At a time when roughly half of financial institutions still don’t have an effective onboarding program for new customers or members and have not implemented a process of cross-selling that takes advantage of internal and external consumer insight, it is not surprising that the industry does a poor job onboarding new mobile banking households. It is also not surprising that banks and credit unions have not leveraged the mobile banking platform as a way to cross-sell additional products and services. Both of these strategies can provide quick and significant payoffs if done correctly.

Mobile Banking Onboarding

It is already a well known fact within the financial services industry that onboarding new checking customers improves engagement, stems attrition and provides a strong foundation for relationship expansion. In fact, the first 90 days are universally considered the ‘prime time’ for frequent communication surrounding the use of accounts opened and the engagement with services such as bill pay, funds transfer and direct deposit.

More that just a great time to educate consumers about their new checking account, another stream of communication should revolve around the optimal use of mobile banking. While digital banking executives would love to think otherwise, a new mobile banking customer usually wants education around how to perform P2P payments, internal and external funds transfers, bill payments, and even mobile check deposits.

The importance of onboarding a new mobile banking customer has been found in several research studies by the Digital Banking Report, where the potential for attrition is greatest for the youngest and most digital of consumer groups. While part of this attrition can be explained by the transient nature of younger consumer groups, other studies have highlighted how digital customers are impatient when they do not feel comfortable with an app or a new process. Mobile banking onboarding can help alleviate this anxiety (and resultant attrition).

Financial institutions that recognize the opportunity to onboard new mobile bankers usually focus on services such as electronic statements, alerts, mobile deposit, P2P transfers, etc. Many of the largest financial organizations don’t leave the education of new mobile banking consumers to chance, but instead use email and even direct mail to illustrate the benefits of engagement beyond balance inquiries.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

On Device Sales Opportunities

Even if a mobile banking consumer is onboarded and engaged with their mobile banking app, the majority of banks still drop the ball with regard to using the mobile platform for selling additional services. The Digital Banking Report found that less than 25% of leading financial organizations globally perform sales and marketing within the mobile banking app. Even the ability to open new services within the mobile app is limited to less than 30%.

This lack of cross-selling within the mobile banking application is despite the opportunity available from combining the internal insights regarding product and service use with the potential use of mobile transaction information and locational data (big data). With this combination, banks and credit unions would have a better opportunity than ever to provide extremely targeted and personalized offers to consumers in real-time through mobile devices.

On Device Selling Examples

According to Fiserv, most financial institutions evaluate ROI for the mobile channel in terms of increased customer retention and acquisition, reduced channel costs and an uptick in revenue-enhancing activities, such as debit card use and person-to-person payments. While each of these are important, more and more organizations are realizing that cross-selling is another way to monetize the mobile banking channel.

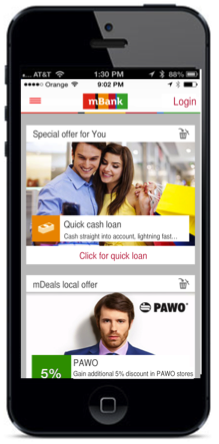

From the cross-selling of mobile banking engagement services such as bill-pay, mobile deposit capture, P2P payments and transfers on the post log-in home screen, to the ability to integrate rewards and sales messages through opt-in mobile alerts, financial marketers have more power than ever to expand relationships and generate loyalty.

Imagine getting an offer for a pre-approved auto loan when your phone indicates you are walking into a car dealership, or getting an ‘electronics loan’ message (potentially with a merchant-funded reward offer) when you walk into a Best Buy store.

But this only touches the surface. Some banks have integrated easy to navigate financial service product comparison functionality within their mobile banking apps, while others are improving cross-sell performance by providing mobile solutions such as 30 second personal loans (mBank).

Some banks have even leveraged the geolocational capabilities of the mobile device to provide real estate insights along with mobile selling of mortgage products with an augmented reality tool, while others are beginning to provide cross-device sales message reinforcement on both phone and tablet applications.

According to to Bank of the West, they used a dynamic messaging program to deliver “tappable” tailored offers and content on their pre-login mobile app screen. They provided intuitive, contextual messages to a customer based on their profile, activities and attributes. In some instances, they used ‘tap to call’ messages to invite customers to learn more by calling them via their dedicated call center. When Bank of the West employed this feature, they saw a significant uptick in new business, such as loan applications, that they may not have otherwise seen.

The mobile device (both smartphones and tablets) provide an open canvas for financial marketers to use their creativity and knowledge of the digital customer to build sales solutions within the mobile banking app that provide value without interrupting the ease of transacting. The key is to make sure that each offer is contextually hyper-targeted and engaging without impacting the requirement for simplicity and speed. To succeed, there must be a viable transfer of value from the bank for the interruption of the mobile banking process.

One of the best combination of simple design and flawless execution of sales within the mobile app continues to be from USAA. They position the message prominently without impacting the flow of transacting. For customers who decide to take advantage of one of the offers, the execution of the sales process is done in a mobile-first manner, with a minimal number of steps and clarity of process.

Untapped Opportunity

Using the mobile channel, product offers and engagement services can be cost-effectively communicated to the right customers, at the right time, driving organic growth, customer retention, customer satisfaction – and ultimately increasing revenue.

Beyond sales messages, the mobile banking platform can provide educational tools, such as short-form videos as well as customer service messages around account security, establishing mobile alerts, etc. The combination of sales and service messages, if correctly targeted and delivered can ultimately be an opportunity for growth.