It’s obvious that consumers will always have a need for financial services, but to what extent traditional banking providers will fulfill this role in the future is unclear.

To measure the state of bank relevance, EY surveyed more than 55,000 consumers around the world as part of their 2016 Global Consumer Banking Relevance study. The good news is that — as of today — 75% of consumers still consider a traditional institution with branches to be their primary financial services provider. Unfortunately, 40% of customers express both decreased dependence on their bank and are increasingly excited about what alternative companies might offer them.

EY says the conclusion is inescapable: the relevance of banks is waning.

According to EY, the threats facing traditional institutions are real. Digitally native companies have substantively changed consumer behaviors, preferences and expectations by showing them what a great customer experience should look like. Consumers today want an exceptional experience that’s consistent across all channels. They expect simple, intuitive processes. They need to see increased transparency, personalization and tailoring. In short, the stakes are rising.

However, most banks and credit unions are ill-equipped to respond, burdened by legacy technology and processes that make it difficult to change at a pace necessary to keep up. Meanwhile, outside disruptors and neobanks that don’t share these legacy issues are increasingly able to deliver what consumers want, chiseling away in areas like payments and lending that have historically been a cornerstone of the traditional banking model.

In EY’s study, only one-third of consumers said they see any differentiation among banking providers.

Reality Check: When there is no differentiation in a category, price becomes the sole parameter consumers use to compare brands. The less differentiated your brand is, the more you’ll be forced to compete with rates and fees, making it nearly impossible to grow market share and generate more income.

To quantify the relevance of banking providers today, EY measured consumers’ current behaviors and future attitudes:

1. How customers bank now — the proportion of people who see their primary institution as a traditional player, and the mix of products they currently hold with that provider.

2. How customers want to bank in the future — consumers’ level of trust in traditional banking providers, and the mix of products they would consider a traditional institution for in the future.

Not long ago, banks faced little or no competition, so they played a prominent role in the lives of nearly all consumers. Today? Not so much.

“This study demonstrates the impact new competitors have had on banking services,” EY wrote in its report. “Decreasing consumer engagement with banks and increasing interest in banking alternatives shows how vulnerable incumbent banks are to losing customers to new types of providers.”

EY says it is imperative that banking providers increase their relevancy and reclaim their central place in people’s lives. Specifically, EY identified the following four areas where banks and credit unions must focus.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

1. Enhance Analytical Insights

Banks have traditionally relied on datapoints like age and income to predict customer preferences and future propensity, but these overly simplistic models are increasingly poor predictors of actual outcomes. As a result, EY says traditional institutions do not consumers them as well as they think they do… and nowhere near as well as they should. They must better understand consumer behaviors, and tailor their proposition in ways that will appeal to different types of customers.

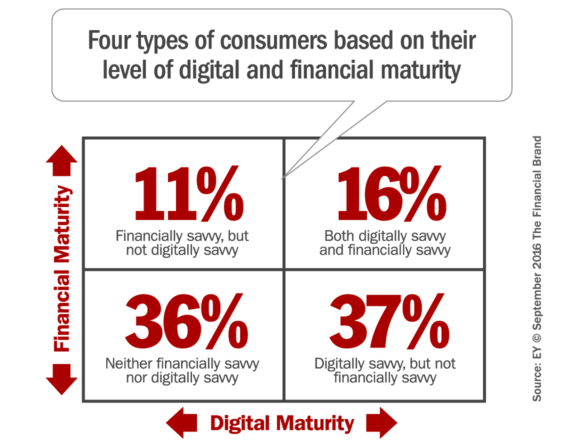

EY says this requires banks and credit unions take a fresh look at their analytics capabilities to figure out how they can glean more sophisticated insights from data. For example, EY suggests comparing financial savviness (a consumer’s level of understanding of- and comfort with financial products) against their digital savviness (one’s level of experience and comfort with online and mobile digital interfaces.

A key insight here is that digitally-savvy consumers are not necessarily financially savvy, and vice versa. EY also found that respondents are typically more digitally confident than they are financially savvy. Contrary to common belief, digital savviness only slightly correlates with age. And these findings apply across all age groups and countries.

While some consumer segments are being adequately served by big (impersonal) banks — namely the financially- and digitally savvy, who are comfortable fulfilling most of their banking needs through digital/self-service channels — others are not. Over a third of consumers feel they are digitally competent but financially unsophisticated, suggesting that they need better advice and more hand-holding when it comes to banking products and money management. Similarly, almost half of consumers aren’t fully comfortable with digital channels, so they may need more advice and guidance in technological areas (e.g., how-to tutorials, step-by-step instructions).

2. Advocate to Build Trust With Consumers

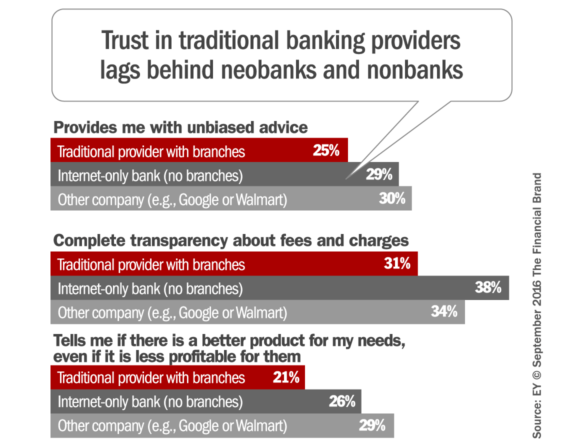

While consumers trust banking providers when it comes to the transactional aspects of their relationship (e.g., security of accounts and accuracy with transactions), there are significantly lower levels of trust when it comes to the advice and guidance financial institutions offer them — Who’s side is the bank on?

The level of trust consumers have in banks lags behind nontraditional competitors such as digital-only neobanks and supermarkets who offer banking services. This applies universally across the three dimensions EY tested: transparency in fees, providing unbiased advice, and recommending products that are in the best interest of the customer.

EY says the best way a financial institution can build trust is to always do the right thing for the customer and provide unbiased, high-quality advice. What else should banking providers do to build consumer trust? EY offers these recommendations:

- Radically transform the front line’s ability to provide unbiased, high-quality service

- Enforce operational excellence to eliminate errors and shorten service timelines

- Foster a customer-centric culture by empowering both front-line and back-office employees to directly engage with customers

- Ensure complete transparency on product pricing and features

- Proactively protect the customer from data privacy and cybersecurity threats

EY also suggests traditional institutions might reassess the range of services they offer, perhaps straying into territory they have not previously to create an ecosystem of service that encompasses non-financial services. For example, rather than just selling mortgages, banks could help consumers prepare to purchase a home, search for a new home, and then make the move.

3. Rethink Distribution and Customer Engagement

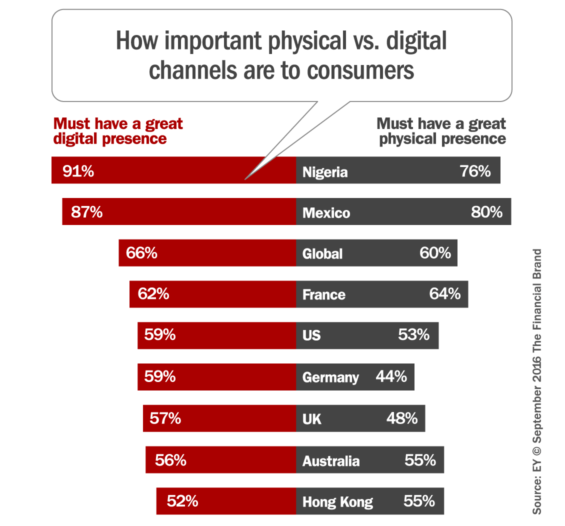

While the future of the banking industry is undoubtedly digital, consumers still want human interaction too. While 82% of consumers say they go online first when initially looking for banking services, nearly 60% indicate that they want to visit a branch when making a purchase and/or talk to a real person to get advice.

In the EY study, 44% of consumers say they would not trust a bank without branches, a number that jumps as high as 63% in markets like Mexico. And 55% of consumers say it is important that they be able speak to a person at their bank 24/7.

Reality Check: Digital is not replacing the human experience. The two channels are complementary.

The EY study also revealed that 62% of consumers feel it is important for their banking provider to deliver a true omni-channel experience. That means banks and credit unions must think beyond a “multi-channel” approach where each channel is organized and managed in its own self-contained silo. Instead they need to design robust, integrated cross-channel journeys that allow consumers to move from touchpoint to touchpoint depending on their needs and preferences — without having to make compromises or work around any constraints.

EY says its findings suggest that shutting down branches — a vogue battle cry among digital extremists — may be the wrong conclusion. To enhance distribution and customer connection infrastructure, EY says financial institutions should critically reevaluate plans to close branches, and instead rethink the role, format and size of branches.

4. Innovate Like a Fintech

Consumers want simple experiences, products that are easy to understand, transparency and 24/7 access… and that’s precisely what fintech companies an nonbank providers are delivering. Globally, 42% of consumers have used nonbank providers in the last 12 months, and 21% of those who have not yet used them are considering doing so.

According to EY, the allure of a better customer experience is what pulls consumers to nonbank competitors. Across the 32 countries in EY’s study, 41% of consumers indicate they would not hesitate to change financial services providers if they found one that offered a better online/digital offer/experience.

In order to fend off the threat and give consumers what they want, EY says banks and credit unions need to start innovating not only like fintech but with fintech. The fintech world is increasingly being perceived as the innovation engine for the industry, so EY says banking providers should be continually scanning the market for companies to emulate, partner with or acquire. Financial institutions must also radically simplify their product portfolios, product features and pricing, setting up cross-functional teams to redefine the entire customer experience.

How to Make Consumers Love Banks Again

To remain relevant, EY says banking providers must nurture the customer experience by listening to market demands for convenient, simple-to-use, easy-to-understand banking products and services that integrate seamlessly into their lives.

Go beyond banking — Deepen customer relationship by offering solutions that go beyond banking products and address all aspects of important stages of customers’ lives.

Make it easy — Grow customer-centered digital platforms and effectively enable the sales force to give customers real-time, anytime access to products, services, support and advice.

Make it personalized — Leverage market and customer insights to build relationship-based products and pricing that is delivered seamlessly across all channels.

Keep customers’ interest at heart — Invest in the skills, culture, incentives and toolkit of your front line.

Make trust a top priority — Promote transparency in all transactions and proactively protect the customer from data, privacy and cybersecurity threats.