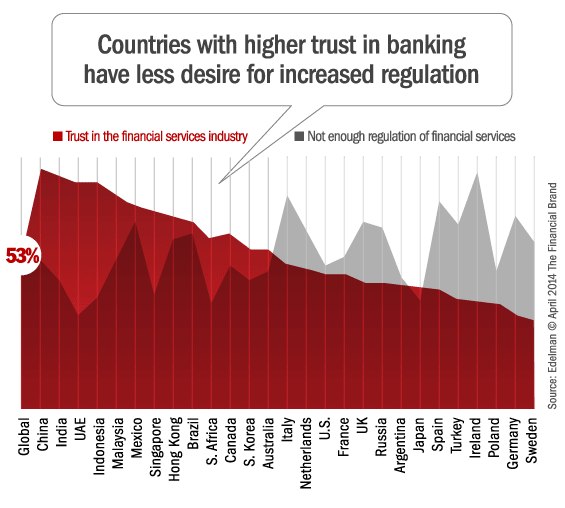

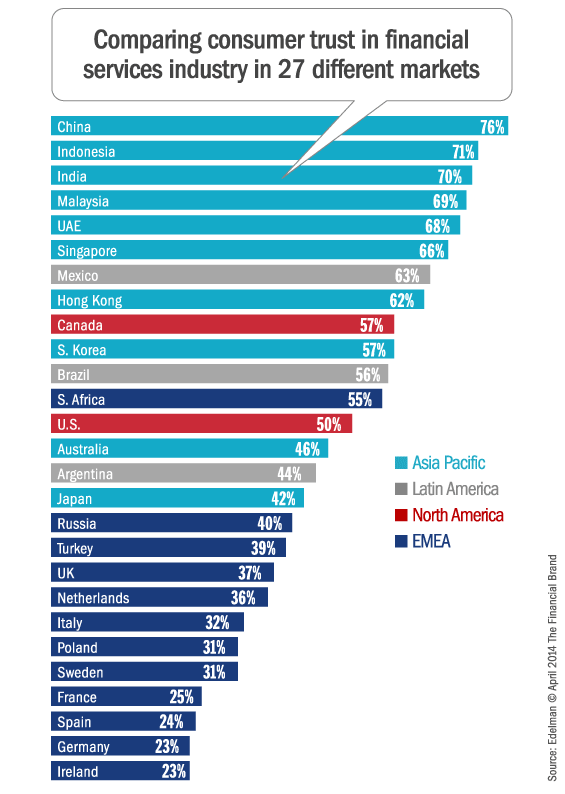

As the financial services industry continues its path to recovery, the importance of trust – or lack thereof – remains front and center. Despite slight improvements in trust levels compared to five years ago, the demand for structural and regulatory reform in the industry remains high across the globe, and the need to rebuild trust through performance is increasingly apparent.

According to findings in the 2014 Edelman Trust Barometer, today’s banking customer wants to be sincerely engaged in a way that conveys a deeper understanding of their personal goals and values, and what is important to them about their financial institutions. Yet, as negative headlines continue, it is increasingly difficult for consumers to trust when the discussion continues to surround new fees, narrow product offerings and fine print – all of which signal a return to the “old ways” of business.

So, what’s ahead? As the financial services landscape changes, so comes opportunity. The Edelman Trust Barometer, now in its 14th year, makes it clear that engagement and integrity are the path forward to building trust with consumers, employees, regulators, partners and clients. Now is the time for industry leaders to seize the opportunity by rebuilding trust in a way that is sustainable for business and puts customers and society at the center of focus.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Edelman says that trust is built according to 16 different factors clustered in five separate groups, listed here in rank order of importance.

Engagement

- Listens to customer needs and feedback

- Treats employees well

- Places customers ahead of profits

- Communicates frequently and honestly on the state of its business

Integrity

- Has ethical business practices

- Takes responsible actions to address an issue or crisis

- Has transparent and open business practices

Products & Services

- Offers high quality products or services

- Is an innovator of new products, services or ideas

Purpose

- Works to protect and improve the environment

- Addresses society’s needs in its everyday business

- Creates programs that positively impact the local community

- Partners with NGOs, government and third parties to address societal needs

Operations

- Has highly-regarded and widely admired top leadership

- Ranks on a global list of top companies

- Delivers consistent financial returns to investors