Consumers today have the expectation that any desired information or service will be available on any device, in context, at their precise moment of need. is forcing all industries to meet exponentially increasing customer demands and creates an environment in which only nimble, customer-obsessed firms will succeed. No industry is insulated from this shift — including banking.

Banks and credit unions must remain keenly aware of the unique journeys consumers take along the purchase pathway. The influences shaping people’s decisions can y as they move from the “Discover” phase — where consumers are conducting their preliminary search for providers — to the “Explore” phase, and ultimately the “Buy” phase. This evolving, fluid journey is rife with so many nuances that financial institutions struggle to find the right balance between digital- and human interactions.

In seeking to understand how customers are proceeding down the purchase pathway for four different financial products, Deluxe Corporation commissioned Forrester Consulting to conduct a survey of over 3,500 adults in the US who had done at least one of the following in the past 12 months:

- Opened a checking account, savings account, IRA, or certificate of deposit (CD)

- Applied for and obtained a new mortgage, refinance, home equity loan, auto loan, credit card, or personal loan/line of credit

Researchers found that these newly-empowered consumers have redefined their expectations in their path to purchase banking products, shaped by their generational differences and digital experiences with other industries. They have learned to want more from the digital channels they use, yet at the same time they still expect financial brands to make personal connections at key points along the customer journey.

While recommendations from family and personal friends have always played a role in how consumers pick their banking providers, they increasingly prefer to research their options online before making a decision. They want the ability to search for banking products on all mobile channels, and they want that information available in an instant.

The study shows that consumers prefer the self-service, DIY nature of the web for research, leveraging financial calculators and online comparison tools. But the more complex a product becomes, the more likely consumers are to seek human interaction. For example, when completing a mortgage or personal loan application, 41% of respondents opt for the in-branch option. On the flip side, the prevalence of credit card options online means nearly 60% of new accounts are opened digitally.

Resources Consumers Use to Research Banking Products

| Online information/tools consumers utilize | CheckingAccts | CreditCards | HomeLoans | AutoLoans |

|---|---|---|---|---|

| Information on provider�s current rates | 34% | 49% | 56% | 58% |

| Product comparison chart | 41% | 28% | 39% | 26% |

| Payment calculator | 12% | 5% | 52% | 53% |

| Closing costs, points, fees calculator | 15% | 11% | 52% | 25% |

| Affordability calculator | 11% | 9% | 41% | 37% |

| Product recommendation tools based on needs | 24% | 14% | 26% | 16% |

| Estimates on time provider would take to open account/approve loan | 14% | 15% | 25% | 22% |

| Educational content on the application process | 18% | 8% | 24% | 16% |

Financial institutions that make information hard to find online risk losing today’s digital consumers. At the same time, those institutions that have not optimized their digital channels for mobile and social media usage will also run afoul of tech-savvy consumers.

“You have to be able to communicate and interact where the consumer is, whether on smart phones, tablets, the internet, direct mail, email, you name it,” explained John Filby, President of Deluxe Financial Services.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Rising Expectations Set by Nonbank Experiences

The experiences of financial consumers today are not just shaped by their interactions with financial institutions; they are shaped by everything they do digitally, including online shopping experiences, social networking sites, on-demand video services, and instant access to products and services such as ride-sharing. Companies in these spaces are raising the bar for digital experiences as they continuously exploit digital technologies to delight their customers and reset consumer expectations in the process. Furthermore, these expectations will continue to increase as every new generation of consumers becomes more digitally native than the last, raising the bar when companies seek to grow their customer base.

“As financial consumers have more and more interactions with consumer brands that provide multi-channel communications, they will transfer their expectations to banks and credit unions,” explained Scott Wallace, VP/Marketing at Deluxe Financial Services. “People want multiple research channels and tools before they will engage their local branch to open a new account.”

According to the study, consumers will gravitate toward companies who can deliver the best omni-channel experiences, and do so at the drop of a hat. That means banks and credit unions will have to focus on becoming increasingly nimble if they are going to satisfy consumers and keep service levels high.

How to Improve the Omnichannel Journey

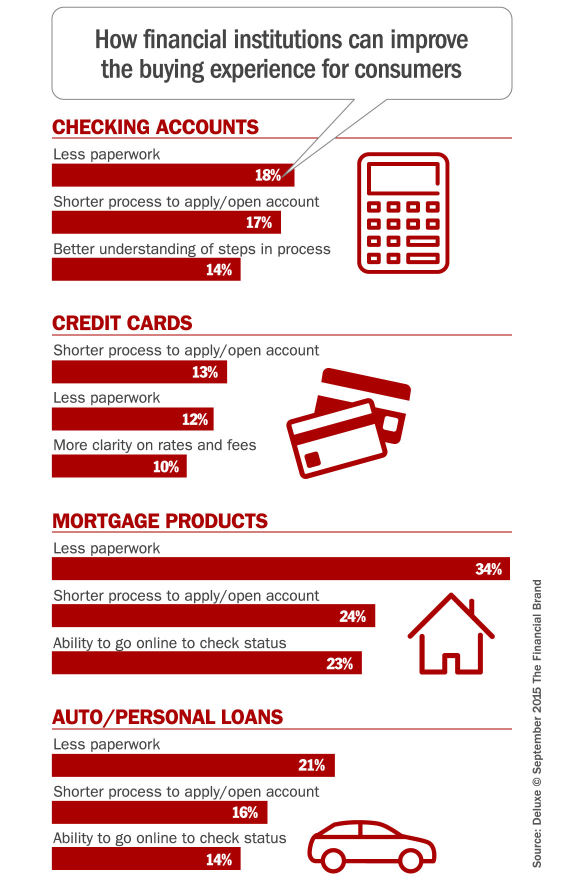

The study found that a shorter, less intensive application/account opening process would improve the purchase pathway for all financial products. For checking, credit cards, auto/personal loans, and especially mortgages/home equity loans, both a reduction in paperwork and a shorter process for applying/opening an account are the top factors that would both simplify and improve the purchase process.

Transparency in the application process is key, with 14% of customers who purchased a checking account saying they wanted to better understand the steps in the application process before they applied. And 10% of those applying for credit cards said they wanted more clarity on rates — indicating they had difficulty in uncovering vital information easily. Mortgage/home equity loan and auto/personal loan customers wanted the ability to go online to check their application status (23% and 14%, respectively).

Key Recommendations From The Report

Collaborate across the business to deliver a better purchase experience. Deepen your understanding of the purchase journey and needs of different types of financial product purchasers by working with customer insight, marketing, and product teams. Leveraging data analytics and developing clear segmentation of product purchasers is important to gaining a deeper understanding of their needs.

Use digital to support consumers throughout the entire journey. Digital is important across all phases of the purchase journey. You need to provide the right mix of information, educational content and online tools, wrapped in a personalized experience that’s both fast and easy.

Take a needs-based — not product-based — approach through digital touchpoints. Consumers don’t wake up one day and think, “Gee, I think I’ll get a loan today, or maybe open a checking account.” They have real life events such as divorce, marriage, a move or the birth of a child driving their financial decisions. A needs-based approach to marketing will make it easier to explain why consumers may need related products. Inasmuch, digital teams can explore developing tools that can be embedded into key product pages and application forms to help uncover consumers’ needs.

Build a simple, multichannel sales process. Map out cross-channel interactions to develop frictionless handoffs between digital and human-assisted channels.

Weave human and digital together. Despite the growth of digital touchpoints, human assistance continues to play a pivotal role in the purchase journey. Digital teams need to make it easy for existing customers and prospects to get human assistance through websites and apps. For more complex products like mortgages, financial institutions should consider empowering their employees with digital tools, such as tablets filled with sales and service tools.