Big banks, big fees, one big ‘Thank You’ card

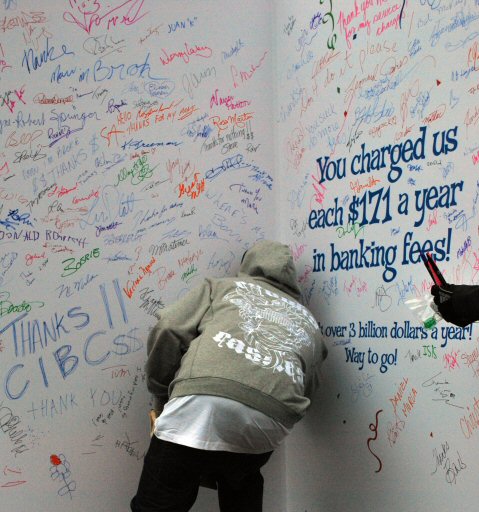

Canadians are being invited to make a big statement — literally — about ever-increasing banking fees. Coast Capital Savings, a credit union in British Columbia, is asking people to add their signatures and messages to an 8’x10′ greeting card that “congratulates” big banks for the $3 billion in fees that they charge Canadians annually.

Coast Capital Savings is collecting hundreds of signatures of Canadians in what the credit union

is describing as “B.C.’s biggest greeting card.” The tongue-in-cheek card thanks big banks for

charging Canadians $3 billion in fees annually.

Coast Capital will have an “I Love Fees” street team collecting signatures on the mock greeting card over the next week.

Key Question: Will Coast Capital actually send the thank you card to one of the banks? Or a trade organization in the Canadian banking industry?

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The tongue-in-cheek card is part of a wider campaign from Coast Capital Savings highlighting “ridiculous bank transaction costs.” The long-standing campaign, running for years now, includes TV and outdoor signage urging consumers to question the fees that they pay why they continue to pay them. Ads use satirical statements such as “Banking fees are like paying rent on my own money,” and “Banking fees are exciting because you never see them coming.”

“I Love Fees 1”

“Vending Machine”

A marvelous concept, where the credit union gave away free crap (their word) in vending

machines simply to prove “people like free stuff,” like Coast Capital’s free accounts.

Coast Capital has a ton of commercials about fees and what’s free. Here are some of the others, all very funny:

- “Free Research 1”

- “Free Research 2”

- “Free Research 3”

- “Free for All”

- “No Fees = No Stress”

They even take on fees in Punjabi and other languages frequently spoken around the highly-cosmopolitan British Columbia province.

A recent Ipsos Reid survey commissioned by Coast Capital Savings found that on average, Canadians pay $14.30 monthly in service fees on their main personal chequing account (that’s a “checking account” for you Yanks). Added up, that is an average of $171.60 per Canadian annually, and a combined total of $3 billion each year.

“Now is the time to be questioning every penny that we spend.”

— Mike Bushore, CIO

Coast Capital Savings

“We are all dealing with the fallout from the ongoing recession, and now is the time to be questioning every penny that we spend — banking fees included,” says Mike Bushore, CIO/Coast Capital. “While we’re having a bit of fun with this at the banks’ expense, we know banking fees are a serious pet peeve with Canadians.”

Bushore thinks it’s outrageous that the big banks are charging people fees for the ‘privilege’ of accessing their money. “It’s your money,” he says. “It doesn’t make sense that you have to pay to get at it.”

Coast Capital Savings touts itself as the first full-service financial institution in Canada to offer free chequing (back in 2005). But perhaps the credit union is best known for “Julie,” the talking greeter who plays a witty hostess at the Coast Capital website. If you haven’t seen Julie yet, stop by and say “hi” to her (and her friend “Lisa” while you’re at it).