19 Crisis – And Recalibrate for the Future” PwC

Article updated April 10 with clarifications and additional resources.